From humble beginnings in 1952, La Trobe Financial went on to enter retail asset management in 1989 – a pivotal moment in our history. Since then, in addition to institutional investment, which continues to this day, we have provided investments with the duration and return profile to suit a wide range of retail and wholesale investors. More recently, our expansion into US private credit similarly offers access to a market traditionally hard to access for retail investors.

Across this period, the market has continued to evolve. As recently as a decade ago you may have struggled to name more than a handful of private credit providers. It’s a different story today. The industry abounds with private credit managers capitalising on the well-documented rise in demand by investors for low volatility yield, matched with assets generated by a banking sector continuing to inflect their lending programmes towards increasingly ‘vanilla’ exposures.

With growth comes scrutiny

Private credit is not new, and there is little argument that the growth in private markets has been fundamentally good, including private credit. Private markets, as part of the broader “alternative assets” class, have globally grown asset under management from 5% pre-GFC to 15% today.

The sector’s recent track record has earned the trust of investors. That’s why it’s growing. The talk of a potential ‘Minsky Moment’, where a period of prosperity precipitates a sudden collapse has echoes in a familiar expression from lending: bad loans are written in good times.

ASIC’s focus on private credit is an opportunity to lift standards across the industry, at a pivotal moment for the industry. We welcome the call for greater scrutiny and higher standards across the industry. We recognise the challenge and the opportunity to lift industry standards. In doing so, we can continue to play our dual role: funding the Australian economy and delivering dependable, uncorrelated income solutions to investors.

A moment in the sun

If private credit is to have its moment in the sun, it’s timely to repeat that sunlight is the best disinfectant. Transparency matters. Private markets do not adhere to the same continuous disclosure obligations as public markets, but that’s no excuse for opacity.

La Trobe Financial leads the sector in transparency. Our monthly portfolio reporting is available for investors to review, consider, and question. We have made available what we believe an interested analyst would want to review if they were to consider an allocation across our strategies. In addition, we actively welcome queries on our allocations, and testing of our strategies. Ongoing, repeatable, and uniform data reporting should be available for investors to easily obtain from a manager’s public website.

Click here to view the La Trobe Australian Credit Fund monthly portfolio metrics.

Click here to view the La Trobe US Private Credit Fund – Class B portfolio metrics.

Transparency is non-negotiable. Investors deserve consistent, high-quality reporting and clear communication. La Trobe Financial has long provided detailed, transparent reporting across each of our strategies. While uniform standards remain a work in progress, in their absence, every manager must still be able to clearly explain how they manage money and what investors are exposed to. There’s no excuse for opacity. If a fund doesn’t disclose portfolio composition, fees, costs, and related-party transactions, that’s a red flag.

