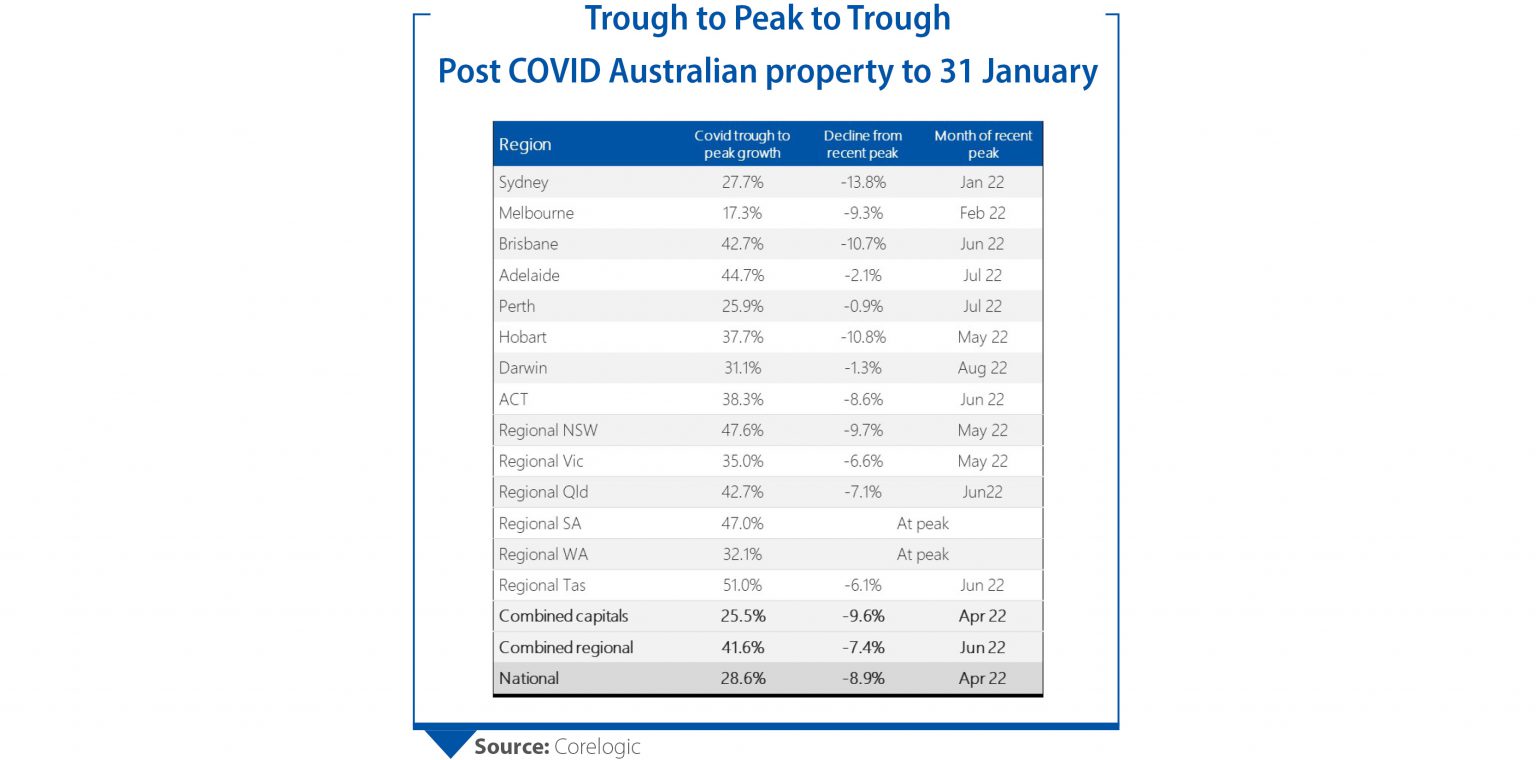

Even as Australian property prices continue to moderate, they remain well ahead of the previous peak.

Consider Sydney, rising 27.7% across the pandemic period to its peak at January 2022. Since peak, it has moderated by 13.8% to the end of January 2023. While this is still manifestly positive, we do expect there to be further falls to come.

The road to moderation

Following the fastest increase of residential house prices on record, it is perhaps unsurprising that there has been a fall of some magnitude.

