Australia’s population is aging. And while a surge in longevity is a miracle of the modern world, it introduces a range of investment challenges as we build portfolios in support of potential 40-year retirements.

One such challenge is building portfolios which can withstand ongoing economic volatility. With people living longer and with more to invest, there is also more at stake. So it’s no surprise that retirement income strategies are undergoing a fundamental shift.

In 2025, alternative investments continue to grow in relevance. Diversified portfolios are no longer just allocated to cash, bonds and stocks. As investors look beyond traditional investments to build portfolios, both traditional and alternative asset classes play critical roles. In response, financial professionals are increasingly incorporating alternative income-generating assets to meet the evolving needs of retirees.

Private Credit – new opportunities in an old asset class

One asset class gaining traction is private credit, which can provide low volatility yield for investors across the cycle.

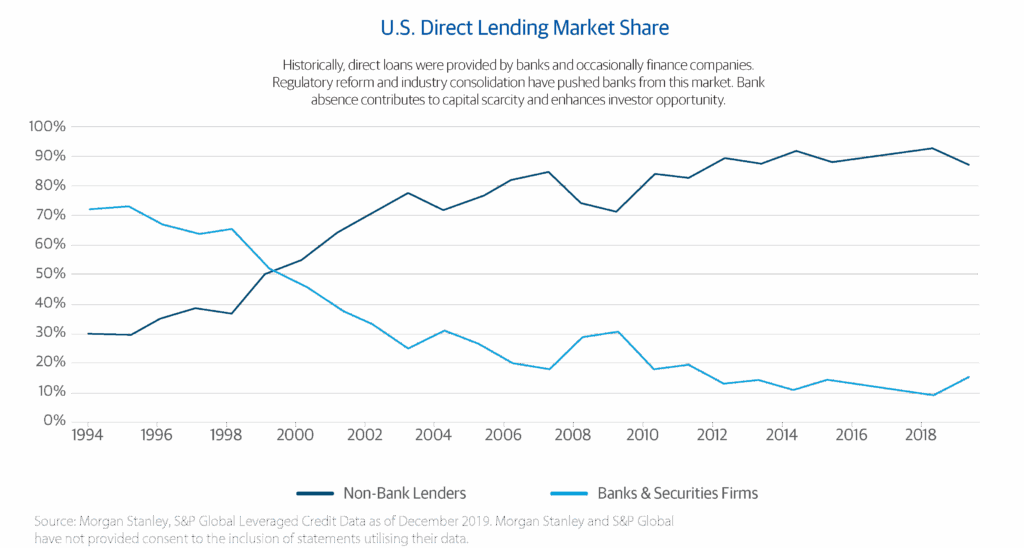

When considering the recent growth of private credit, it’s important to look further back at its history to see this is no flash in the pan. Hardly a recent phenomenon, corporate borrowers in the U.S have been increasingly turning to private credit for some thirty years. In fact, the percentage of directly originated loans written by non-banks surpassed the banks in 1999.

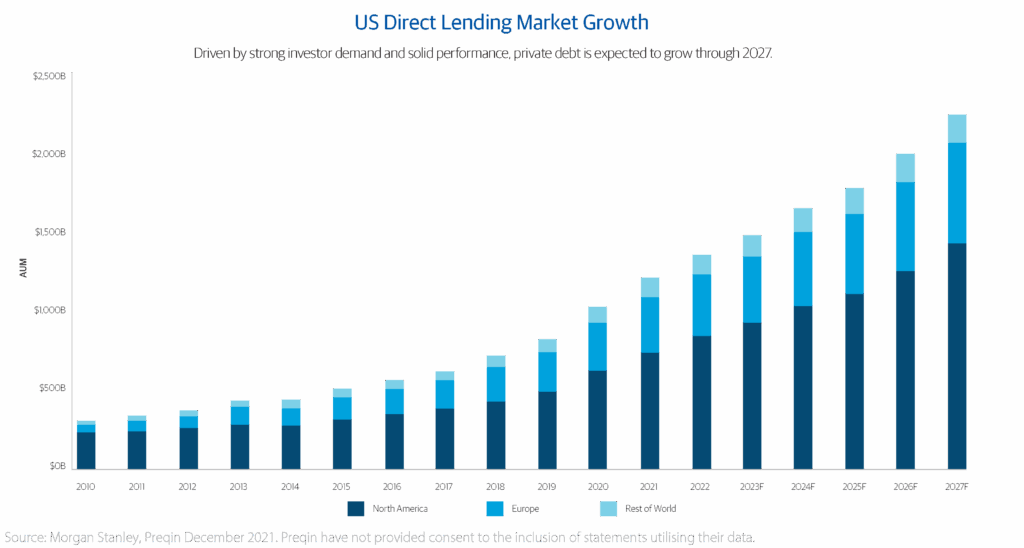

Off a low base 30 years ago, it has taken some time to reach a critical mass. Once a focus of institutional and wholesale investors, the size of the global private credit market has grown to relevance just at the moment where investors needed it – a moment where low volatility, inflation-responsive income producing assets meet market demand.

