As Australian retirees face the dual challenge of increased longevity and market uncertainty, the demand for reliable, inflation-responsive income strategies continues to grow. Pleasingly, Australians do not have their heads in the sand. We are increasingly financially literate, and a raft of investments exist to assist investors on their financial journey.

Following a spike in inflation, and the subsequent increase in interest rates, we can be forgiven for feeling a little less wealthy. However, on the whole Australians are wealthier than ever and continuing to contribute towards their retirement portfolios.

Consider Self-Managed Super Funds. SMSFs continue to grow in popularity as individuals take control of their financial destiny towards, and into, a dignified retirement. As at June 2024, some 616,941 SMSFs were operating on behalf of 1.14million individuals. Or another way of looking at it, between 4-5% of the population has an SMSF.

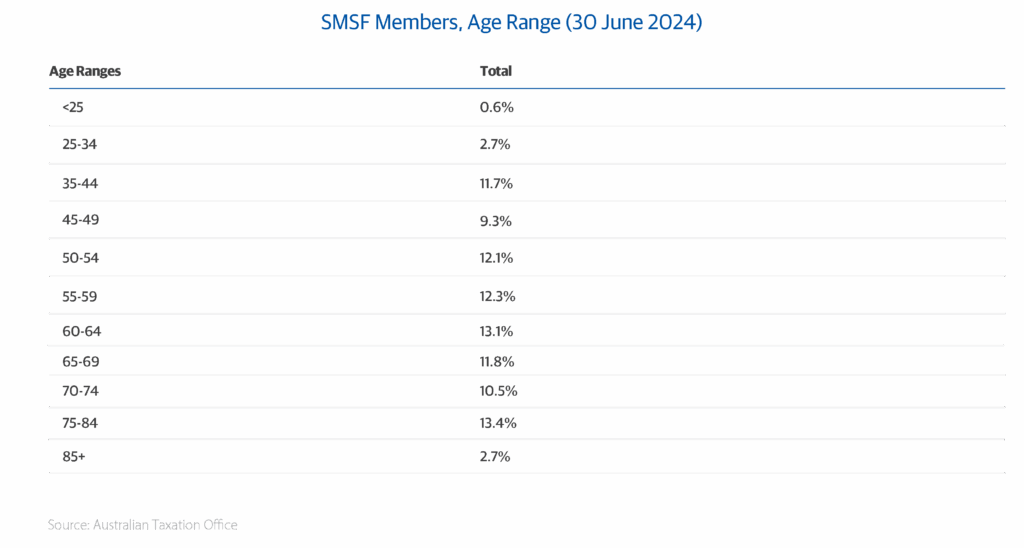

SMSFs are not just the domain of retirees. The most recent statistics from the ATO show a very even spread in age ranges between 35-84. A clear signal that investors of all ages are planning for their retirement with focus, dedication, and control. Total assets within these portfolios are now over $1 trillion. So, this is a significant cohort of investors, investing a significant cohort of money.

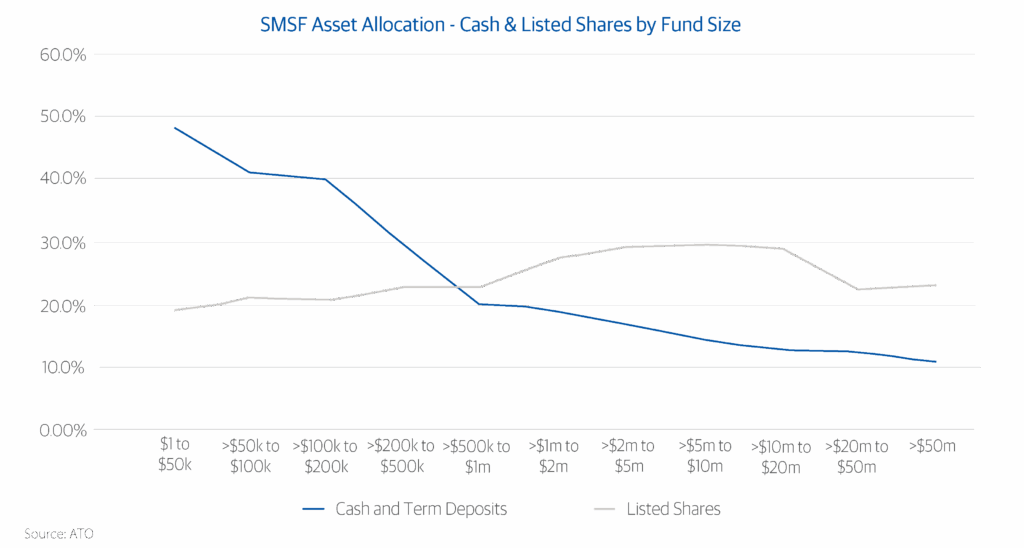

Dig a little deeper, and you see some interesting asset allocation trends across investors as the amount of investable wealth grows.

