Introduction: A Pivotal Moment in Finance

If you see one cockroach, there are likely to be more. But in investing, facts matter more than euphemisms. Systemic risk doesn’t come from cockroaches; it comes from a broken system.

We know this because today’s financial system had to be repaired and rebuilt after the Global Financial Crisis in 2007, the most pivotal moment, and the last systemic failure of the financial system.

For La Trobe Financial, the GFC proved the robustness of our portfolios and the strengths of our liquidity management framework. We clearly demonstrated that even when financial markets were in failure, our durable approach continued to deliver for investors.

From Crisis to Catalyst: The GFC’s Regulatory Legacy

The GFC didn’t occur only because of bad loans in the U.S. housing sector, of which there were many! And it wasn’t just a market shock – it was a systemic failure.

Excessive leverage, concentrated risk, opaque and complex structures, which were bundled and syndicated created a fragile system, too interconnected, and primed for contagion, exposing bank depositors to risk. Rising foreclosures in the U.S. housing market were amplified by the broken system, turning a relatively small and localised issue into a catastrophic global financial event.

Regulators responded decisively. Post-GFC reforms dismantled that fragility, strengthening banks and putting guardrails in place to prevent similar occurrences in the future: reduced leverage, improved capital buffers, increased transparency, and stress testing.

The consequence – banks retreated from their more traditional playground towards only the most conservative and vanilla lending. This opened a gap for other providers to deploy more capital into the economy. Enter private credit: a broad phrase used to describe direct lending provided by asset managers and financial institutions who are not a bank. Importantly, private credit didn’t emerge as a rogue wave; it grew in the safe harbor regulators created. The structural shift moved risk away from depositors with banks to investors with asset managers. That’s the real story behind its rise.

A Globally Mature Market

Globally, private credit has grown by a factor of 10 since the GFC, with developed economies like the US, UK, and Europe leading the way. Early in 2025, the private credit market surpassed $3trn in assets under management (AUM) and has been one of the fastest-growing segments of the financial system over the past 15 years, according to an article by McKinsey, adding $1trn in the past 18 months alone.

