Income Tailwinds

Attractive industry & market tailwinds, with growing addressable market

Target Distribution Return

Unit Price (as at 30/06/2025)

Class Inception Date

The U.S. middle market is benefiting from the biggest investment tailwinds of the coming decades. This includes re-shoring of jobs and manufacturing to middle-America and the AUD$500+bn pledged by the US Government to support decarbonisation.

Australian investors can access this asset class through a strategy carefully curated by our product partners, Morgan Stanley.

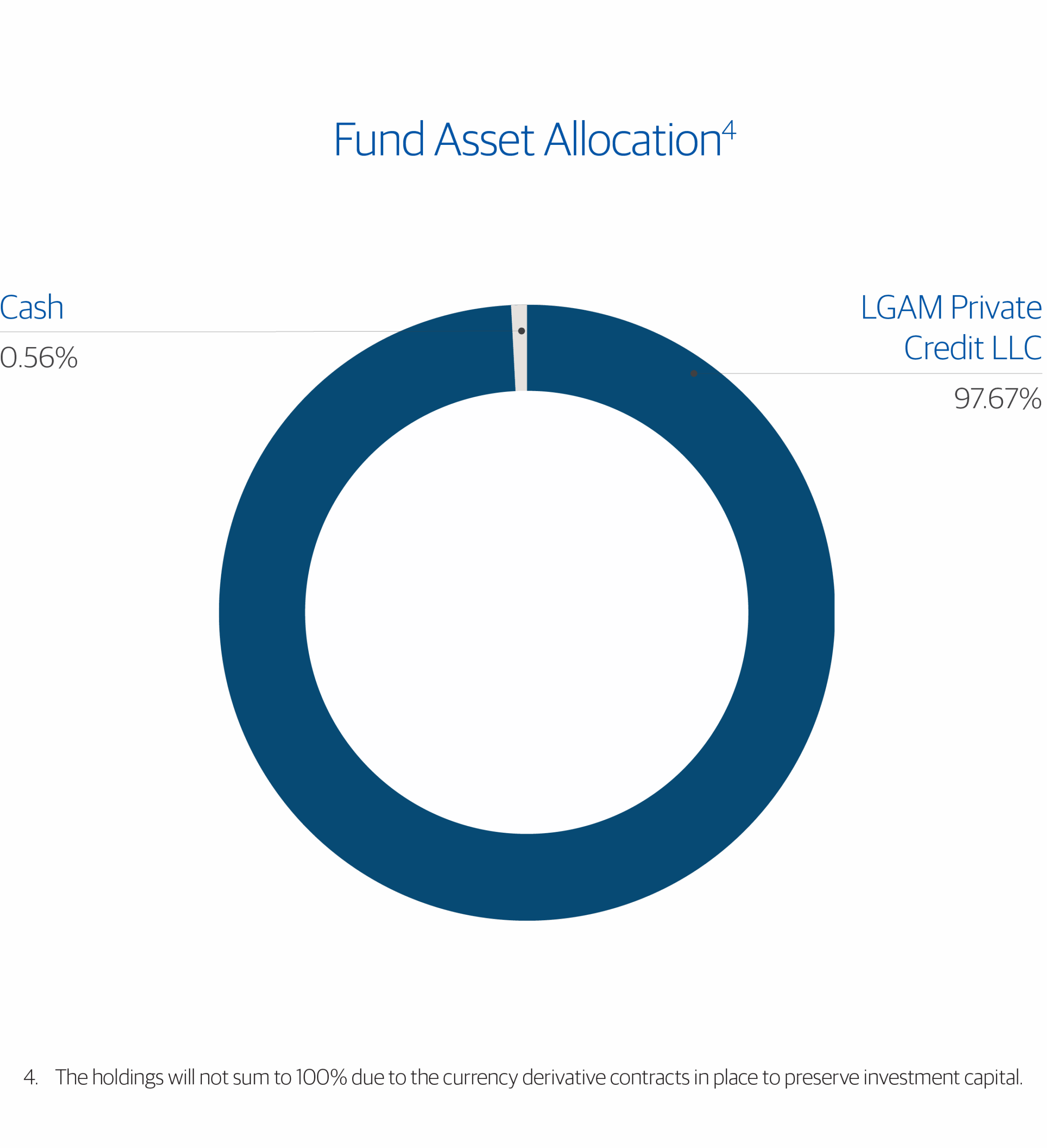

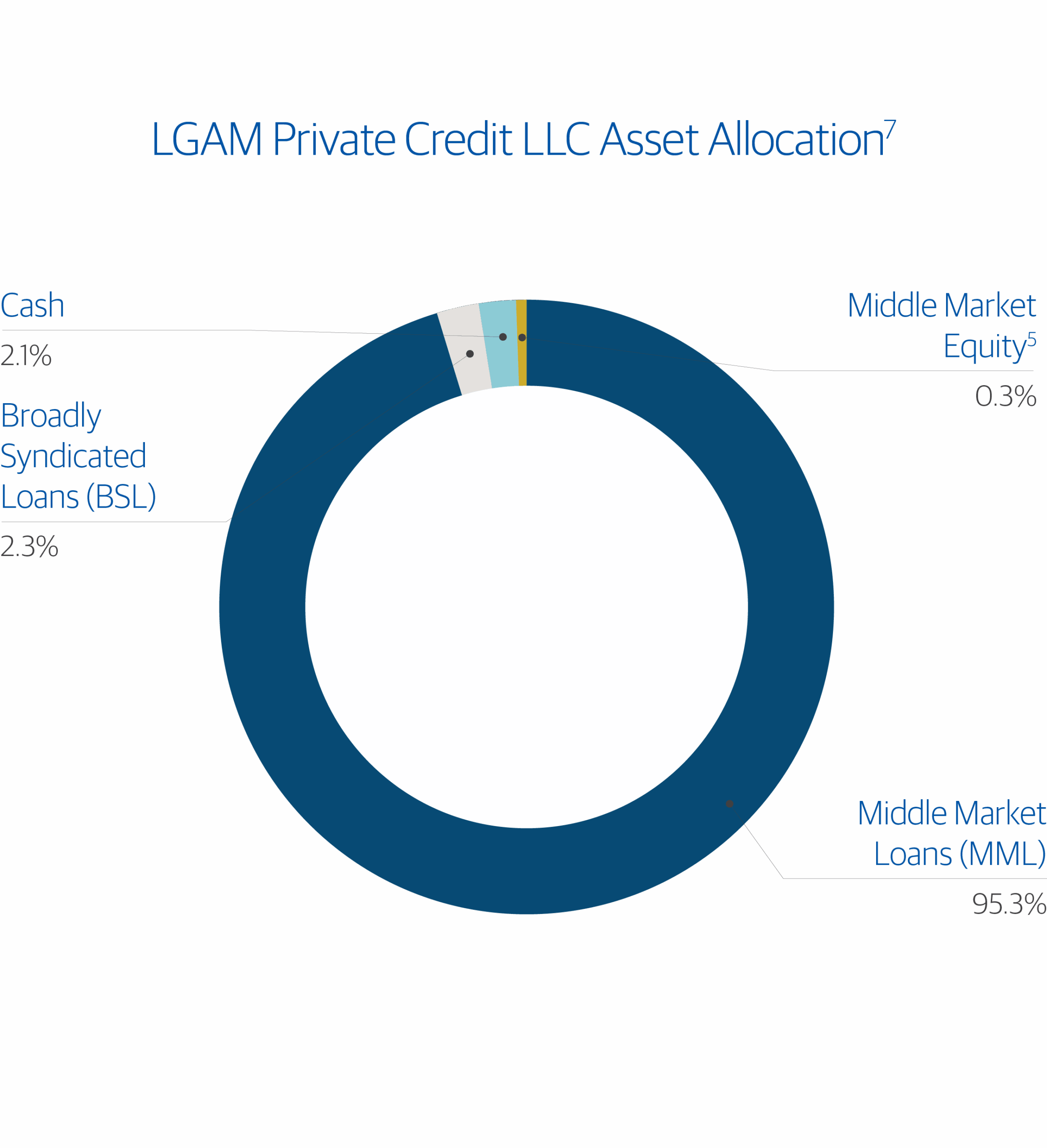

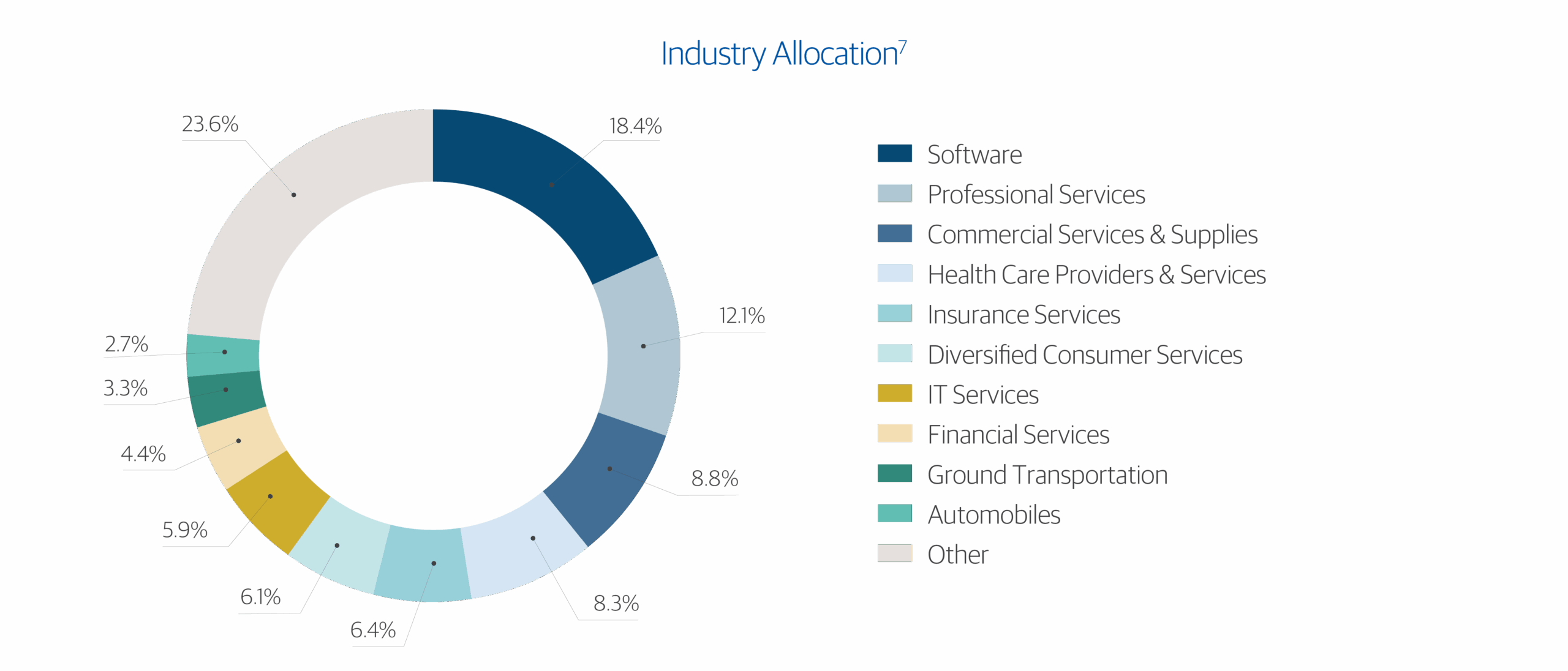

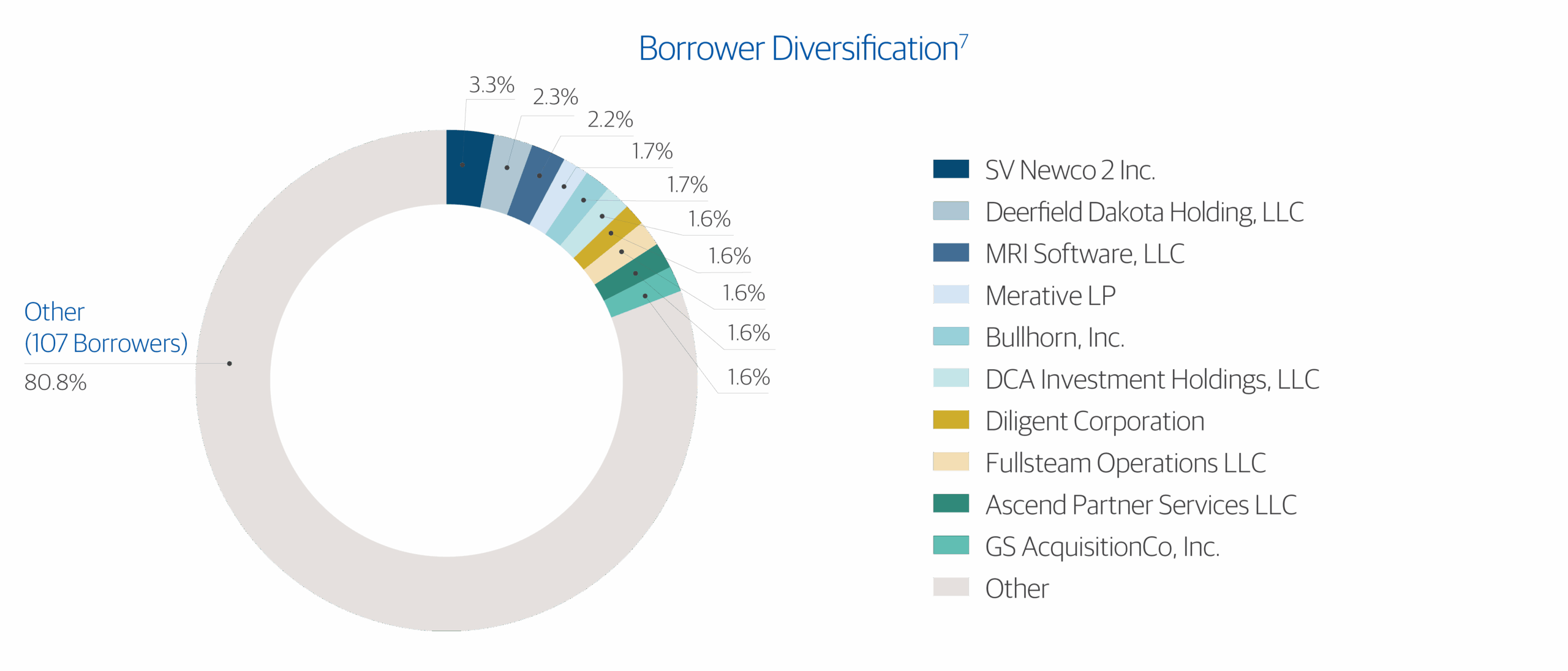

The US Private Credit Fund indirectly invests into a defensive portfolio comprising a majority of directly originated senior secured loans issued to US middle market companies.

Attractive industry & market tailwinds, with growing addressable market

Directly negotiated senior debt, majority or predominantly PE sponsored

Important information : This offer is for retail investors in Australia only. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

* The target distribution return is net of fees and expenses but excludes any adjustments for FX rate fluctuations. The target return is reviewed monthly and may change. This target return is determined with reference to the return benchmark of the Secured Overnight Financing Rate (SOFR) + 3% as at 1 June 2025. This is a target return only and may not be achieved.