The above chart shows how allocations across Cash and Term Deposits, and Listed Shares, move as the fund size changes. This highlights two things. Firstly, that investors hold significantly less cash as they grow their wealth. While it might be that investors with less funds are liquidating their holdings, once total assets exceed $500k, investors are looking elsewhere for their investments.

The second sign is that the more wealth an investor has, the more they invest into listed shares. Up until about $20m in total wealth, SMSF investors invest more into this category as their wealth grows. Outside of crypto assets, these two categories have the largest movements across fund size of defined SMSF assets.

Accessing Quality Investments

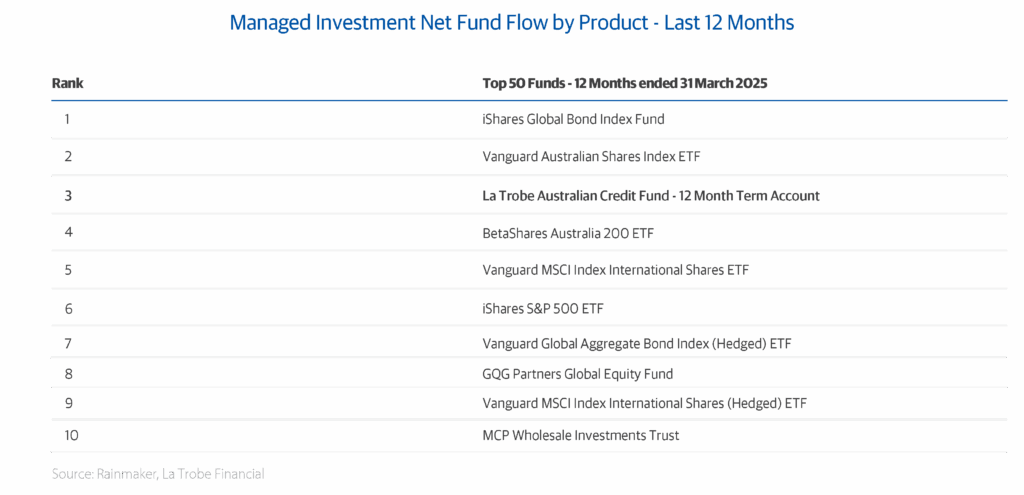

Investors of all age cohorts need quality products, delivered in a convenient way. Consider net fund flows into Australian managed investment schemes. Data shows that listed entry points into index funds, private credit and fixed income offerings, dominate total flows on a product-by-product basis.

La Trobe Financial’s 12 Month Term Account experienced the strongest growth of any non-listed, non-index fund over the past 12 months.*

Consider what this table of net fund flows demonstrates. For investors, index funds provide convenience with the added benefit of trading on the ASX. Investors can build responsive portfolios with asset class and sector allocations that suit a wide range of requirements.

With listed investment options continuing to evolve, now is the time for finance professionals to reassess how these vehicles can enhance retirement outcomes—delivering both stability and flexibility in an increasingly complex financial environment. As investors grow their wealth, they’ll demand it.

New: Listed Investment Trust

With 70 years of unbroken commitment to private capital markets, and over 35 years in retail asset management, La Trobe Financial is Australia’s premier alternative asset manager.

To meet the needs of today’s investors, we are pleased to introduce the La Trobe Private Credit Fund (ASX: LF1). The Fund is a listed investment trust, offering the opportunity to invest in a diversified private credit strategy, earn an ongoing monthly income, with the flexibility of investing via the Australian Securities Exchange (ASX).

With underlying investment into the 12 Month Term Account and La Trobe US Private Credit Fund, the La Trobe Private Credit Fund could become a useful addition to your investment portfolio with low volatility returns, monthly income, and diversification across two complementary strategies.

The Fund will target a cash distribution yield of RBA Official Cash Rate + 3.25% p.a. (net of fees, costs and taxes incurred by the Fund). **

More information can be found on our website or by dialling our Asset Management Team on 13 13 57.

**The target cash distribution yield is an objective target only and may not be achieved. Any shortfall in net income generated may result in a distribution payment made out of capital invested. Future returns are not guaranteed and a loss of principal may occur. Investors should review the Risks summary set out in Section 8 of this PDS. The first distribution is expected to be paid with reference to the period ending on 31 July 2025, with July 2025 being the first full month following the Settlement Date.

Any financial product advice is general only and has been prepared without considering your objectives, financial situation or needs. You should, before investing or continuing to invest in the La Trobe Australian Credit Fund, La Trobe Private Credit Fund & La Trobe US Private Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the relevant Product Disclosure Statement for the fund.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321, La Trobe Private Credit Fund ARSN 686 964 312 and the La Trobe US Private Credit Fund ARSN 677 174 382. It is important that you consider the relevant Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in the fund. The PDSs and Target Market Determinations are available on our website.

Any advice is general and does not consider your circumstances.