The backbone of the U.S. economy isn’t Wall Street – it’s the 200,000-plus middle market companies quietly driving one-third of American jobs and 40% of its GDP. These businesses form the engine room of American growth, and now investors can tap directly into their momentum.

In a market where traditional fixed income struggles to deliver, private credit has emerged as a powerful alternative – offering attractive risk-adjusted returns, floating-rate protection, and exposure to real, cash-generating businesses. At the centre of this opportunity is the La Trobe US Private Credit (USPC) Fund, which provides access to senior secured loans to high-quality U.S. middle market companies, sourced and managed in partnership with global investment powerhouse Morgan Stanley.

What Is Direct Lending – and Why Does It Matter?

Direct lending is perhaps the simplest form of private credit, where loans are made directly to companies – typically private, middle market firms – without going through traditional banks. These loans are privately negotiated and often used to fund acquisitions, refinance existing debt, or support growth initiatives.

The USPC Fund focuses on senior secured, first-lien loans, which sit at the top of the capital structure. This means investors are first in line for monthly repayments, first in line when the loan comes to be repaid, and the loans are backed by collateral. Private equity sponsors have a controlling equity stake in these senior secured loans, and contribute significant equity, or “skin in the game”, creating a cushion beneath the debt and aligning interests with lenders.

Why Is Direct Lending Growing So Rapidly?

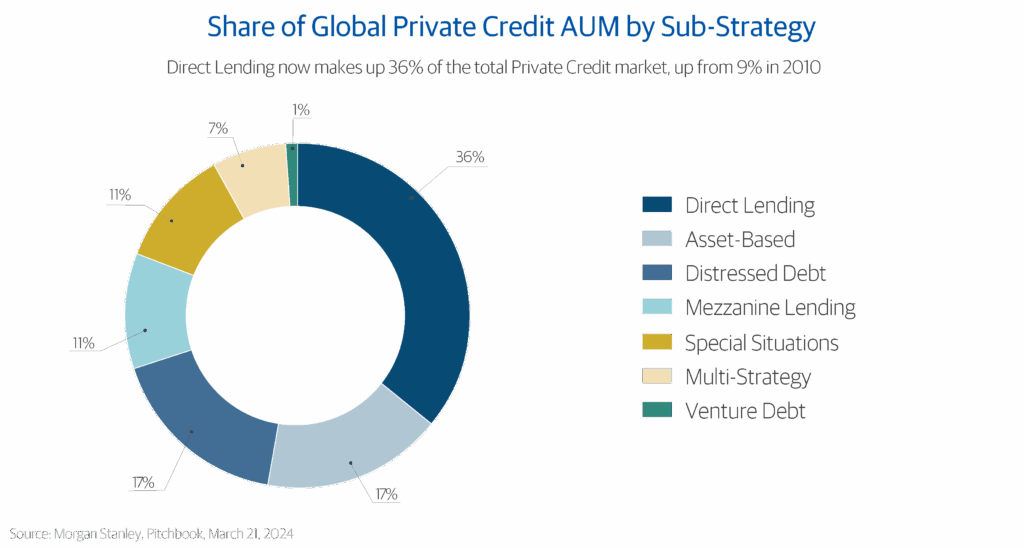

The direct lending market has expanded dramatically – from just 9% of the global private credit AUM in 2010 to 36% today.

Several factors are driving this growth:

- Post-GFC bank regulation has reduced traditional bank appetite and capacity to lend to middle market companies.

- Private equity “dry powder” – capital waiting to be deployed – has surged, creating demand for acquisition financing.

- Borrowers benefit from speed, certainty, and transparency, without needing credit ratings or facing syndication risk without having to compromise on credit quality.

- Investors benefit from higher yields, floating-rate protection, and the illiquidity premium associated with private assets.