Guardrails for success

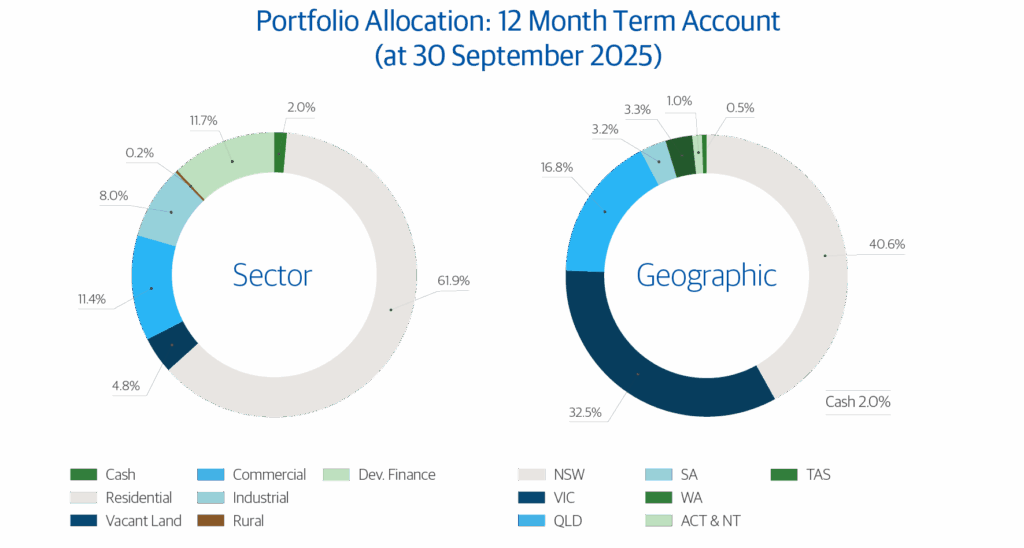

No fund in any asset class can guarantee success. But they can increase the chance of success if they have appropriate guardrails. For example, construction and development loans have historically been more cyclical than other real estate private credit assets. Which is why our strategies have appropriate guardrails to limit exposure to this, and other cyclical sectors. Our 12 Month Term Account has a maximum exposure to development finance of 15%. This limits the potential for the cyclicality of this sector outweighing the other private credit assets in the portfolio and is undeniably a good thing.

Going a step further, a fund can be designed to have a large number of smaller assets, or a small number of larger assets. The level of diversification built into a portfolio can impact performance at times of market stress.

Consider the La Trobe Australian Credit Fund, with over 14,000 individual loan exposures with an average amount of $913,444. This is a large number of smaller exposures, and a granular profile unmatched in the sector. The following portfolio allocations on 30 September 2025 confirm our commitment to diversification:

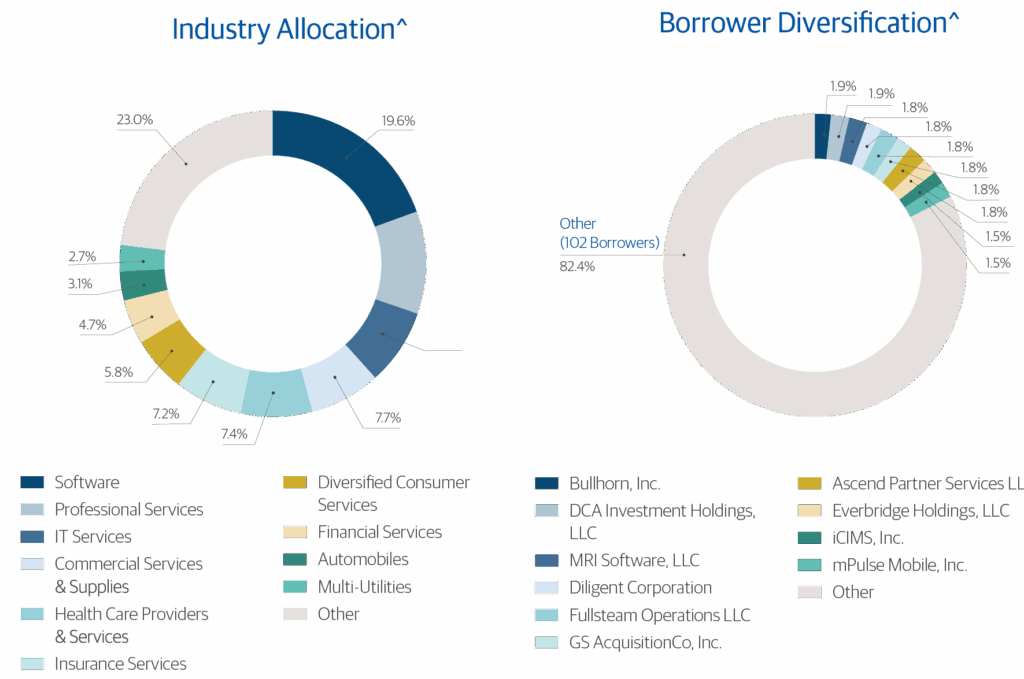

Diversification and guardrails form an important part of our US Private Credit Fund. Widely diversified by sector, and well diversified by individual borrower, the portfolio is well diversified and designed to perform at all points along the economic cycle:

Portfolio Allocation: La Trobe US Private Credit Fund

We welcome funds outlining their portfolio guardrails to ensure a clear understanding of their asset profiles.

Oils Ain’t Oils

Remember the Castrol advertisement for its oil back in the 1980s? The argument was that however generic they may seem, different types of oil are anything but similar. We have been prosecuting the case for some time that it’s the same in private credit. Individual managers, strategies, and assets can deliver wildly different outcomes and performance over a market cycle.

