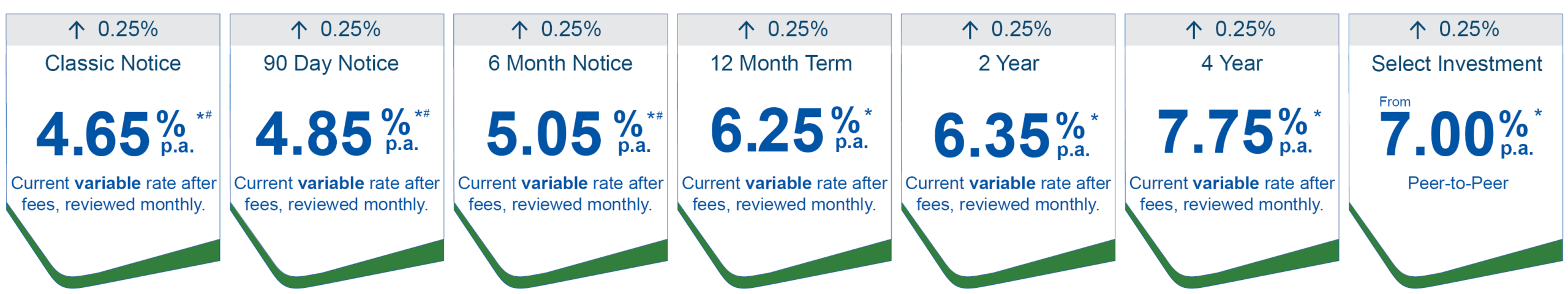

Good news: Investment Returns are Increasing

We are pleased to confirm that effective 1 March 2026, investment rates across all La Trobe Australian Credit Fund investment products will increase.

Stronger Returns Backed by Quality and Diversification

For more than seven decades, La Trobe Financial has been looking out for investors. Our portfolios are built with discipline – highly granular, deeply diversified and supported by conservative credit underwriting. This approach has delivered low-volatility, consistent monthly income and 100% return of capital since inception across every pooled account1.

The latest rate increase reflects the continued strength and resilience of our portfolios. Each asset is selected for its quality and ability to perform across economic cycles, ensuring consistent, dependable income outcomes for investors.

We are pleased to pass on these higher returns, driven by the strong performance of our underlying portfolios.

We will continue to monitor the rate environment and will update investors should further changes occur.

1 Past Performance is not a reliable indicator of future performance.

*The variable rates of return will be current at 1 March 2026. The rates of return are reviewed and determined monthly, are not guaranteed, and may be lower than expected. The rates of return are determined by the future revenue of the Credit Fund, and distributions for any given month are paid within 14 days after month end.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

# We will make every endeavour to release your funds after receiving your withdrawal request: within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account, and 180 days for the 6 Month Notice Account. However, we have 12-months under the Fund’s Constitution to fulfill the request. When determining whether to honour your withdrawal request within the specified timeframes we have to have regard to the Fund’s ability to realise for value the relevant assets and the best interests of investors. While there is a risk of not honouring your withdrawal request within 2 business days, 90 days or 180 days, it’s important to note that there has never been a case in the history of the Fund when we have not honoured a withdrawal request on time due to a lack of liquidity.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement (PDS) when deciding whether to invest, or continue investing, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website.

Any advice is general and does not consider your personal circumstances.