Over the past 12 months, the general view within the market has been that a fall of 15-20% (plus or minus) is likely, irrespective of how bad economic news may have been. Positively though, should these predictions be accurate, a 15-20% drop will mean that the prices won’t fall below recent gains.

Resilience in the market

Australia holds the second-highest level of GDP per capita in the world among larger, developed countries. We are a resilient and wealthy nation.

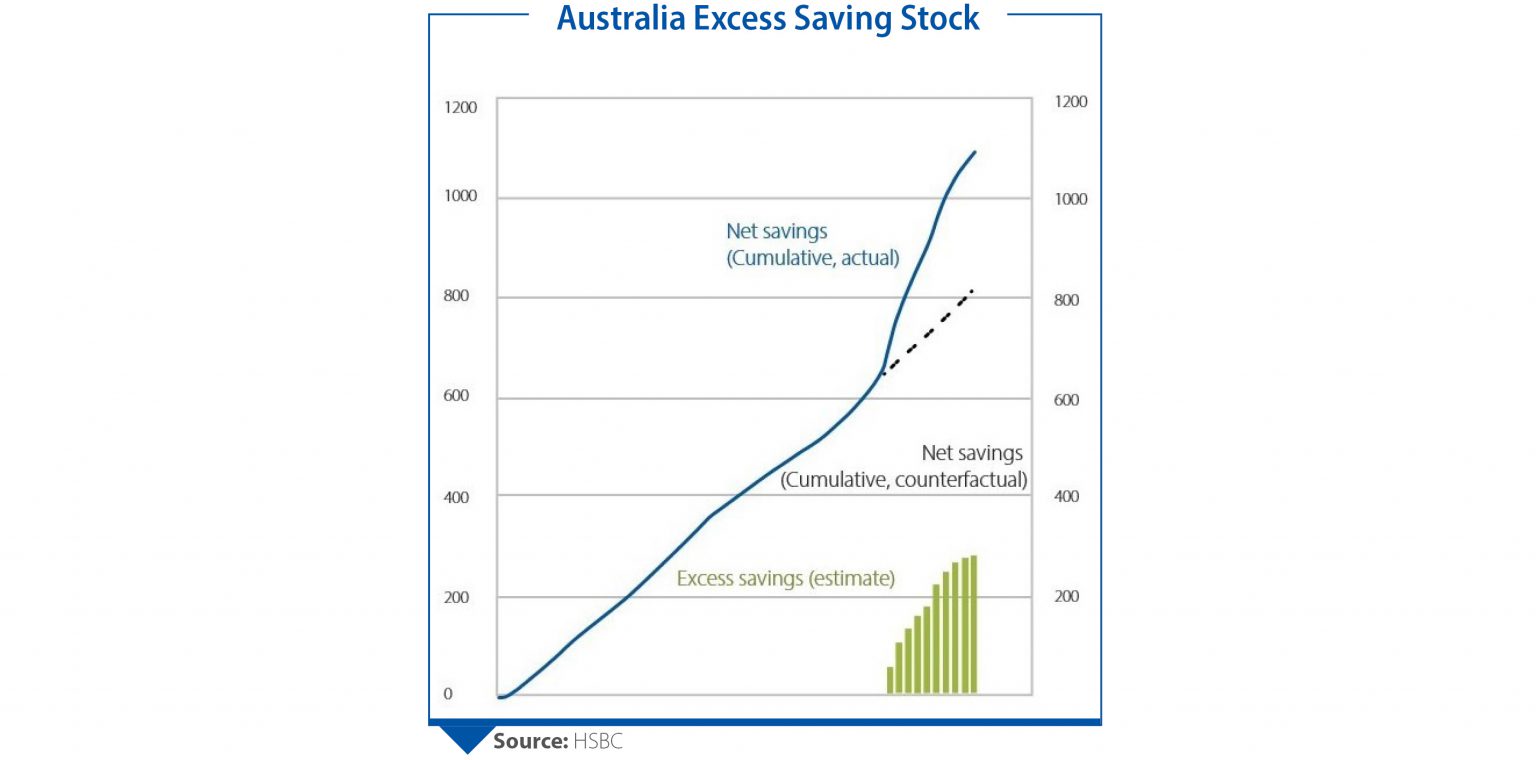

Through the pandemic, households put aside c$280 billion in surplus savings, resulting in a significant savings buffer against recent volatility. As we’re seeing across a range of consumption stats, households are continuing to hold onto surplus savings, with some $110 billion sitting in mortgage offset accounts alone.

