The one constant in markets is volatility.

We all acknowledge it. We all accept that heightened volatility is but a moment away, and can be set off by any number of things. Consider the events which have accelerated volatility in markets over the last four years: a global pandemic, a war in Ukraine, a regional banking crisis in the US, and simmering tensions in the Middle East.

That’s a lot for markets to digest, and makes constructing investment portfolios for investors particularly challenging. What to do with the annual-cycle of once-in-a-generation events?

Before we consider that further, let’s pause and reflect on where we’re at on the sliding scale of volatility.

Domestic Economy: Measured Optimism

For the first time likely since the ‘recession we had to have’ in the 1990s, Australian’s all have a view on the key economic indicators: inflation, unemployment, economic growth and – of course –the topics du jour: central bank rates and property prices.

As we survey these key economic indicators they point to a period of normalisation. A case for measured optimism. Unemployment is low, and staying low. At 3.8% in March 2024, even a sharp uplift would still have Australia in a position of full employment.

Inflation has moderated. There is of course a risk that it stays ‘sticky’ – just like the experience across the pond in the US – however there is no doubt that the hard work done to date has been effective. Economic growth is also positive, albeit soft. But after a pandemic and a sharp uplift in interest rates, the fact it is positive remains a good news story, and certainly a better story than the recessionary environment the UK is experiencing.

Despite the case for measured optimism, the next round of heightened volatility could be just a moment away.

Geopolitical Risk: The Wildcard of 2024

As part of a national financial adviser roadshow through March 2024, we were asked to present our views on the headwinds and tailwinds which will likely drive our economic fortunes in the year ahead. The wildcard for 2024: Geopolitics.

Geopolitical risk represents the risk arising out of interactions between countries impacting trade relationships, security partnerships, alliances, climate initiatives, supply chain and territorial disputes. It’s often described as the ‘unknown unknown’, and can escalate at any moment. You only need to consider the war in Ukraine and the impact it had on global inflation and interest rates to get a sense of how geopolitical risks can drive negative market outcomes at a moment’s notice.

As we look out over the current geopolitical landscape, we find ourselves in a period of heightened geopolitical risk. The war in Ukraine is now into its third year with no resolution in sight. There is a war in the Middle East which, given the recent involvement by Iran, threatens to escalate further and draw in neighbouring / politically aligned countries.

These are just two global conflicts which could escalate, de-escalate, or otherwise drive economic outcomes here in Australia and across the globe in 2024 and beyond.

Investing to Address Volatility & Risk

The case for measured optimism relies on all things remaining equal.

If all things do remain equal, Australia will continue down the narrow path. That is, controlling inflation while avoiding any particularly nasty economic outcomes.

That’s a nice sentiment, but our caution to investors is to always remember that volatility is perpetual, and you never know what’s around the corner.

So back to our central thesis – the challenge of constructing investment portfolios to address volatility and the unknown unknowns.

Careful planning starts with clear-minded asset selection. A well-constructed portfolio considers your own personal risk appetite, and will contain a range of investments which can perform for you at all points along the economic cycle.

While that might sound like a daunting task, there is a wealth of external research you can consult to give some helpful guidance on broader asset class thematics.

