Investors step into 2026 facing one of the most complex macro backdrops in more than a decade. Warning lights are flashing across global markets: from slowing economic growth to soaring gold prices, from historically high equity valuations to rising long‑term bond yields in markets traditionally viewed as stable. Uncertainty is not only elevated, but also already influencing market pricing, investor sentiment, and capital flows.

Unlike previous periods of volatility where risks tended to cluster in one region or asset class, today’s uncertainty is broad‑based. Global growth forecasts are softening, geopolitical tensions remain unresolved, and market valuations appear increasingly disconnected from underlying fundamentals. Together, these forces shape a landscape that investors cannot ignore.

- Slowing Global Growth and Diverging Economic Signals

Major institutions point to a continued slowdown in global GDP growth, with expectations settling near 2.6–2.7% 1, well below the pre‑pandemic trend. This structural softness has implications for fiscal capacity, employment, and long‑term productivity, reinforcing a fragile economic environment.

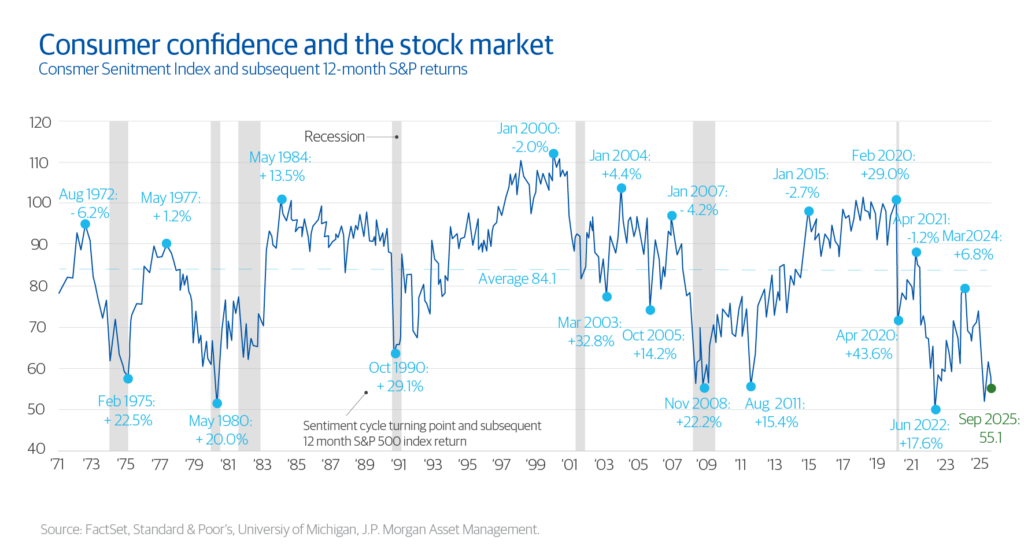

At the same time, the divergence between economic sentiment and market behaviour is widening. Consumer confidence remains subdued globally, even as equity markets delivered unexpected gains in 2025. This disconnect increases market vulnerability: historically, when markets and households disagree, markets tend to correct.

- Rising Market Valuations and the Return of Bubble Concerns

The rise of AI‑linked sectors has driven valuations to levels many analysts now describe as “bubble‑adjacent.” Multiple data points support this concern:

- The Buffett Indicator reaching ~224%, the highest level on record 2

- Tech‑heavy indices priced at historic earnings multiples

- Consensus view among Deutsche Bank surveyed institutions that an AI driven correction ranks as a top global risk for 2026 3

Valuations of this magnitude reduce market resilience. When an asset class trades significantly above fundamental value, corrections can be sharp and contagious, particularly as investors grapple with broader macro uncertainty.

Buffett Indicator (Market Cap / GDP) over the past 30 years.

