In an environment of increased interest rates, as at all times across our 34 years in retail asset management, our portfolios remain in excellent health. So much so, that on 1 November 2023 we provided an out-of-cycle increase in the investment rates of our 12 Month and 2 Year Accounts by 20 basis points.

The performance of our portfolios continues, even as market interest rates increase again. And through this lens, we are pleased to announce that from 1 December 2023, investment rates across each of our portfolio accounts are increasing as follows:

| Account | Current Rate | New Rate |

| Classic Notice | 4.95%*# | 5.15%*# |

| 90 Day Notice | 5.25%*# | 5.45%*# |

| 6 Month Notice | 5.50%*# | 5.70%*# |

| 12 Month | 6.45%* | 6.65%* |

| 2 Year | 6.55%* | 6.75%* |

| 4 Year | 8.00%* | 8.20%* |

| Select Investment | From 6.50%* | From 7.50%* |

Investors should never blindly accept yield without a thought or a care. How a manager generates yield for their investors is critical. Yield and volatility are not mutually exclusive after all. Remember, market rates are increasing in response to market uncertainty and right now you can name your economic cliché as regulators react to persistent inflation readings.

At La Trobe Financial, we prioritise transparency within our portfolios and have continued to uplift our monthly reporting to allow investors a leading level of disclosure. We think it’s important you know exactly how your hard-earned money is being managed, and we’re not aware of any manager in our sector offering this level of disclosure.

With 31 October 2023 data now available, it’s timely to review some of the fundamentals which give the La Trobe Australian Credit Fund its cross-cyclical resilience.

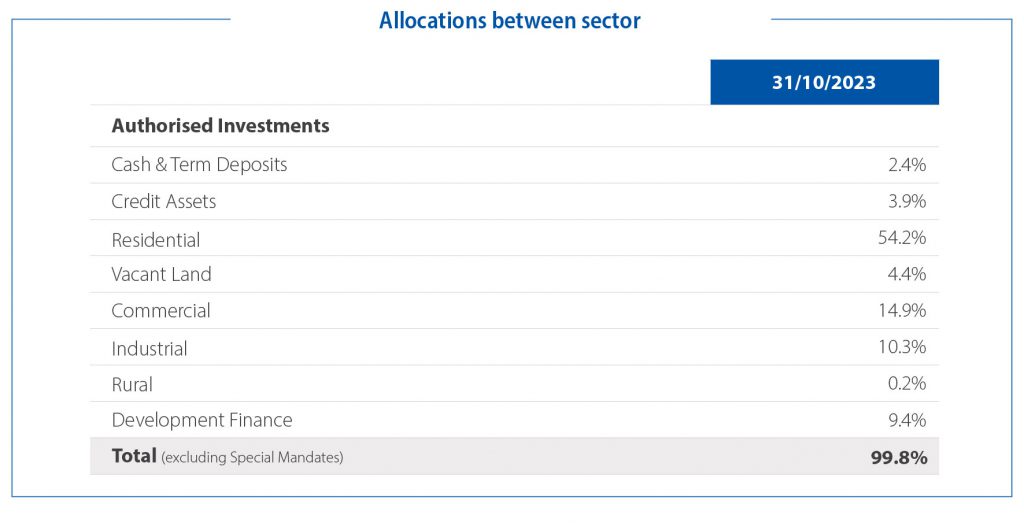

Allocations between sector

La Trobe Financial prioritises diversification across sector and location. Across the Credit Fund, assets comprise a 54.2% exposure to residentially secured loans, with the balance of assets strategically allocated across other sectors. With its ballast in residentially-secured loans, combined with low and controlled exposures against non-residential asset types, the Credit Fund can generate its low-volatility yield profiles.

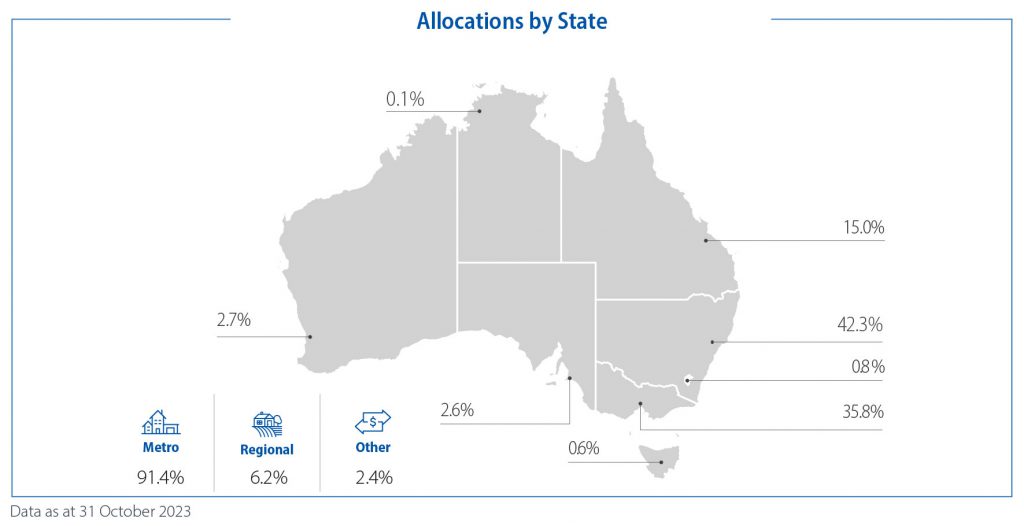

Allocations by State

Diversification doesn’t just end with sectoral allocation. It also sees a focus on lending across Australia, ensuring the performance of one market won’t adversely impact portfolio performance. The Credit Fund’s 11,651 loans follow the population, with exposures broadly in line with Australia’s population base.

Allocation by number of loans

Indeed, the 11,651 loans themselves represent a level of diversification which is rare in our sector. With an average size of just $782,250 across the Credit Fund, this is a large number of smaller loans. A granular exposure which sees no one loan as a potential driver of performance across portfolios. No loan exceeds 5% of the total Credit Fund balance, and a weighted average loan-to-valuation ratio of 64.6% ensures our borrowers have brought significant capital to the table.

Perhaps the only certainty at the moment is that uncertainty will continue. So, don’t take chances on funds with opaque or risky structures. Look for diversification. Demand transparency. Invest with managers who can demonstrate track records at all points along the economic cycle.

We are proud of our impeccable performance across three decades of the Credit Fund, including that no investor has ever lost a cent of capital in our portfolio accounts. We are driven to ensuring that experience is repeated for the next three decades to come.

*The rates of return on your investment will be effective from 1 December 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The applicable distribution for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.