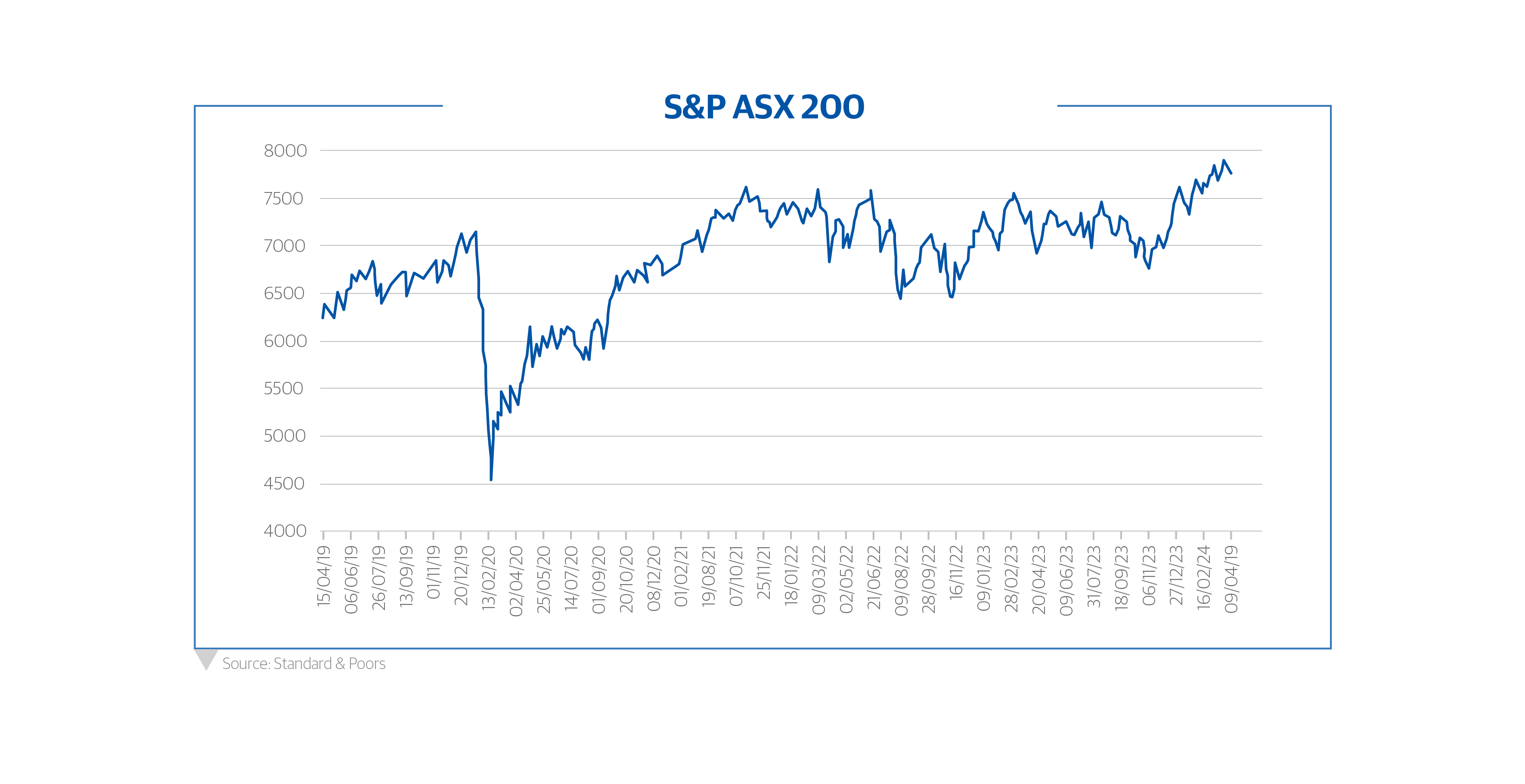

For example, Morningstari have called bonds as being too expensive relative to prevailing inflation. Similarly, it’s no secret that domestic equities are enjoying a strong bull run, with the largest 200 firms on the Australian Stock Exchange currently near an all-time high. Hardly a scenario to offer an investor protection from future volatility.

So what asset classes are asset allocators currently placing funds in an attempt to control volatility. The big shift is towards fixed income and, in particular, private credit. JP Morgan have included private credit as one of its high-conviction investment ideas, particularly ‘direct lending’. It’s not a new asset class, its growth is not excessive, forward returns are strong, and the market is offering investors adequate compensation for the risksii.

According to data from Rainmaker, in the 12 months to 30 September 2023, 9 of the top 20 fastest growing funds in Australia were in the credit / fixed income space. Investments that, on their face, provide a defensive, higher yielding income position rather than a growth focus. A controlled allocation into property credit, for example, can provide useful diversification away from bonds and equities to deliver low volatility outcomes.

Timing markets at the best of times is difficult. Timing investments around risk is even more so. But building a well-diversified portfolio with a view to cross-cyclical performance can make a real difference to investment outcomes.

At La Trobe Financial, our range of portfolio accounts each demonstrate zero capital losses since their inception date, with low volatility income returns throughout.

Decades of disruptions show us that volatility is perpetual, and while we don’t know when the next shock is coming, rest assured, it is. So, a wise investor will keep their eyes on the prize: When things seem good, what better time to prepare for the next time things go bad?

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

Past Performance is not a reliable indicator of future performance.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2024 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.