# Redemption requests are generally processed on a quarterly basis in accordance with the PDS. Investors do not have a right to redeem and the Responsible Entity (RE) may reject redemption requests. The ability to redeem is subject to liquidity and the processing of redemptions may be delayed or suspended in certain circumstances. The RE will limit redemptions to up to 5% of the issued Class B Units each quarter. Redemption requests exceeding that limit may be accepted by the RE, pro-rated or scaled back to 5%. Please refer to the PDS for more details about redeeming Class B Units and how to submit a redemption request form.

All investing involves risk. The summary below sets out some of the risks that a prospective investor should be aware of and consider before investing in the La Trobe US Private Credit Fund (USPCF).

Please refer to section 6 of the PDS for more detailed risk disclosures, including in respect of specific investment risks in the LGAM Private Credit LLC (Underlying Fund).

Investment risk: As with most investing, there is no guarantee that investors will earn a positive return from investing in the USPCF. Investors may receive back less monies than they invested, and there is no guarantee of regular distributions of income from an investment in the USPCF.

Valuation risk: La Trobe Financial expects to receive valuations of the Underlying Fund on a monthly basis. The Investment Adviser of the Underlying Fund will determine the fair value of the Underlying Fund’s assets in its reasonable judgment based on various factors and may rely on internal pricing models. Such valuations may vary from similar valuations performed by independent third-parties for similar types of assets. Accordingly, due to a wide variety of market factors and the nature of certain assets to be held by the Underlying Fund, there is no guarantee the USPCF can realise its investments in the Underlying Fund at the valuations provided by the Investment Adviser.

Interest rate risk: Changes in interest rates may negatively affect, directly or indirectly, investment values or returns.

Currency risk: La Trobe Financial will implement hedging arrangements to seek to reduce the impact of exchange rate fluctuations between Australian dollars and the base currency of the Underlying Fund, on the value of USPCF assets. While La Trobe Financial intends to do this on a best endeavours basis, the USPCF may not provide complete protection from adverse currency movements and could limit potential gains.

Liquidity risk: Liquidity risk may mean that Units of the USPCF are unable to be sold or the Fund’s exposure is unable to be rebalanced within a timely period and at a fair price, potentially resulting in delays in processing redemption, or even suspension of redemptions.

As at 30 June, 2025.

View the Monthly Fund Profile

Read the Product Disclosure Statement.

Apply online using our simple 4-step process.

We will email you with your access details so you can start investing.

We are always here to help. Call our friendly Asset Management team on 1800 818 818

Important:

~ While the Responsible Entity intends to do this on a best endeavours basis, the Fund may not provide complete protection from adverse currency movements.

* The target distribution return is net of fees and expenses but excludes any adjustments for FX rate fluctuations. The target return is reviewed monthly and may change. This target return is determined with reference to the return benchmark of the Secured Overnight Financing Rate (SOFR) + 3% as at 1 June 2025. This is a target return only and may not be achieved.

# Redemption requests are generally processed on a quarterly basis in accordance with the PDS. Investors do not have a right to redeem and the Responsible Entity (RE) may reject redemption requests. The ability to redeem is subject to liquidity and the processing of redemptions may be delayed or suspended in certain circumstances. The RE will limit redemptions to up to 5% of the issued Class B Units each quarter. Redemption requests exceeding that limit may be accepted by the RE, pro-rated or scaled back to 5%. Please refer to the PDS for more details about redeeming Class B Units and how to submit a redemption request form.

Any advice on our website is general and has been prepared without considering your objectives, financial situation, or needs. When making your investment decision, note that (1) an investment in our products is not the same as a term deposit, lacking coverage under the Australian Government’s deposit guarantee scheme and posing a higher risk than a bank-issued term deposit; and (2) additional risks are associated with an investment in our products which are detailed in section 9 of the La Trobe Australian Credit Fund PDS, and section 6 of the La Trobe US Private Credit Fund PDS respectively. Full disclaimers are available here.