The result of this is an asset class with the breadth, depth and a track record to support retail-friendly strategies

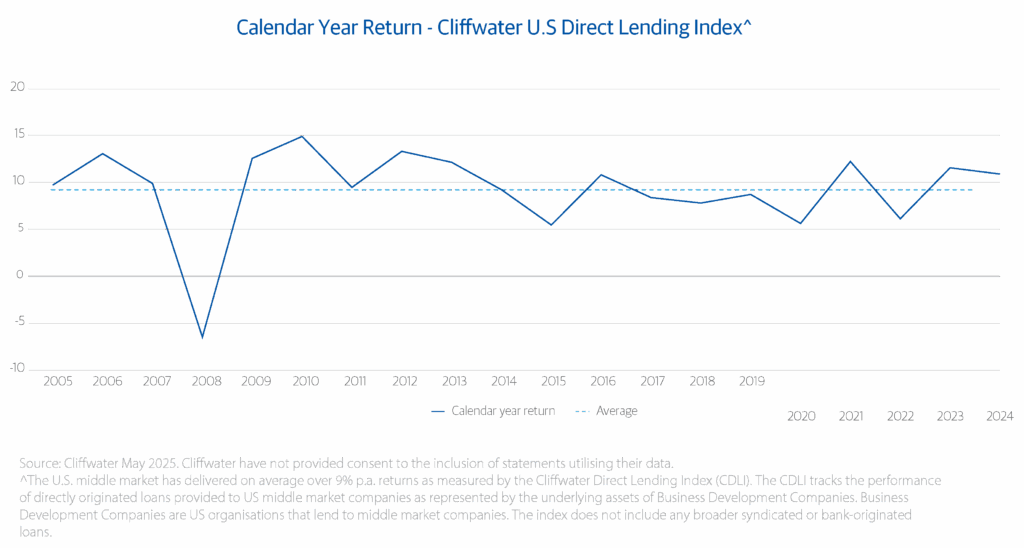

For investors, US Private Credit represents a low-volatility investment. This ties in with the generational thematic of living longer, and building portfolios to stand the test of time. With an annualised return of nearly 10% per annum for the last 20 years, a targeted allocation to US private credit can form a meaningful component of an investor’s portfolio.

La Trobe Global Asset Management

With 70 years of unbroken commitment to private capital markets, La Trobe Financial is Australia’s premier alternative asset manager.

Supporting the demand for more choice in investments, La Trobe Financial is committed to delivering investment offerings from Australia and around the world. Using our extensive internal capabilities, and global partnerships, we offer a growing range of unique investment products for Australian investors.

Our La Trobe Australian Credit Fund has a long history of performing for our 110,000 investors^. The flagship strategy, 12 Month Term Account has a track record of zero investor capital losses, zero gating of liquidity, and all distributions paid on time and in full.*

Our La Trobe US Private Credit Fund allows investors to access low volatility income from the U.S middle market – the world’s largest private credit market. A product brought to market in partnership with Morgan Stanley providing monthly income, low volatility returns, and capital hedged exposure to this important global asset class.

New: Listed Investment Trust

To meet the needs of today’s investors, we are pleased to introduce the La Trobe Private Credit Fund (ASX: LF1). The Fund is a listed investment trust, giving investors the opportunity to invest in a diversified private credit strategy, earning an ongoing monthly income, with the flexibility of investing via the Australian Securities Exchange (ASX).

With underlying investment into the 12 Month Term Account and La Trobe US Private Credit Fund, the La Trobe Private Credit Fund could become a useful addition to your investment portfolio with low volatility returns, monthly income, and diversification across two complementary strategies.

The Fund will target a cash distribution yield of RBA Official Cash Rate + 3.25% p.a. (net of fees, costs and taxes incurred by the Fund). **

More information can be found on our website or by dialling our Asset Management Team on 13 13 57.

**The target cash distribution yield is an objective target only and may not be achieved. Any shortfall in net income generated may result in a distribution payment made out of capital invested. Future returns are not guaranteed and a loss of principal may occur. Investors should review the Risks summary set out in Section 8 of this PDS. The first distribution is expected to be paid with reference to the period ending on 31 July 2025, with July 2025 being the first full month following the Settlement Date.

* Past Performance is not a reliable indicator of future performance.

^ Total investors is calculated by adding all individual & joint investors (which includes some investors with a current zero balance in their account) to reasonable estimates of investors investing trusts or SMSFs.

Any financial product advice is general only and has been prepared without considering your objectives, financial situation or needs. You should, before investing or continuing to invest in the La Trobe Australian Credit Fund, La Trobe Private Credit Fund & La Trobe US Private Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the relevant Product Disclosure Statement for the fund.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321, La Trobe Private Credit Fund ARSN 686 964 312 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important that you consider the relevant Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in the fund. The PDSs and Target Market Determinations are available on our website.

Any advice is general and does not consider your circumstances.