The U.S. Middle Market: A Deep and Resilient Opportunity

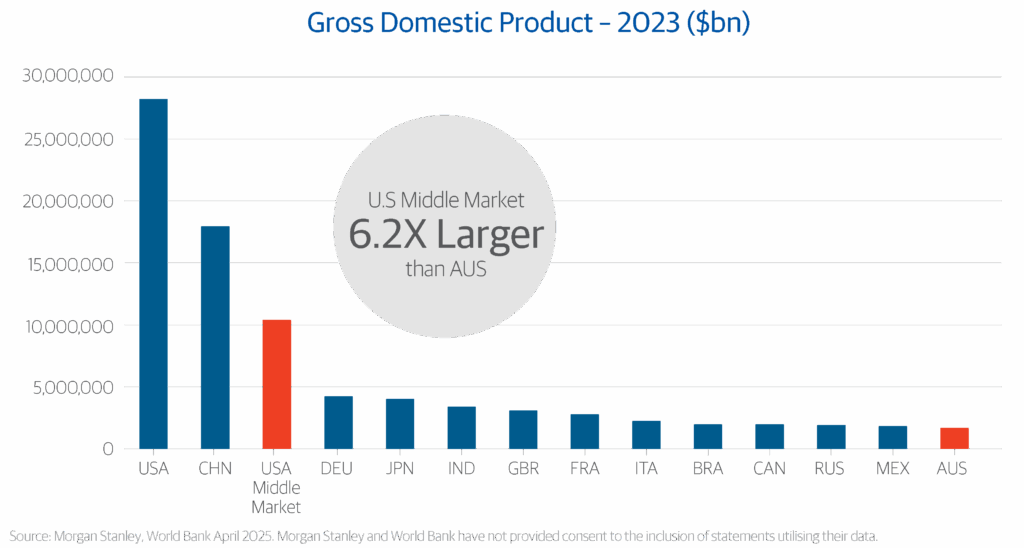

The U.S. middle market is vast and vital. It comprises over 200,000 companies with EBITDA ranging from USD $25 million to $1 billion. These businesses account for one-third of U.S. jobs and 40% of GDP. If the U.S. middle market were a country, it would be the third-largest economy in the world – over six times the size of Australia’s.

This segment is also politically supported. From Trump’s tariffs or ‘make America great again’ mantra, to Biden’s Inflation Reduction Act, bipartisan policies are driving investment into domestic manufacturing and infrastructure – fuelling growth in the middle market.

The USPC Fund: Strategy and Structure

The USPC Fund aims to deliver defensive exposure from this critical segment of the U.S. economy. It invests in a diversified portfolio of senior secured loans to high-quality middle market companies, with a focus on:

- Non-cyclical, capital-light businesses

- cash flows and recurring revenue models with proven resilience across the economic cycle

- High barriers to entry and strong management teams

Importantly, the fund does not focus on sectors with high regulatory or economic sensitivity, such as retail, restaurants, and healthcare. Instead, it targets service-based industries that provide essential, non-discretionary services.

The portfolio currently includes 132 individual loan assets across 32 industries, with an average investment size of USD $4.4 million. No single exposure exceeds 3% of the portfolio, ensuring robust diversification.

Built-In Conservative Construction

The fund strengthens its strategies through its focus on senior secured loans (99% of the portfolio) and conservative loan-to-value ratios. On average, the loan-to-valuation ratio is just 40%, meaning there’s a 60% equity buffer beneath each loan – typically provided by the private equity sponsors.

This structure aims to ensure that investors are well-protected, with sponsors highly incentivised to actively manage portfolio companies and preserve capital.

The Morgan Stanley Advantage

A key differentiator for the USPC Fund is its partnership with Morgan Stanley, which acts as the program sub-adviser. This relationship provides access to:

- A large origination platform with deal flow exceeding its capital base

- A transparent allocation policy across multiple pools of capital

- Deep underwriting expertise and institutional infrastructure

- A dedicated team of 19 senior originators with an average of 16 years’ experience

Morgan Stanley’s US$22bn direct lending platform includes 10 pools of capital, including La Trobe Financial’s USPC Fund. When a loan is originated and approved by Morgan Stanley’s investment committee, the USPC Fund participates alongside other pools – benefiting from scale, diversification, and institutional-grade due diligence, providing a noticeable point of difference.

This structure allows La Trobe Financial to offer retail investors access to a fund-of-one strategy that mirrors the mandates of larger institutional portfolios, without compromising on credit quality or portfolio construction.

Who Are the Borrowers?

The fund lends to middle market companies typically undergoing acquisition by private equity firms. These are generally mature businesses with:

- Defensible market positions

- Diversified customer and supplier bases

- Low capital expenditure requirements

- Recession-resistant cash flows

These characteristics align with La Trobe Financial’s investment philosophy: preservation of capital, long-term credit performance, and risk mitigation.

Why It Matters for Investors

For investors, the USPC Fund offers:

- Monthly income with low volatility

- Quarterly liquidity#

- Currency-hedged exposure to U.S. assets~

- Access to a pure-play strategy in senior secured direct lending

It’s a way to tap into the strength and resilience of the U.S. middle market – the cyclicality or complexity of other credit strategies.

La Trobe Financial Asset Management Limited ACN 007 332 363 AFSL 222213 is the Responsible Entity of the La Trobe US Private Credit Fund ARSN 677 174 382. It is important for you to consider the Product Disclosure Statement and Target Market Determination for the Fund before investing.

# A quarterly limit of 5% of the total value of the issued Class B Units applies to redemption requests. See the Product Disclosure Statement for more details.

~ While the Responsible Entity intends to do this on a best endeavours basis, the Fund may not provide complete protection from adverse currency movements.

Past Performance is not a reliable indicator of future performance.

Any Financial product advice is general only and has been prepared without considering your objectives, financial situation or needs. You should, before investing or continuing to invest in the La Trobe US Private Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and consider the Product Disclosure Statement for the Fund.