Which is why it’s important to understand what’s under the hood. Consider the following definitions from the Moneysmart website (www.moneysmart.gov.au):

- Corporate lending: direct loans to businesses

- Real estate lending: loans for buying or developing residential or commercial property

- Asset-backed lending: loans or investments secured by pools of assets like mortgages, car loans, and credit card repayments

- Investment in debt instruments, such as bonds or debentures

Each sector will have its own risk and return profile. Each manager will have its own risk appetite within its preferred sector. Therefore, we welcome the call for disclosures around transparency and risks, particularly with many strategies so far untested through genuine market stress events.

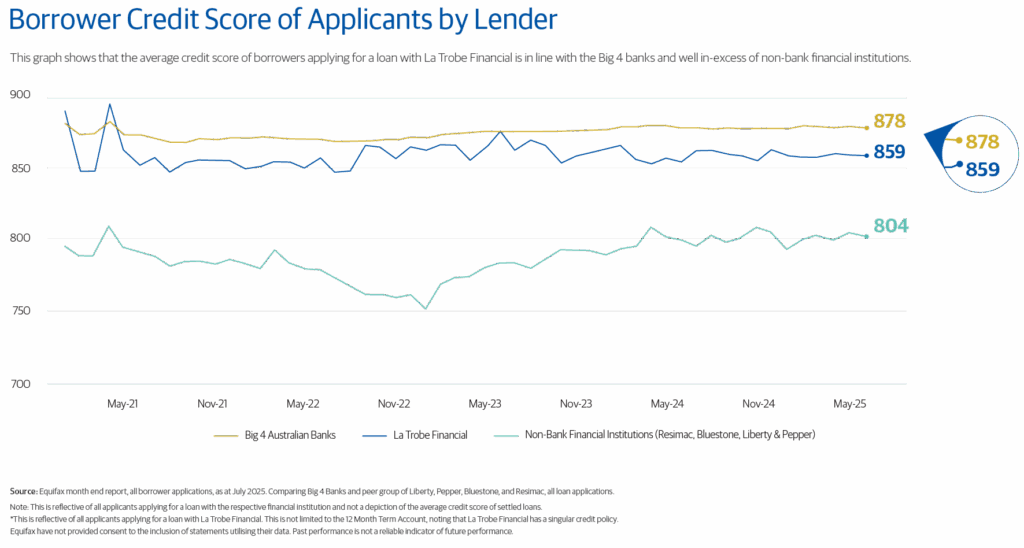

Consider the average credit score of a La Trobe Financial loan applicants as outlined below. Operating alongside the average credit score of a borrower from Australia’s Big 4 Banks, borrowers in our Australian Credit Fund sit well above the credit scores of our scaled, non-bank competitors. A genuine destination for quality borrowers looking to transact outside of the banks.

Let the sun shine

As the current scrutiny of private credit continues, we will continue to keep the market updated on our views on key discussion points. That’s how we build trust, and that’s how we deliver for investors.

The Moneysmart website asks investors to make sure they understand the following key components of private credit:

- How the investment works

- How the fund generates a return

- Risks and liquidity

- Fees

And at La Trobe Financial, we couldn’t agree more.

^As of 31 August 2025, based on fair market value. No guarantee can be given that the Fund will be able to identify similar or comparable investment opportunities, or have the same overall composition as

shown above, in future periods. The Fund’s portfolio composition is subject to change any time without notice as permitted by the Fund’s offering and governing documents, as may be supplemented and amended

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence No. 392385. La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321, the La Trobe US Private Credit Fund ARSN 677 174 382 and the La Trobe Private Credit Fund (ASX: LF1) ARSN 686 964 312.

Past Performance is not a reliable indicator of future performance.

Any financial product advice is general only and has been prepared without considering your objectives, financial situation or needs. You should, before investing or continuing to invest in the La Trobe Australian Credit Fund, the La Trobe US Private Credit Fund or the La Trobe Private Credit Fund (ASX:LF1) consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the relevant Product Disclosure Statement for the fund. The PDSs and Target Market Determinations are available on our website.