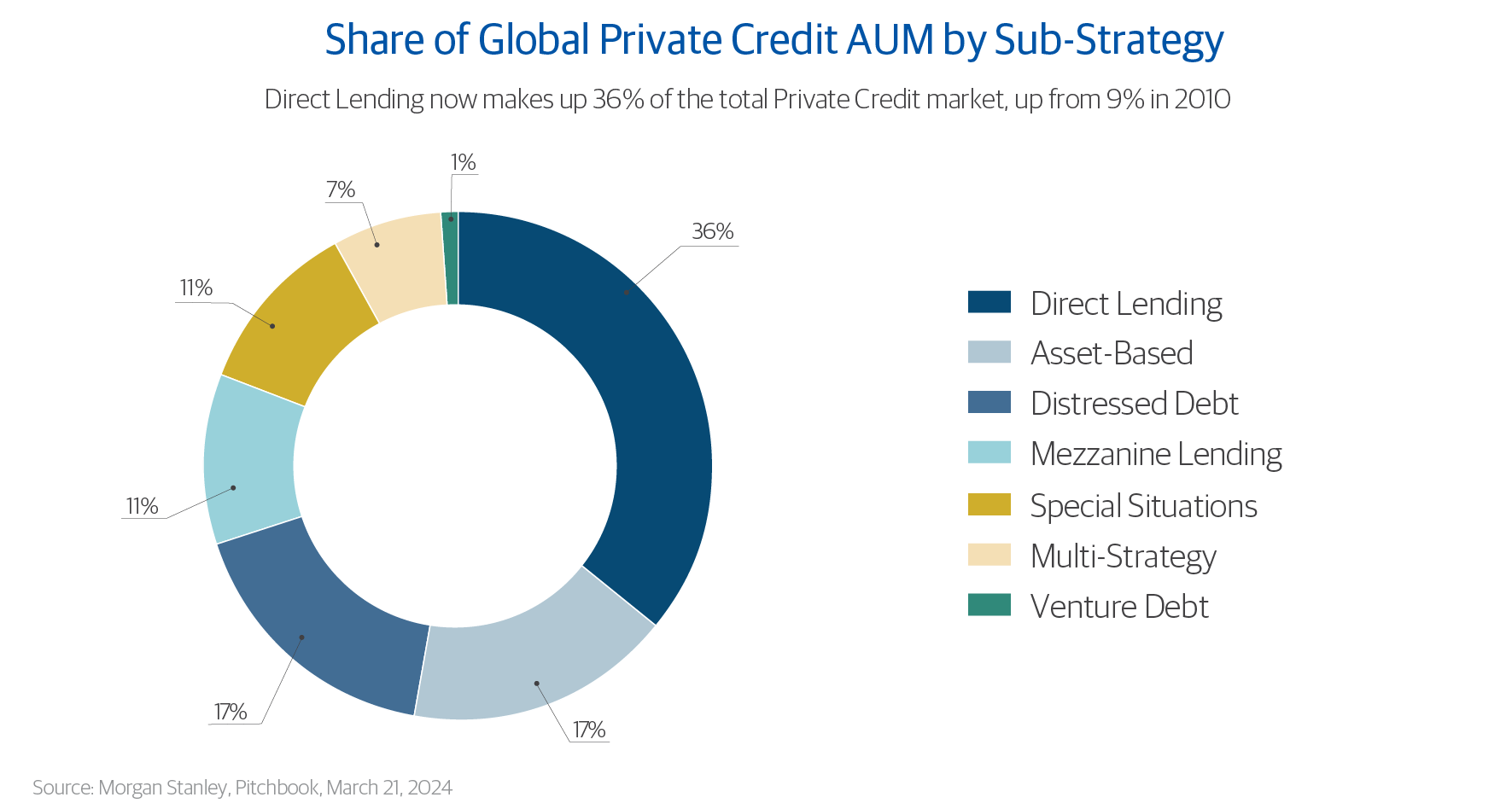

Direct lending’s contribution to this growth is notable, growing from single-digit market share post-GFC to 36% today. Direct lending strategies provide credit primarily to private, mid-market companies. Direct lending strategies can be appealing as they invest in the senior-most part of a company’s capital structure, which may provide steady current income with lower risk. There are plenty of key drivers for growth, including investment in infrastructure and energy. Private credit is expected to play a leading role in the global green energy transition according to EY. As a result, private credit is now to be a mainstay of the global financial landscape, a counter-cyclical champion in times of economic turbulence.

Which is Slowly Emerging in Australia

Today, Australia’s private credit market stands at its own pivotal moment.

Mortgage credit – like that provided by La Trobe Financial for over 70 years – has been a consistent feature of the Australian financial system for decades. La Trobe Financial services the complex prime cohort of borrowers and while growing, remains a small percentage of the overall $3.1 trillion real estate credit market.

Importantly, mortgage schemes have been regulated by ASIC since 2008 under the RG45. A mature regulatory regime, RG45 sets benchmarks and disclosure requirements across a range of key topics including risk management, fees and transparency, valuations, and related party transactions.

By comparison, non-real estate private credit (i.e. corporate private credit) is in its relative infancy in Australia and sits at $132bn*. Its growth of 16% per annum over the last 10 years, off a lower base, is outpacing mortgage scheme growth, and in a comparatively less regulated environment. That is, corporate private credit managers are not currently subject to RG45 or any other comparable regime.

It’s this growth and the need for greater regulatory oversight that sparks “bubble” talk and systemic risk chatter – but context matters. Corporate private credit participation remains modest in comparison to other developed economies, but demand is rising as investors seek enhanced income and borrowers seek flexible funding.

It’s that demand which is driving ASIC’s interest and review of corporate private credit here in Australia.

Private Credit: Structural Shift, Not Bubble

The narrative that “private credit growth equals systemic risk,” ignores its regulatory roots and economic reality. Growth has been measured and intentional, supported by transparent and disciplined providers. Unlike bubbles, structural shifts don’t pop – but they do require vigilance.

Private credit offers an alternative: direct loans, active management, and workout expertise. Today, in a private credit context, a loan in arrears is no more alarming than a stock losing value – provided it sits within a diversified, actively managed portfolio with a manager with proven expertise and experience.