Currently, Australians are paying more into their mortgages than they are required to. In fact, current aggregate mortgage payments exceed the likely total required amount factoring in the interest rate peak later this year.

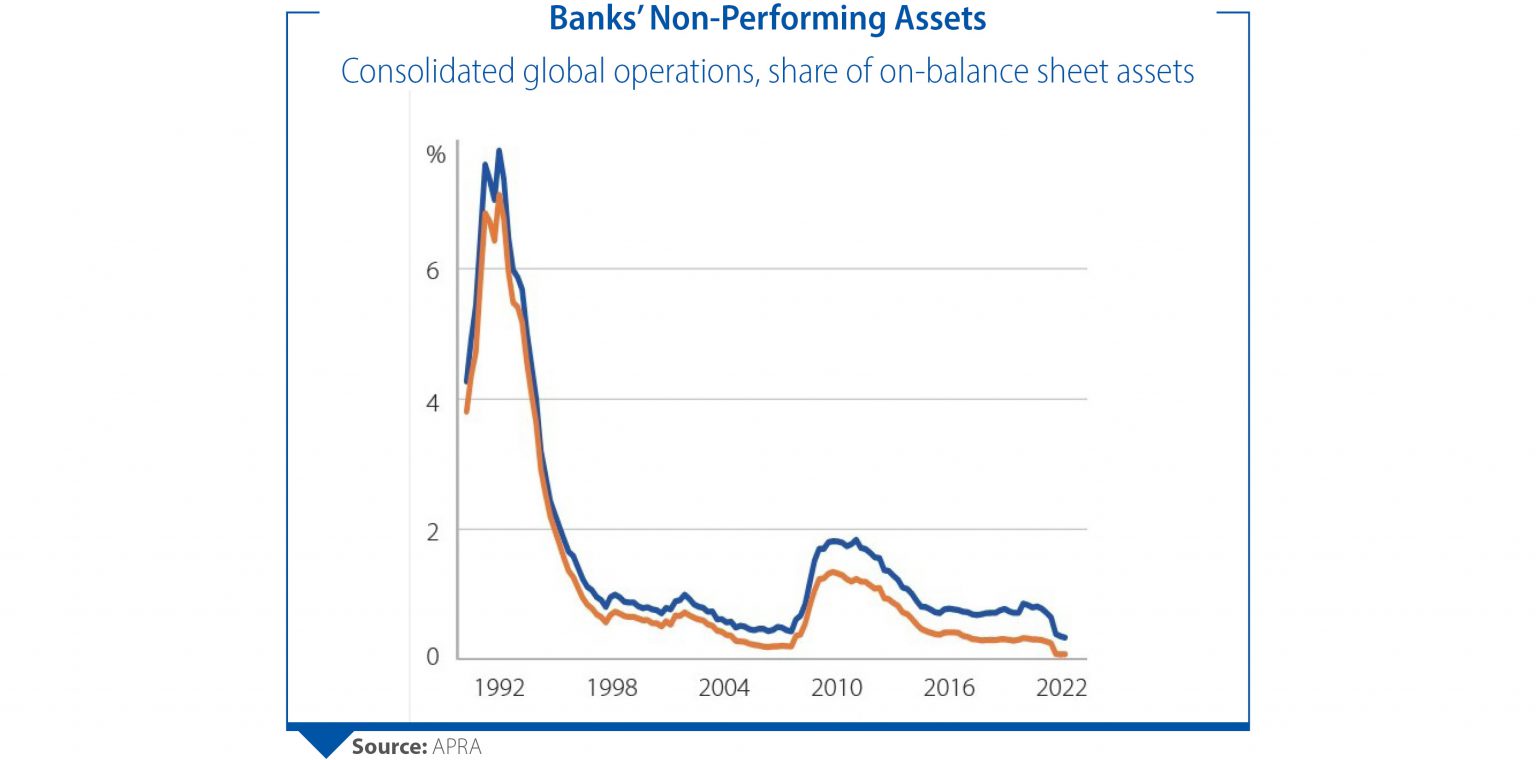

Indeed, similar to what we have seen at La Trobe Financial, Australian banks reported falling arrears through 2022, even with inflation and interest rates rising. However – even though we do acknowledge that this may be a period of difficulty for many – as a country with full employment, nearing peak interest rates and with a strong household sector, Australia as a collective is well placed to meet the challenges ahead.