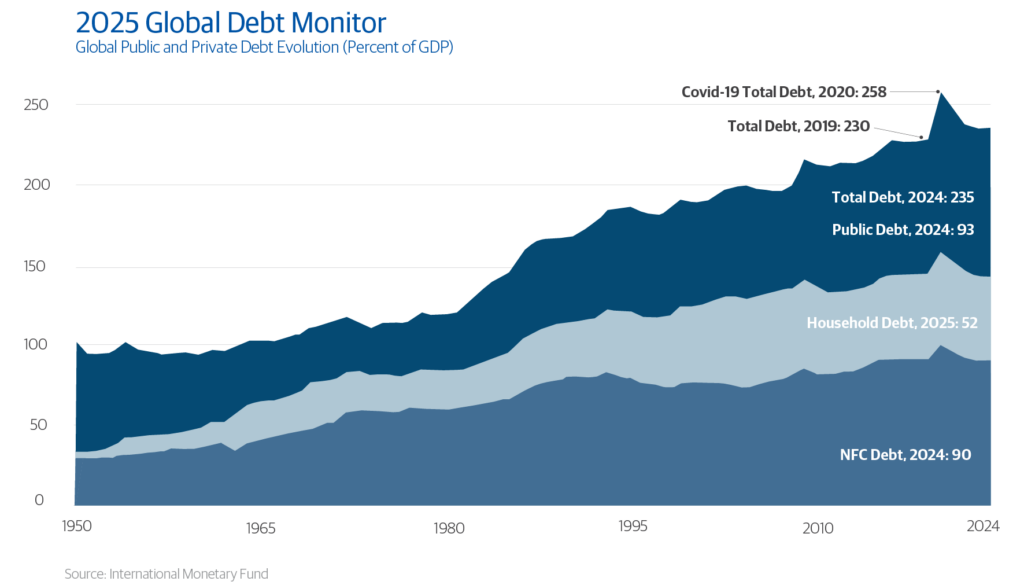

- Debt Levels Limiting Policy Flexibility

Public and private debt globally has surged to levels that leave policymakers with reduced manoeuvrability. The World Bank and UN highlight fiscal pressures, especially in emerging markets where rising borrowing costs collide with slowing growth.

For investors, this means traditional policy responses – aggressive stimulus, extended rate cuts, or large‑scale balance‑sheet support – may no longer be as readily available or effective. High debt loads also amplify the impact of external shocks.

Global debt-to-GDP trends (public + private) since 2000.

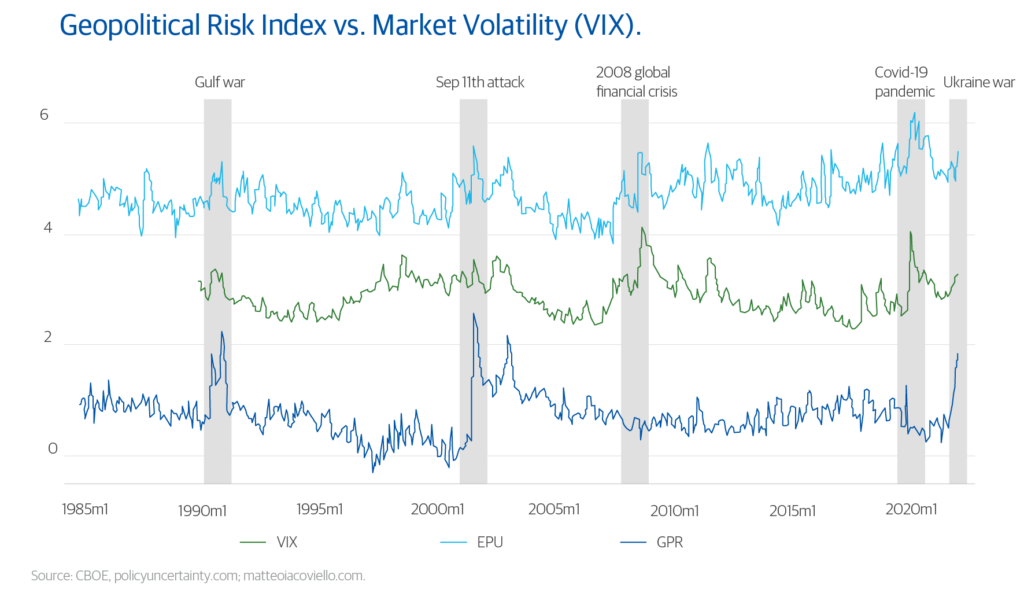

- Geopolitical Tensions Reinforcing Uncertainty

Geopolitics is a defining feature of the 2026 investment environment. From trade tensions and tariff escalations to renewed flashpoints in the Middle East, the global order appears increasingly unstable. Key institutions note a convergence of economic, geopolitical, and technological tensions, creating overlapping risks rather than isolated ones.

