French philosopher Auguste Comte first coined the phrase ‘Demography is Destiny’, to describe how the size and structure of a population can tell you a lot about its future. Indeed, a country’s demographics play an indispensable role in shaping its economic development and sustainability: the age structure, education level, labour force participation rate, fertility rate and migration patterns can materially influence a nation’s economic prosperity.

A younger, skilled population can provide a robust labour force, boosting economic productivity and driving innovation. This is not just handy, but imperative for an economy striving to maintain a high standard of living. Conversely, an aging population can increase the demand for healthcare and social security services, leading to more significant public spending.

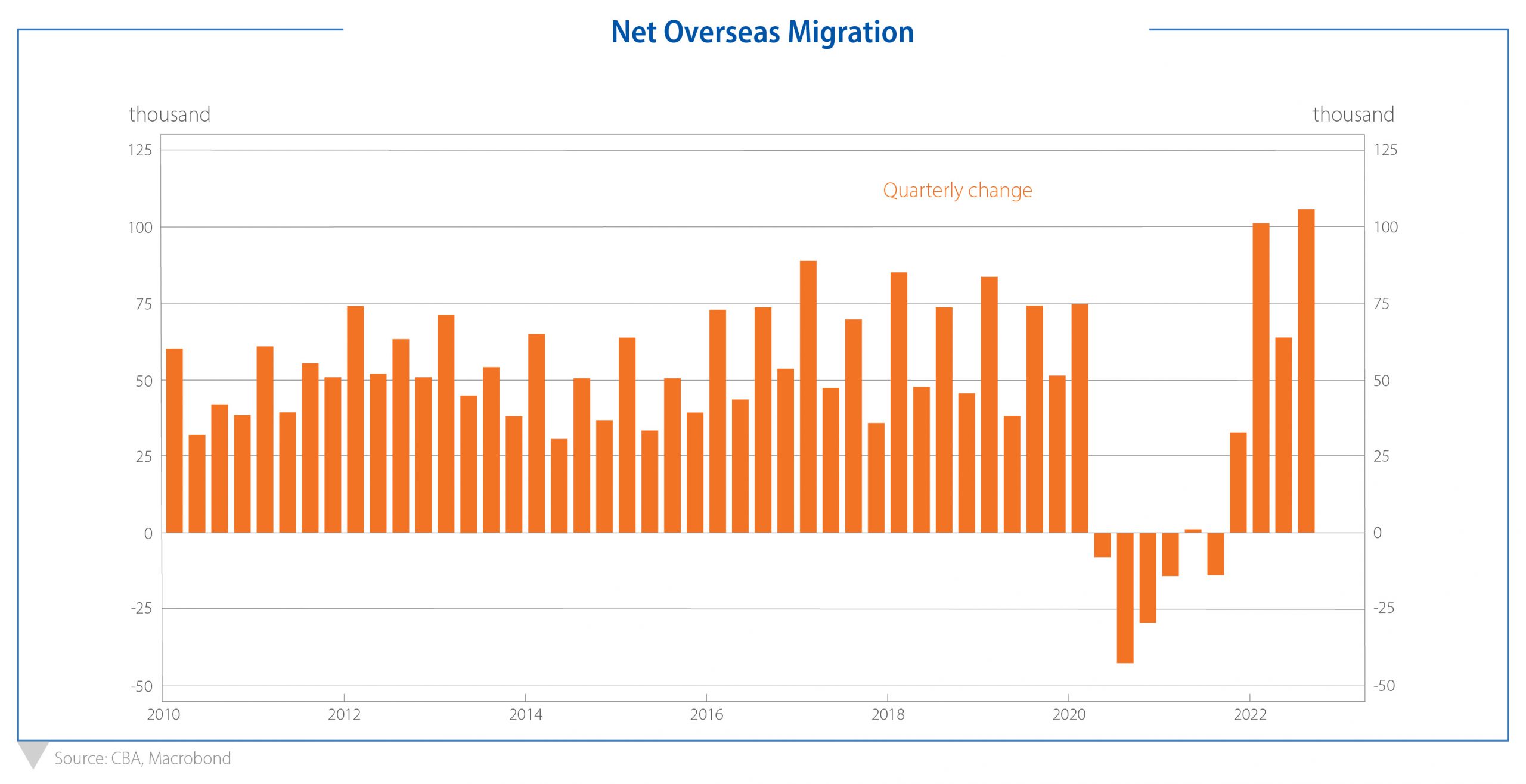

Throughout the COVID pandemic period, we regularly said that closing boarders to international arrivals was one of the major headwinds facing our domestic economy. That has come to pass, with Australia in 2020-21 experiencing our first negative net migration period since World War II. As we emerged from the pandemic period, our rebounding economy did not have enough people to fill job vacancies, driving unemployment to 50-year lows. The ability to source quality labour has been an acute headwind for employers over the past 24 months.

Borders have since reopened, with international arrivals having accelerated in earnest – net overseas migration now sits at decadal highs. The recent Federal budget estimates overseas migration of 400,000 in the 2023 financial year, and 315,000 in Financial Year 2024, which greatly outpaces the average net migration number of 226,000 per year experienced between 2007-2020.

The recovery in net overseas migration has and will continue to see a rapid recovery in the number of international students, skilled temporary visa holders and working-holiday makers. This is good news for employers seeking to fill roles across the board, for our tourism sector and our education sector.

Rebounding immigration levels, in lieu of a benign net natural growth, is helping to bolster our economic growth and skilled labour prospects into the future. This is being greatly assisted by the fact that international students are now staying longer after completion of their studies, helped by changes to visa conditions allowing graduates to stay and work longer in Australia.

Of course, the second order impact of immigration is an obvious one: if people are moving to Australia for jobs, and sensibly move where the jobs are – overwhelmingly within our capital cities – then we need to have sufficient housing in these locations to meet this demand.