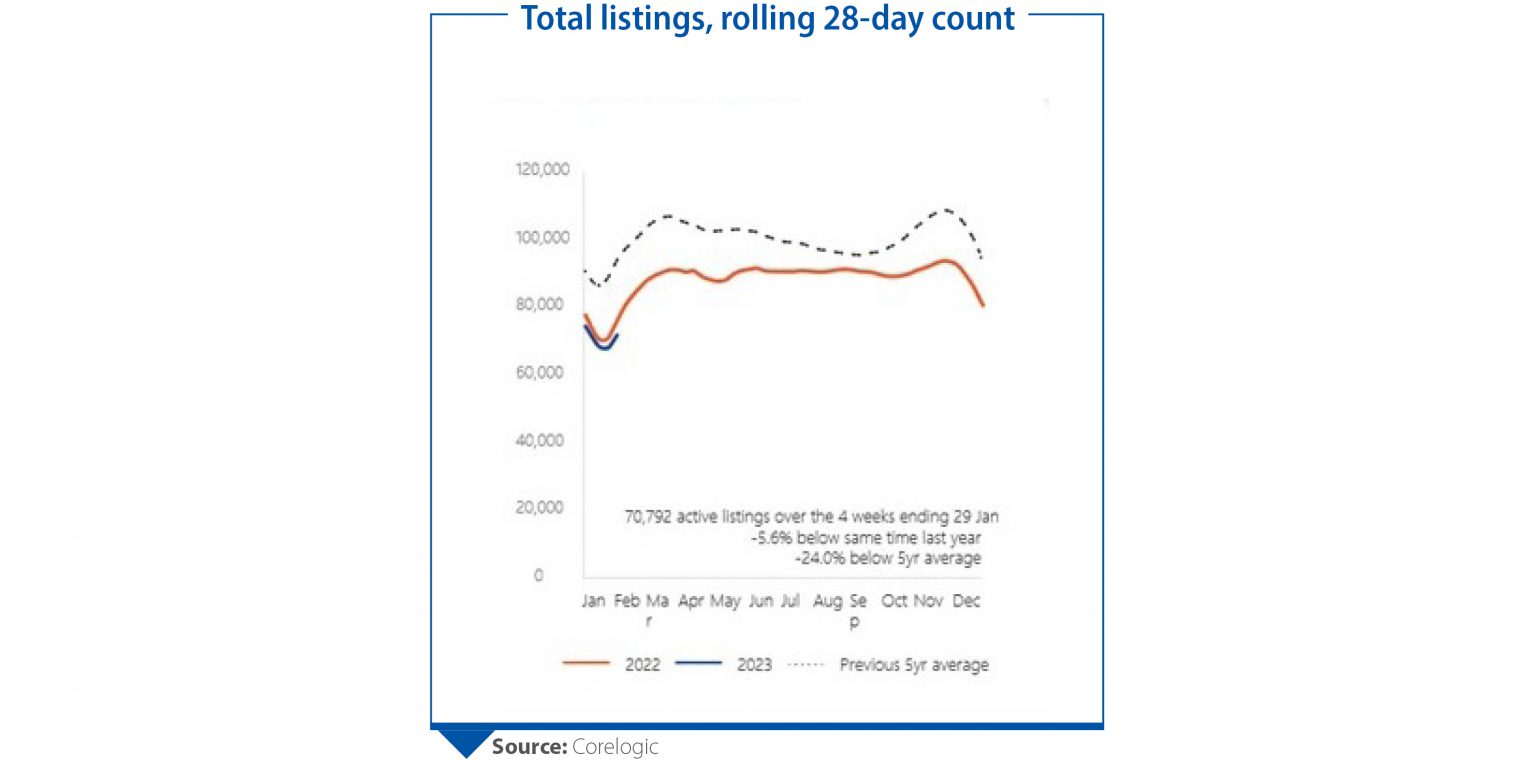

And what about property? At a macro-level, owning property either as a residence or as an investment remains a buy-and-hold strategy. In this moment of market softness, with low arrears and low unemployment, people are simply holding off selling. New listings and total stock on market support this, with figures below 2022 volumes and well below the five-year average:

To summarise, the avoidance of a residential property market capitulation will be aided by:

- Resilient households

- Strong performance as a starting point

- National economic strength, with all states and territories experiencing full employment, and

- Lack of stock on the property market.