For markets, geopolitics matters because it can raise, delay and can shift the volatility premium investors require to hold risk assets, delays capital investment decisions, and can shift global liquidity channels.

Geopolitical Risk Index vs. market volatility (VIX).

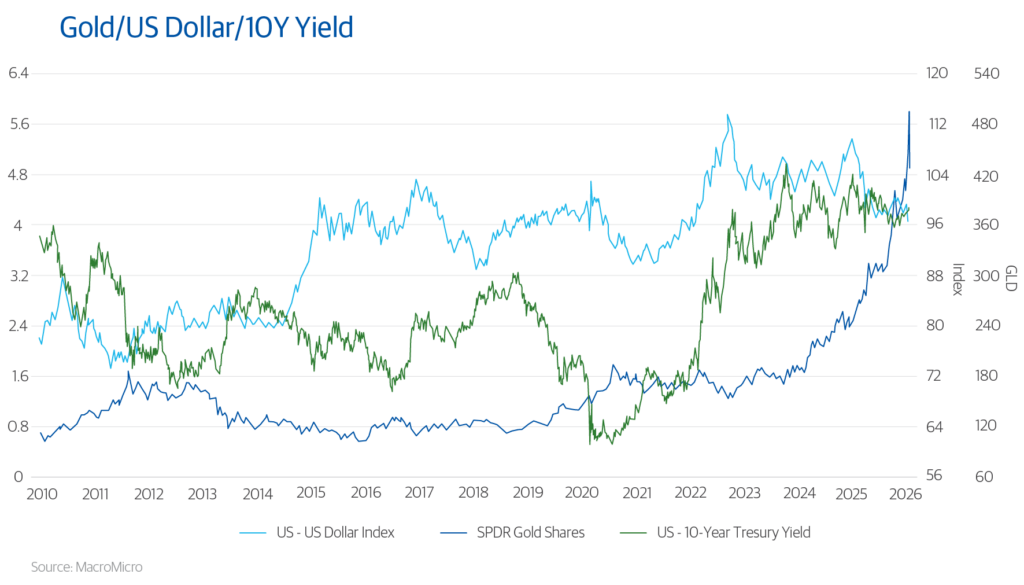

- Gold at Record Highs: The Ultimate Expression of Fear

Gold’s explosive run, exceeding US$5,500/oz in January, reflects acute investor anxiety. Safe‑haven flows have surged due to political instability in the United States, expectations of global rate cuts, central bank accumulation, and weakening USD dynamics.

Gold historically rallies when trust in institutions, governance or monetary stability weakens. Today’s price action signals not speculation, but a genuine flight to safety.

Gold price vs. US real yields and USD index.

- Japan’s Long-Term Yields Break Anchors, A Global Shock

Japan, long perceived as a bastion of yield stability, saw its 40‑year government bond burst above 4% for the first time in its history. This shift represents a fundamental change in how markets view fiscal sustainability and the Bank of Japan’s role as a global liquidity stabiliser.

The spillover matters profoundly:

- Higher Japanese yields can redirect capital away from global markets

- Carry trades may unwind, reducing liquidity in risk assets

- Global discount rates may drift structurally higher

This is a seismic development in global fixed income markets.

Japanese 40‑year yield vs. global long‑term yields.

- Property and Real Assets: An Uneven Landscape

Australian real estate markets continue to adjust to post‑pandemic behaviours. While certain segments (Brisbane office, some prime assets) may be nearing yield peaks, others (Melbourne office , non‑core retail) face further repricing.

Demand remains bifurcated: quality assets retain depth of buyers, while secondary assets face thinner capital pools and higher risk premia. This environment creates both challenges and selective opportunities.