Cockroaches will always exist – isolated defaults happen – but they don’t topple systems when portfolios are diversified and actively managed. That’s the essence of resilience.

Saying the Sensible Part Out Loud

In a healthy ecosystem, cockroaches and swallows coexist. It’s not binary. So too in healthy and vibrant markets. Good asset managers build portfolios armed with bug spray and suncream – robust diversification and rigorous credit standards.

By way of example, during the GFC, direct loan defaults in U.S. mid-market companies, rose to 4%. Of those in default, direct lenders where able to recover on average 70% of the loan#.

We know that today, the U.S. direct lending industry has the highest economic participation globally. That market is the bellwether for direct lending, and if stress starts appearing, that is where we’ll see it first.

Today direct lending defaults in U.S. mid-market companies are running at less than 2%, and recovery from defaults remains strong at ~70% of the loan. This compares favourably to public credit (i.e. broadly syndicated loans) which has a 4% default and a similar 70% recovery rate#.

Far from being a threat, private credit done well supports economic activity, provides investors with dependable income, and fills gaps left by traditional banking. That’s why private credit acts as a stabilising rudder, not a systemic risk.

The Bigger Picture

Direct lending, or private credit, is a broad church. Strategies differ by asset type, risk, liquidity, and return profile. Just as equity managers construct share portfolios, private credit managers engineer loan portfolios – reducing volatility through diversification.

This portfolio effect is critical. It means that while individual loans may face challenges, the overall structure remains resilient. That’s the essence of risk management – and the reason regulators have embraced private credit as part of the solution, not the problem.

Correcting the Record

Some recent commentary around private credit has become as dangerous for investors as the bad actors it claims to expose. Misinformation creates fear and poor investment decisions. Investors deserve clear facts and transparency.

ASIC’s review into private credit isn’t about scaring away retail investors – it’s about transparency and lifting standards as the industry grows, ensuring investors clearly understand what they’re investing into. Sunlight is the best disinfectant, but sensationalism helps no one. The regulator has laid out ten principles for private credit and expects funds to benchmark against them. This is good for investors – and good for the industry.

Private Credit Done Well Is Fundamentally Good

- For investors: dependable returns for appropriate risk

- For borrowers: tailored funding where banks have retreated

- For the economy: fuels domestic production and growth

Private credit is not a niche experiment and has been part of the financial system for 4,000 years. Done well, it is a cornerstone of modern finance.

Our Position

At La Trobe Financial, quality starts with process and ends with outcomes investors can trust. Take, for example, our flagship 12 Month Term Account:

- ~14,500 loans, diversified by borrower type, sector, and geography

- 96% of borrowers with zero negative credit history

- Average LVR: 67%, providing a strong margin of safety

- Current return: 6.00% p.a., paid monthly**

- 100% return of capital since inception in October 2002

- Arrears remain anchored within historical norms

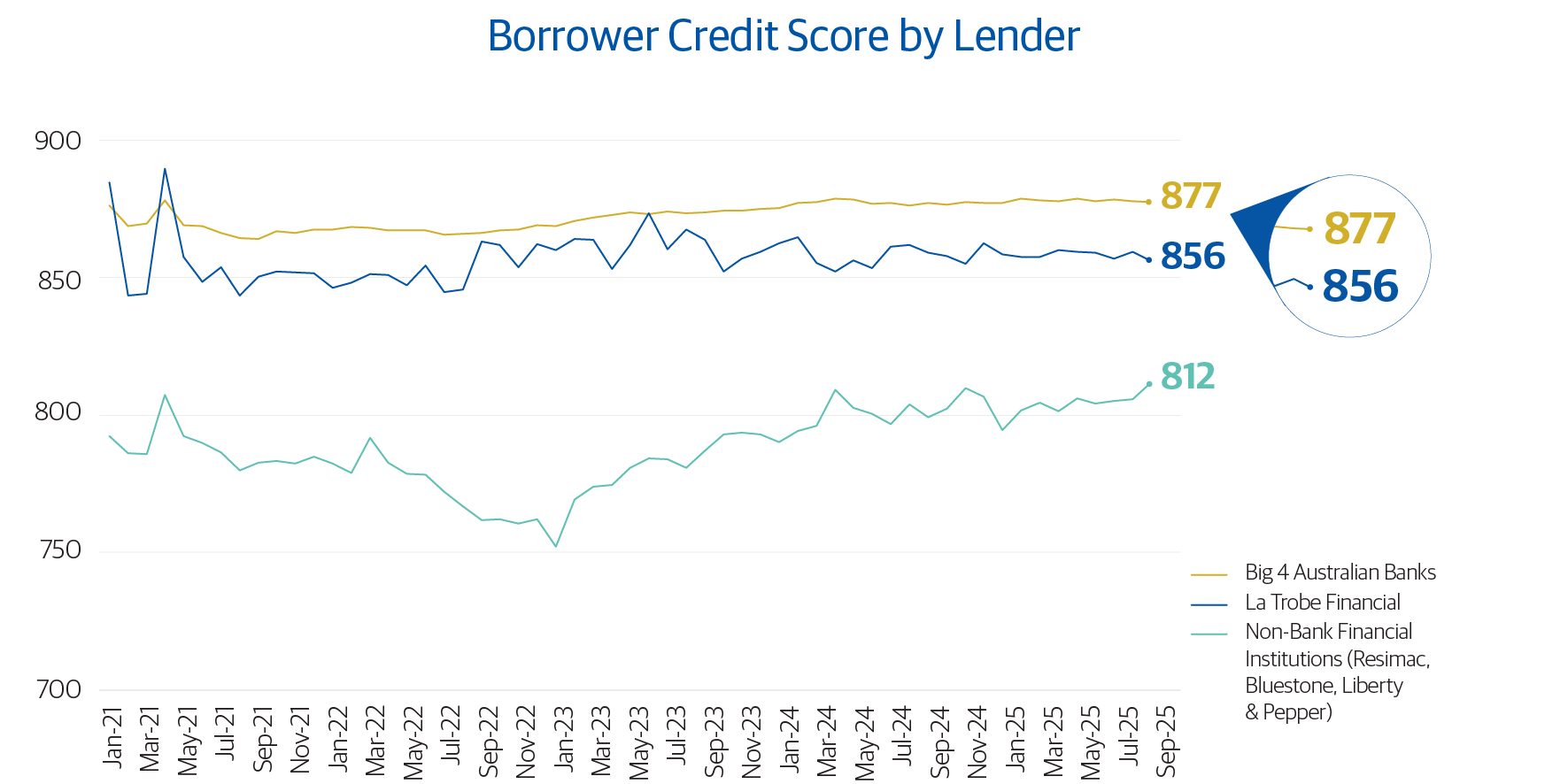

- Credit scores aligned with those of Australia’s Big Four banks

Total Transparency

Transparency is non-negotiable.

At La Trobe Financial, we are committed to market-leading transparency in all our strategies. This includes publishing publicly each month thousands of data points on our private credit strategies. We do this because investors deserve clarity.

Our flagship 12-Month Term Account exemplifies this approach – combining rigorous credit standards with active management to deliver consistent outcomes.

Our Commitment

ASIC’s review is a pivotal moment in Australian private credit because it strengthens investor protection. We reject misinformation because it undermines confidence and harms investors. And we reaffirm our commitment to putting investors first – today, tomorrow, and always.

If it’s good for investors, it’s good for us. Private credit done well is fundamentally good. Let’s keep the conversation sensible, informed, and focused on what matters most: protecting and growing investor wealth.

Past Performance is not a reliable indicator of future performance.

* Australian Private Debt Market Review 2025 by Alvarez & Marsal

**Rate current 1 November 2025, after fees. Rate not guaranteed. Consider the PDS and TMD on our website before investing.

^ Total investors is calculated by adding all individual & joint investors (which includes some investors with a current zero balance in their account) to reasonable estimates of investors investing via trusts or SMSFs.

# Source: https://www.morganstanley.com/im/publication/insights/articles/article_evolutionofdirectlending.pdf

Any Financial product advice is general only and has been prepared without considering your objectives, financial situation or needs. You should, before investing or continuing to invest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and consider the Product Disclosure Statement for the fund. La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 Australian Credit Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important that you consider the Product Disclosure Statement (PDS) when deciding whether to invest or continue to invest in the fund. The PDS and Target Market Determinations are available on our website.