Building wealth towards a dignified retirement remains most people’s long-term financial goal. Along the way, we hope that sensible investment decisions we make across our lifetime materialise in a comfortable lifestyle.

It’s unwise to rest on your laurels. Every decade, there is seemingly a generation-defining event. The 1970s oil crisis. The 1980s with inflation, rate hikes, and ending in a stock market crash. The 1990s recession, the GFC of the late 2000s. More recently COVID, and even in 2025 the volatility that was the Trump Tariffs with ‘Liberation Day’.

Each of these events had the ability to derail even the best-laid investment plans.

Investors need to prepare for volatility. That’s a given. But it doesn’t stop there. Increasingly stretched government budgets point towards no certainty on the delivery cost of aged care, or the wide availability of pensions in the future. So investors today need to plan for long retirements, and greater self-sufficiency than ever before.

These considerations all point towards the need for diversified investments and consideration of risks. Longevity risk – that you’ll outrun your savings. Sequencing risk – that you may need to draw down on investments during bear markets. The longer we live, the more each can become a factor, and materially impact the outcomes we experience later in life.

Emerging Alternative Investments

Today, yield can be sourced across a range of asset classes. The focus is finding balance: sourcing yield, controlling volatility, and maintaining growth for portfolios over a longer timeframe.

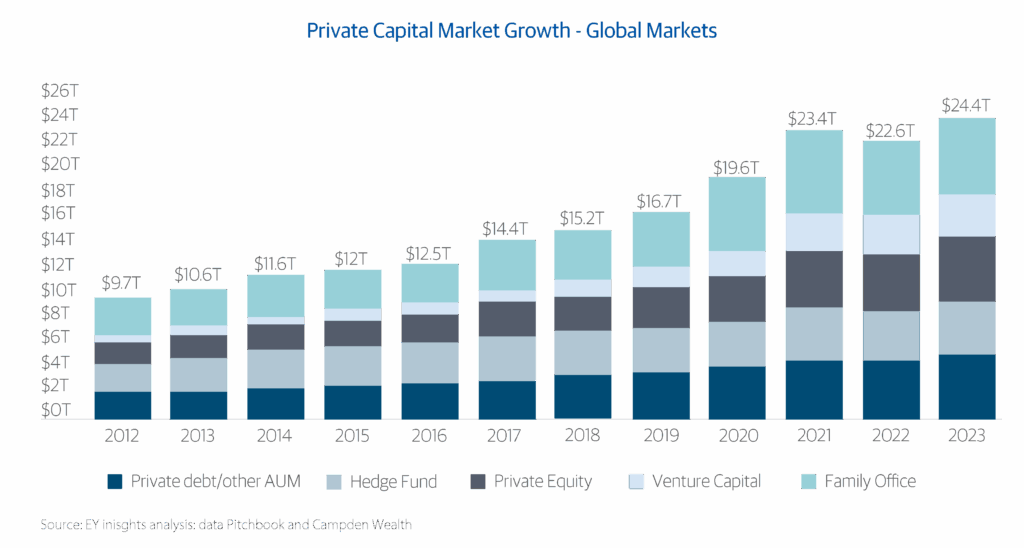

One such opportunity is in private credit, and a whole range of new opportunities have entered the market in recent years. However, alternative investment doesn’t start and finish with private credit. Private capital markets have grown considerably in recent years.

Investors can consider an increasingly wide universe of private capital market investment within infrastructure commercial property. Even strategies within dividend-focussed equities are emerging for investors to consider.

The growth of private capital markets presents opportunities for investors. A growing pool of assets has now reached a critical mass available for investment either directly, or via managers bringing targeted strategies to market.

In the wake of persistent inflation, interest rate uncertainty, and global market instability, Australian retirees are increasingly seeking investment strategies that offer resilience, income stability, and downside protection.

In 2025, alternative investments are emerging as a critical component of retirement portfolios, helping to defend against economic volatility while supporting long-term income needs. Globally, private credit, infrastructure, commercial property and a host of other strategies compete for the opportunity to find a place in investor portfolios.

Alternatives in Private Credit

A component of the growing pool of global private assets, private credit is emerging as a strategy to meet the challenges investors face. Private credit, too, has grown to a critical mass, allowing a wider range of strategies for retail investors to participate in.

But where to look? Emerging managers often lack experience across multiple economic cycles,or lack the diversification within their portfolios to generate low volatility income.

At La Trobe Financial, we hold 70 years of unbroken commitment to private capital markets. With over 35 years in retail asset management, our retail private credit offerings are among Australia’s oldest, largest, and most diversified, making us Australia’s premier alternative asset manager.

New: Listed Investment Trust

To meet the needs of today’s investors, we are pleased to introduce the La Trobe Private Credit Fund (ASX: LF1). The Fund is a listed investment trust, offering the opportunity to invest in a diversified private credit strategy, earn an ongoing monthly income, with the flexibility of investing via the Australian Securities Exchange (ASX).

With underlying investment into the 12 Month Term Account and La Trobe US Private Credit Fund, the La Trobe Private Credit Fund could become a useful addition to your investment portfolio with low volatility returns, monthly income, and diversification across two complementary strategies.

The Fund will target a cash distribution yield of RBA Official Cash Rate + 3.25% p.a. (net of fees, costs and taxes incurred by the Fund). **

More information can be found on our website or by dialling our Asset Management Team on 13 13 57.

**The target cash distribution yield is an objective target only and may not be achieved. Any shortfall in net income generated may result in a distribution payment made out of capital invested. Future returns are not guaranteed and a loss of principal may occur. Investors should review the Risks summary set out in Section 8 of this PDS. The first distribution is expected to be paid with reference to the period ending on 31 July 2025, with July 2025 being the first full month following the Settlement Date.

Any financial product advice is general only and has been prepared without considering your objectives, financial situation or needs. You should, before investing or continuing to invest in the La Trobe Australian Credit Fund, La Trobe Private Credit Fund & La Trobe US Private Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the relevant Product Disclosure Statement for the fund.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321, La Trobe Private Credit Fund ARSN 686 964 312 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important that you consider the relevant Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in the fund. The PDSs and Target Market Determinations are available on our website.

Any advice is general and does not consider your circumstances.