Why portfolio design matters more than the parts

When it comes to investing for income, one thing matters more than most: quality. Strong investment portfolios don’t happen by accident. Like a well‑engineered structure, they are deliberately designed – built with quality assets, within simple and quality frameworks, managed by experienced professionals.

In engineering, you don’t eliminate the forces of nature; you plan for them. A building must withstand wind, rain and unexpected stress. Likewise, an investment portfolio cannot avoid market pressures, but it can be constructed to remain steady when they arrive. That’s what a quality‑first approach delivers.

What Makes a Portfolio Resilient?

The past two decades have tested investors: financial crises, global pandemics, supply‑chain shocks and geopolitical tensions have all created uncertainty. Yet throughout these periods, quality income strategies have continued to deliver steady returns with low volatility. Some have even done so without recording a single investor loss.

The difference lies in how the portfolio is built.

Quality Assets: The Foundation of Portfolio Strength

Diversification plays a central role. In Real Estate Private Credit – or mortgage investment – portfolios can be constructed in many ways. Some managers hold a small number of large loans. Others, like La Trobe Financial, build portfolios using a large number of smaller, carefully assessed loans spread across different borrowers, sectors and locations.

This approach helps ensure that no single event becomes a structural weakness. Just as load‑bearing elements in a building distribute pressure, a well‑diversified portfolio helps absorb market stress.

In private credit, a focus on senior lending matters. As does the loan‑to‑value ratio (LVR); a key indicator of asset quality. While loans can extend beyond 80% LVR, a more conservative approach offers a valuable margin of safety. It ensures that even if property values fall, the underlying loan remains securely supported by the real asset.

A lower LVR reflects a deliberate focus on protecting investor capital. It can contribute to stable income, low arrears and consistently strong performance. In this context, LVR is more than a statistic – it’s part of an engineered approach to risk and return.

Looking Beneath the Surface

Many investors naturally ask: who are the borrowers behind these loans?

In the case of La Trobe Financial, we provide credit to ‘complex prime’ borrowers – individuals with strong financial profiles whose circumstances no longer align with automated bank processes. These include professionals such as doctors, pilots, business owners and trustees of self‑managed super funds.

They may be financially sophisticated, with more complex structures, but they are still high‑quality borrowers.