Additional tailwinds which will act as market stabilisers – and insert an effective floor to the property market –include:

- Rebounding population growth to soak up available supply

- The growth of rental yields supporting property as an investment proposition, and

- The high number of Australians with cash that will be able to purchase property at the ‘right price’.

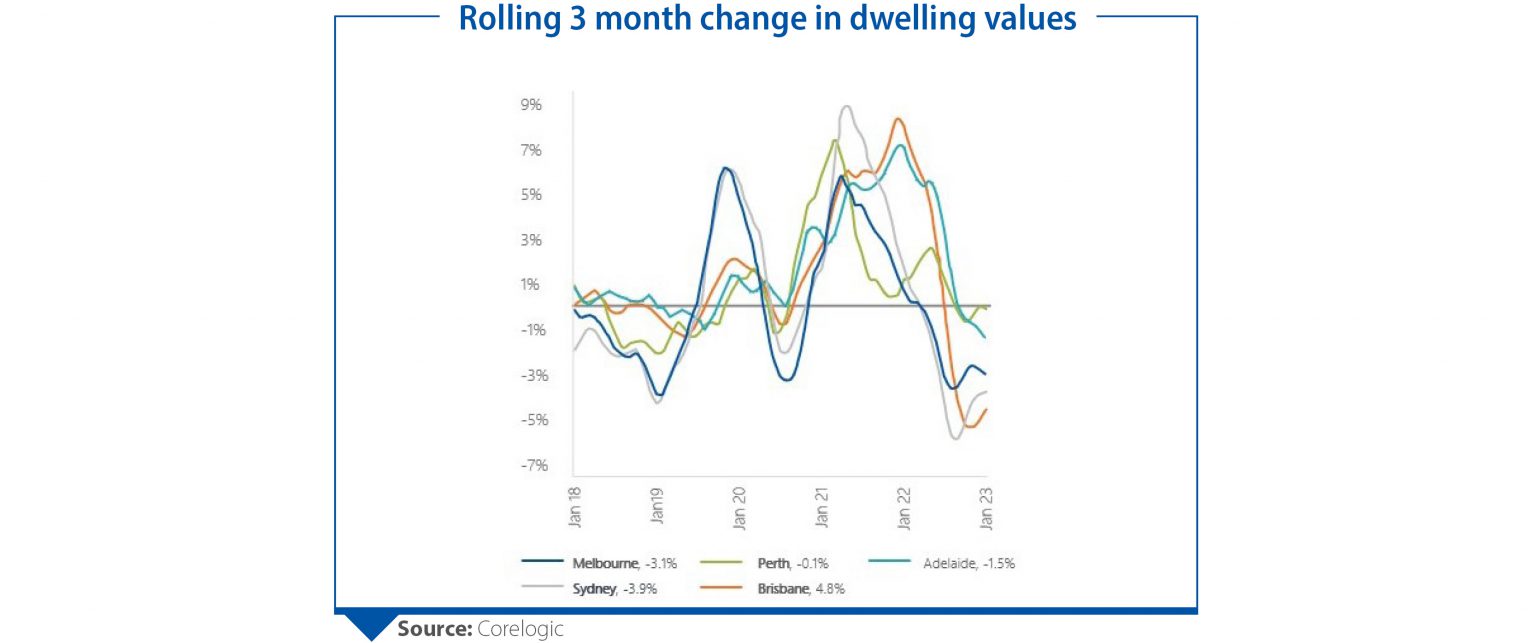

The collective weight of these aggregate factors is starting to show. Property is continuing to fall; however, the rate of decline is stabilising.

La Trobe Financial continues to harness the best attributes of its chosen asset class of property credit to provide low volatility income and downside protection. We look forward to working with each of our 90,000 investors in 2023 with many exciting updates ahead.

*The rates of return on your investment will be effective from 1 February 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The rate of return applicable for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investments. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended. Visit our website for further information.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and Target Market Determinations on our website www.latrobefinancial.com, or ask for a copy by calling us on 1800 818 818.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

© Copyright 2023 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.

This publication does not constitute financial advice and should not be relied upon as such. It is intended only to provide a summary and a general overview on matters of interest and it is not intended to be comprehensive. You should seek your own financial or other professional advice before acting or relying on any of the content.

This publication does not constitute financial advice and should not be relied upon as such. It is intended only to provide a summary and a general overview on matters of interest and it is not intended to be comprehensive. You should seek your own financial or other professional advice before acting or relying on any of the content.