Australian cap rate trends by sector (Office, Industrial, Retail).

- Structural Forces: Demographics, Productivity, and the Search for Yield

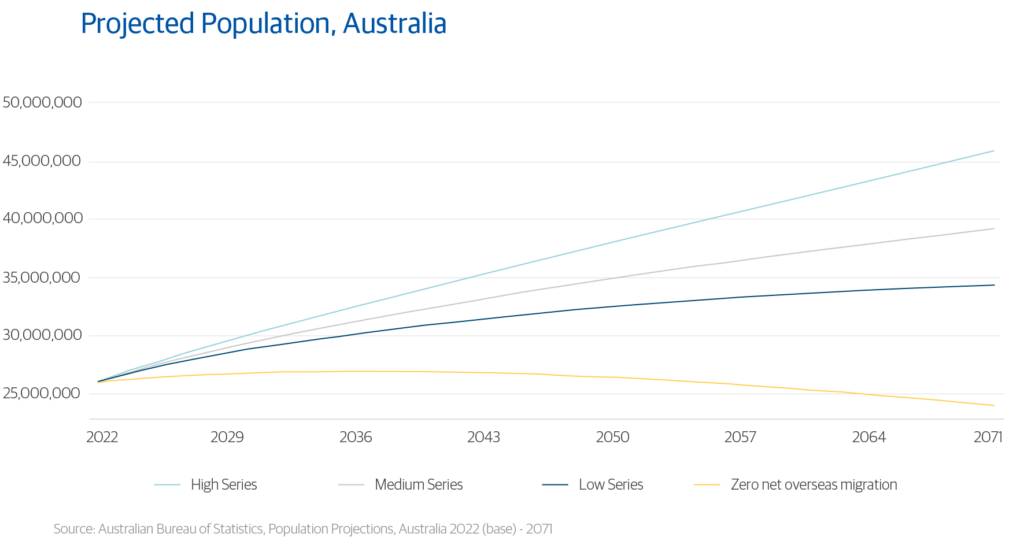

Structural tailwinds from population growth, demographic shifts, and urbanisation, continue to shape long-term investment demand. Australia’s expanding population and ageing demographics are reshaping consumption, infrastructure needs, and real asset demand.

Yet even these solid foundations do not shield investors from shorter-term uncertainty in pricing, liquidity, and risk sentiment.

Australian population projections to 2071 (Treasury / ABS).

What This Means for Investors: Navigating a New Regime

The combination of slowing growth, elevated valuations, geopolitical tensions and rising long-term yields suggests investors are entering a new market regime, one where uncertainty is structural, not cyclical.

For investors, this raises key questions:

- Where can returns be sourced without taking undue risk?

- How do portfolios adapt when traditional safety anchors (government bonds) behave differently?

- Which asset classes offer resilience in a world defined by unpredictable liquidity and volatile discount rates?

The Role of Private Credit

This environment sets the stage for Private Credit, in our next Portfolio Point we’ll explore:

- Why private credit has gained prominence for investors seeking low-volatile, income‑oriented returns

- How its structural features, floating‑rate exposure, security, covenants and diversification, can help navigate uncertainty

- Where private credit fits within multi‑asset portfolios in a higher‑volatility world

Private credit is not a silver bullet, but it provides attributes increasingly valued in uncertain markets: resilience, consistent income, and lower correlation to public‑market cycles.

1 https://unctad.org/news/global-growth-expected-slow-26-through-2026#:~:text=03%20December%202025,Listen

2 https://finance.yahoo.com/news/buffett-indicator-hitting-level-seen-182400883.html

3 https://www.db.com/news/detail/20251126-deutsche-bank-capital-markets-outlook-2026-artificial-intelligence-as-a-growth-engine-in-a-world-of-risks?language_id=1

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321, the La Trobe US Private Credit Fund ARSN 677 174 382 and the La Trobe Private Credit Fund ARSN 686 964 312 (ASX:LF1). It is important that you consider the relevant Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in any of the funds. The PDSs and Target Market Determinations are available on our website.

Any financial product advice is general only and has been prepared without considering your objectives, financial situation or needs.