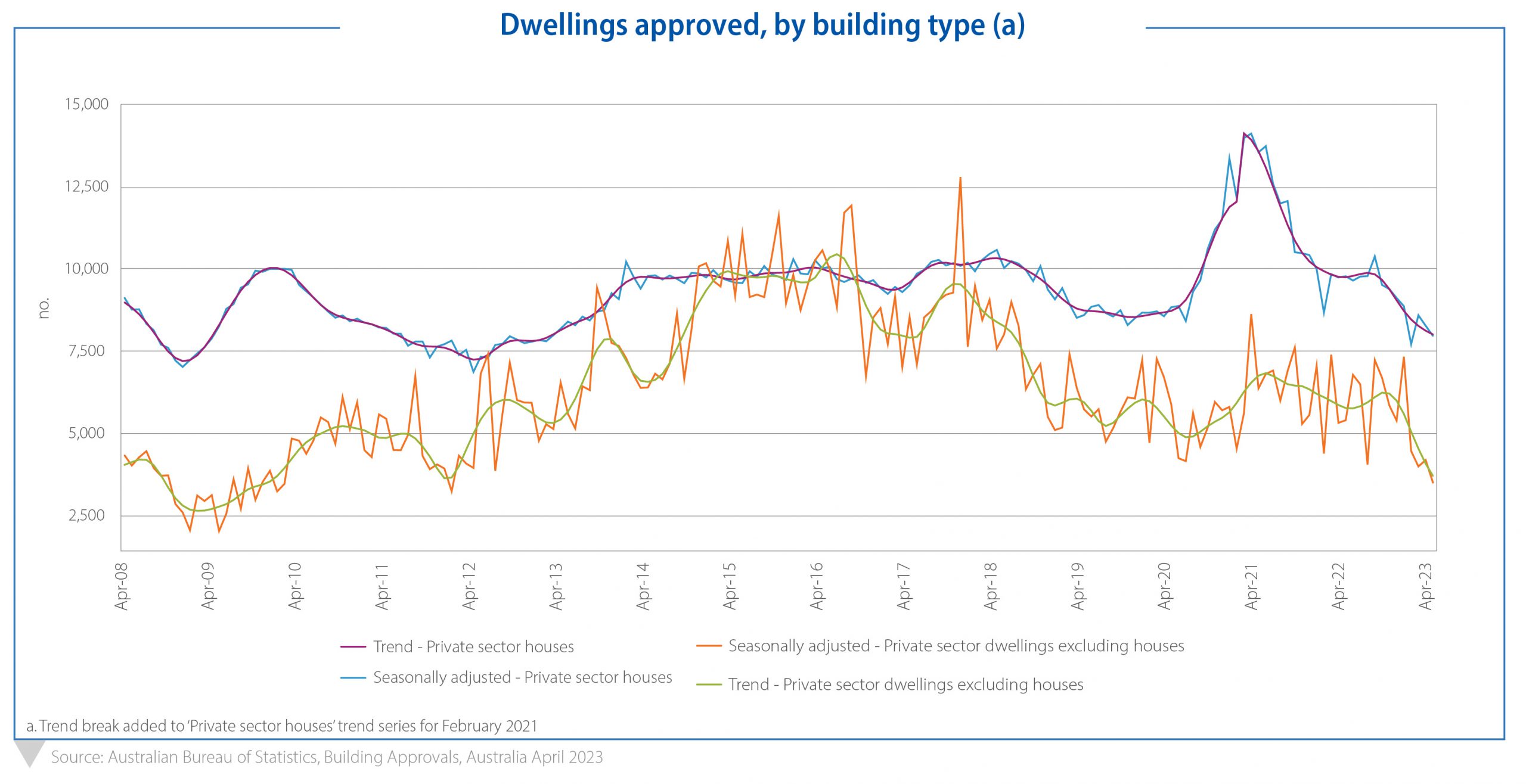

This highlights the structural undersupply of housing stock in Australia, which has been an issue for many years. While this issue predates the pandemic, like many things it has been exacerbated by the pandemic as there has been a continuous decline in new private dwelling construction commencements during that period. Australian capital cities are low-density by international standards, we have not built enough houses, and the pipeline of new stock is moving in the wrong direction.

In April 2023, the total number of new dwellings approved declined by 8.1%, following a 1.0% decrease in March. The overall drop was primarily driven by a decrease in approvals for multi-dwellings, which plunged 16.5% to their lowest point since January 2012. This downward trend in construction activity, juxtaposed against the rising demand, presents a real challenge for housing availability.