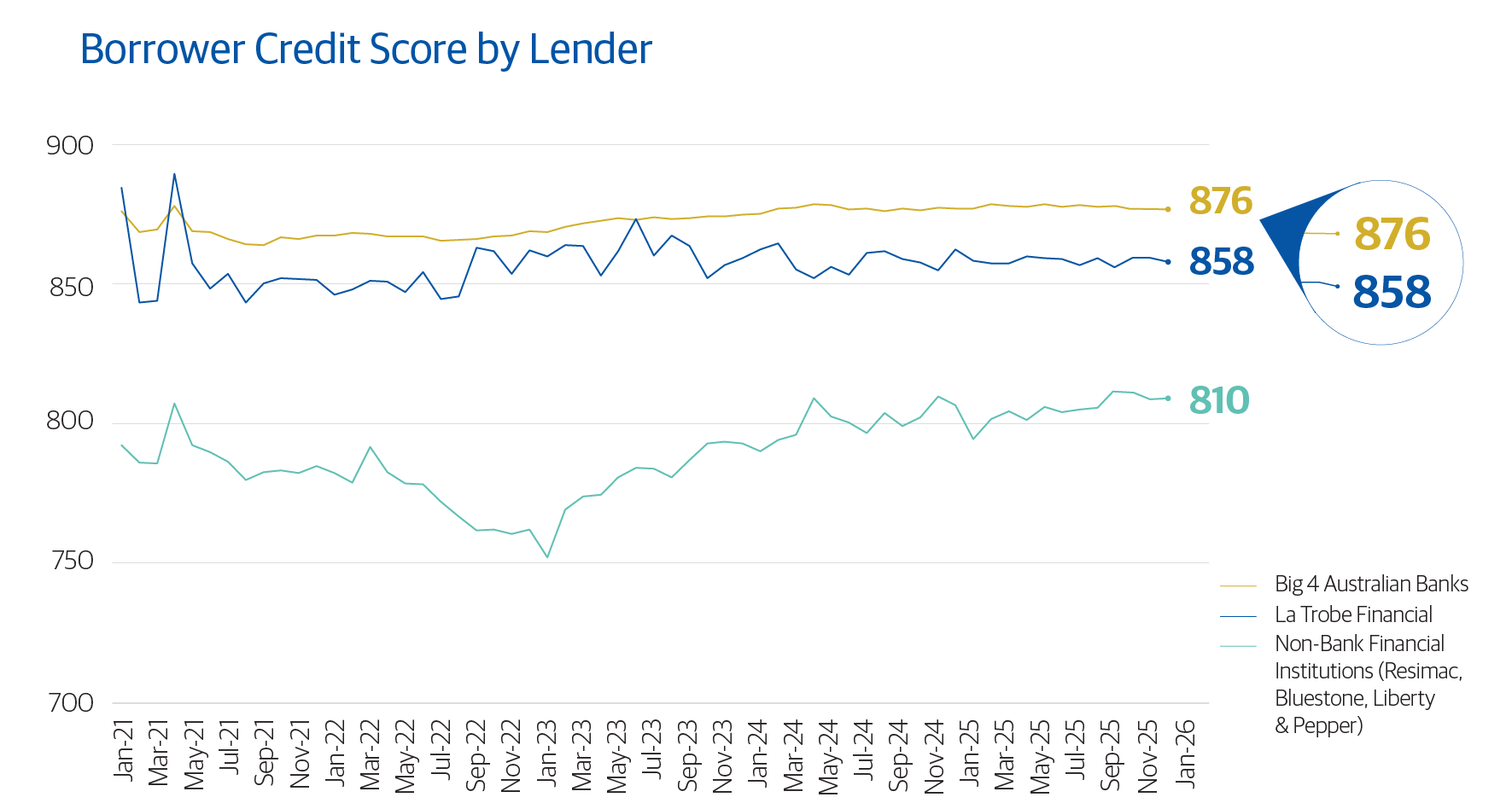

At La Trobe Financial, 96% of borrowers have no history of credit impairment, and their credit scores are comparable to borrowers at Australia’s major banks.

A Personal Approach to Lending

Since the Global Financial Crisis, many banks have relied more heavily on rigid, automated credit systems. This shift has widened the gap for borrowers who are financially strong but no longer easily assessed by automated algorithms.

Private credit lenders like La Trobe Financial bridge that gap by taking a personal, hands‑on approach. Every loan application is reviewed by at least two experienced credit assessors, ensuring decisions are made with professional judgement, not just system rules.

Not a Bank – and Not a Bank Account

By focusing on high‑quality assets, strong credit oversight and a diversified and actively managed lending base, many private credit portfolios have proven their ability to perform through different market conditions.

But it is important to remember: private credit managers are not banks, and private credit investments are not equivalent to term deposits. Investors should always understand whether they are accessing quality assets, within quality structures, managed by specialists with long track records.

The La Trobe Financial Difference

The results over time tell the story. Every portfolio within the La Trobe Financial Australian Credit Fund has delivered consistent income and full capital returns since inception – including during the most volatile periods.

The flagship 12 Month Term Account, currently paying 6.00% p.a. after fees*, has:

- A 23‑year history with no investor losses**

- All maturing withdrawals paid on time and in full

- Consistent outperformance of benchmarks

This is the outcome of a disciplined, quality‑driven approach to portfolio construction – one that aims to deliver reliable income.

At La Trobe Financial, we believe that income investing is about engineering resilience, not taking unnecessary risks. With the right foundations, it is possible to achieve strong, steady returns while protecting the integrity of the investment over time.

*The variable rate of return is current as at 1 November, 2025. The rate of return is reviewed and determined monthly, are not guaranteed, and may be lower than expected. The rate of return is determined by the future revenue of the credit fund, and distributions for any given month are paid within 14 days after month-end. An investment in the credit fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important that you consider the Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest. The PDS and Target Market Determination is available on La Trobe Financial’s website.

Any financial product advice is general only and has been prepared without considering your objectives, financial situation or needs.

**Past performance is not a reliable indicator of future performance.