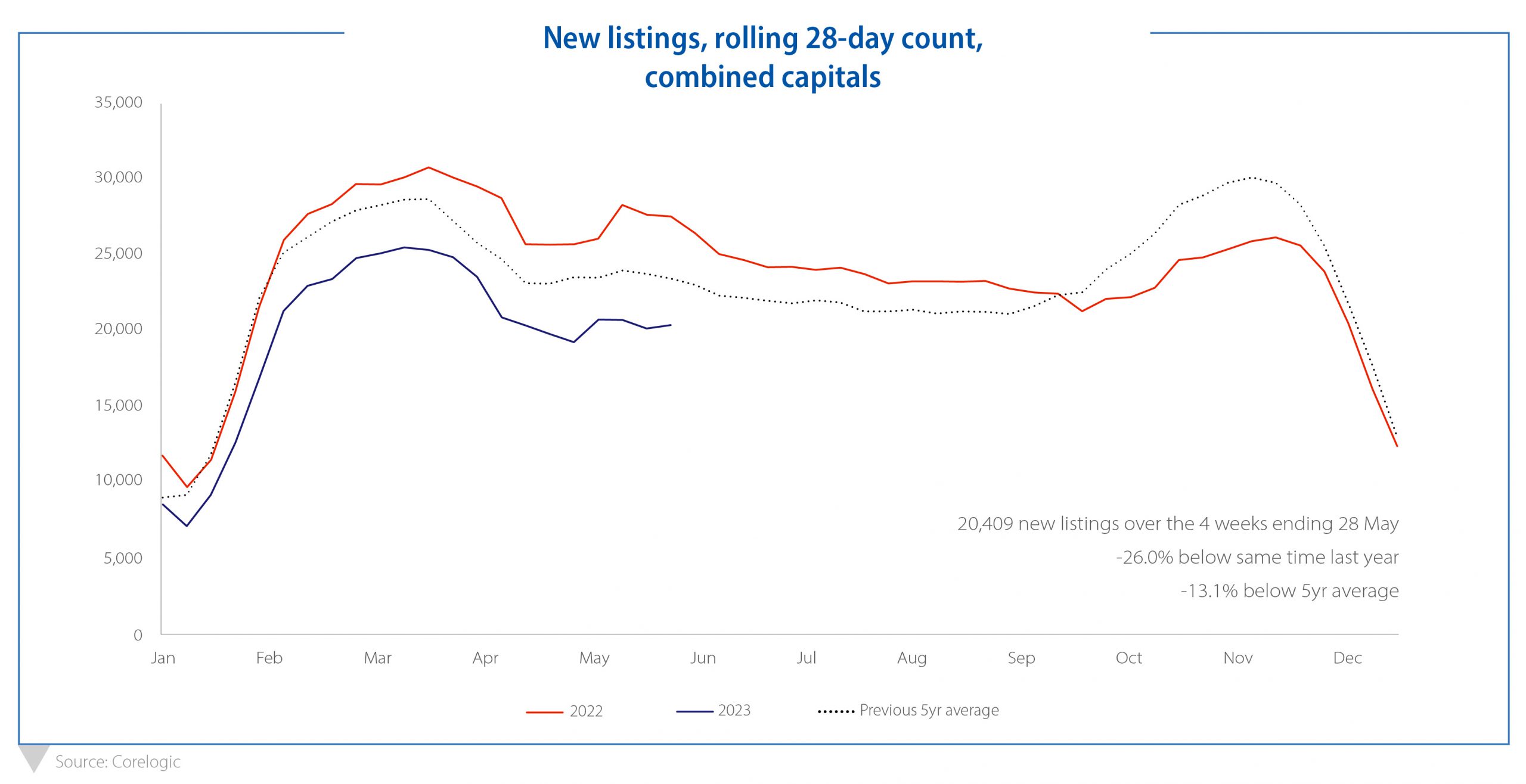

The repercussions of limited housing supply coupled with increased immigration levels are evident in the Australian housing market. CoreLogic’s national Home Value Index (HVI) has registered a third consecutive monthly rise in house prices, with a notable acceleration to 1.2% in May.

This upward movement in housing prices is accompanied with a decrease in advertised listings. In May, approximately 1,800 fewer capital city homes were advertised for sale compared to April. Inventory levels were 15.3% lower than the same time last year and 24.4% below the five-year average for this period.

Auction clearance rates have been consistently at or above 70% for the past three weeks. Even in a period of elevated interest rates, the mounting pressure on securing a residence and the dynamic of demand exceeding supply prevail. Rental availability, and asking rental prices, are likewise at the extreme ends of their usual observations.

Like all matters cyclical, the rebound in migration will normalise. We note that even with the current rebounding numbers, the Federal government’s forecast on population is that it will take until 2029-2030 before net overseas migration catches up to the levels forecast prior to the pandemic. Likewise, the flow of housing stock will resume more normal levels.

Demographics are destiny. And, Australia’s dynamic demographic landscape, characterised by an increasing net overseas migration, will continue to present opportunities and challenges: on one hand, population growth fuels a very necessary flow of skilled labour boosting our economic fortunes. On the other hand, our regulators and governments must ensure that the most basic of human needs – shelter – is available and affordable for all.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.