Long-term supporters of La Trobe Financial will have heard us preach that the performance of the assets in a portfolio drive the investment outcome for investors. Which is why it’s imperative that a manager constructs a pool of highly diversified, quality assets, which will help to protect investors during periods of market volatility.

At La Trobe Financial, we established each of our portfolio investment accounts on the simple premise that a diversified portfolio of highly granular, high-quality mortgage assets performs across the cycle. Portfolios which we have been built with discipline over time and which are purposefully diversified across loan size, borrower type, security location and sector.

Diversification

Commitment to diversification remains one of La Trobe Financial’s key investment fundamentals, fundamentals which have allowed us to deliver a storied history of performance for our 90,000 investors. And part of the reason why investors have made a strategic allocation across our portfolios from their investible wealth.

But diversification should not begin and end with the manager. Diversification is also relevant for investors and how they construct their investment portfolios. A well-diversified portfolio will commonly have a combination of growth investments and income investments. Including exposures to income investments focussed on providing a steady stream of income can provide predictability and stability to overall portfolio returns and the income generated reinvested or used for current living expenses (important in this high inflation environment).

Credit funds are one of these types of regular income-generating investments and – while Credit Funds have their own risks for investors to consider – they generally offer a highly repeatable and sustainable way to add value to your portfolio with low volatility.

Asset Quality

Asset quality matters. It matters because in the constant world of volatility, asset prices fluctuate and can drive results across asset classes. At La Trobe Financial, we focus on selecting the highest quality assets for our portfolios. This allows us to extract value from our chosen asset class of property credit for the benefit of our investors.

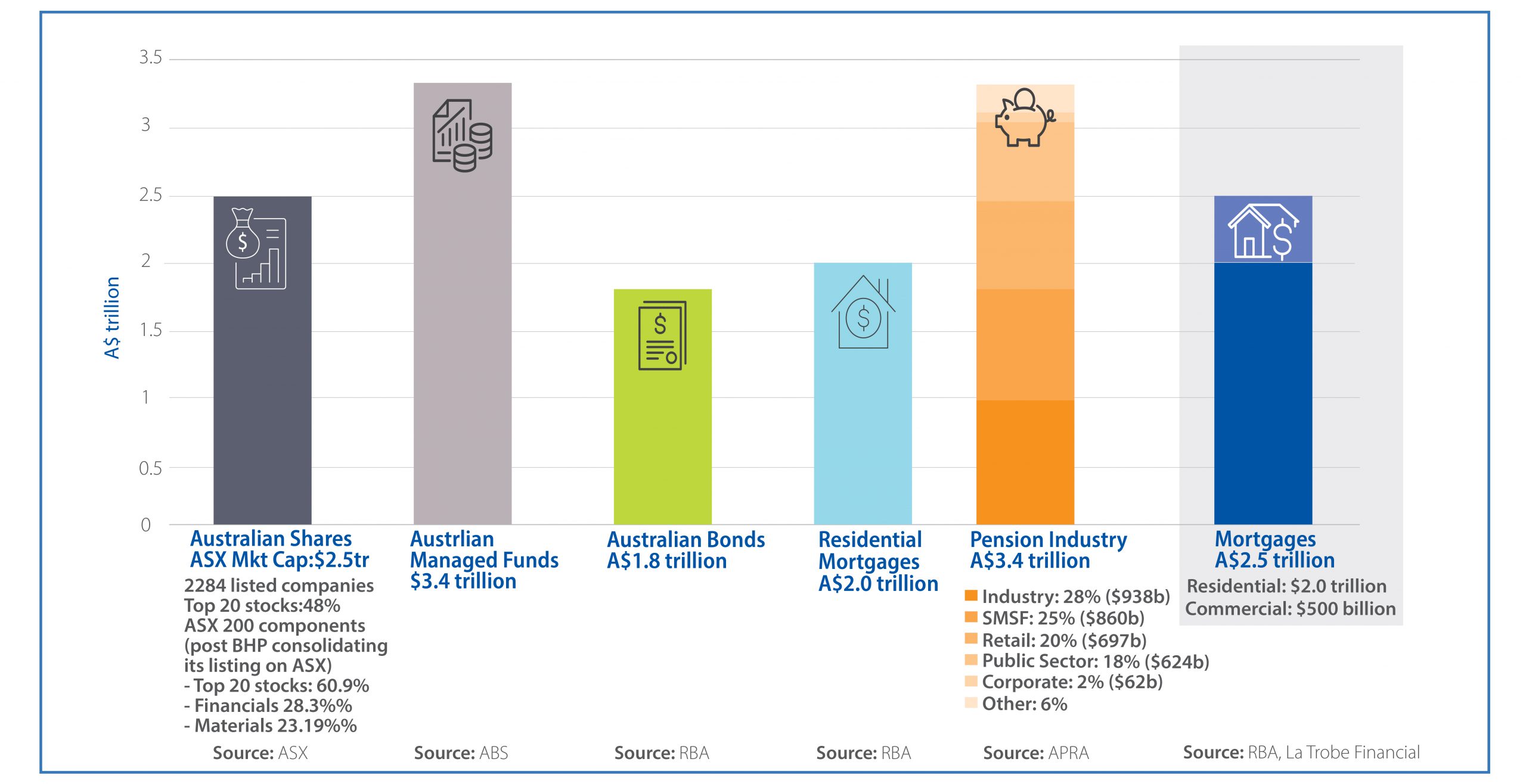

Property credit in Australia represents a A$2.5 trillion asset class, and is of a similar size to the ASX and larger than the Australian Bond market. With such a large pool of assets to select from, exposures to property credit can offer a range of benefits to investors as part of their overall investment portfolio, including:

- It is inflation responsive

- It can provide low volatility variable income

- The distributions to investors will typically include alpha outperformance against the wider asset class

- It is relatively intuitive and easy to understand

A strategic allocation to property credit in portfolios can help manage investment risks. Consider the following key investment risks, and how property credit can help address each:

- Capital risk: addressed through each loan being secured by a mortgage, over a property, with set loan to valuation ratios.

- Income risk: well-selected property credit managers provide products which can generate income for investors across the cycle.

- Inflation risk: A very real risk in our current environment as inflation erodes real income performance. A portfolio of variable rate mortgages can respond to inflation and can maintain real income over time.

- Sequencing risk: The low volatility nature of property credit and the regular income it can offer makes an allocation a natural fit for a defensively positioned portfolio or as part of the defensive allocation to a portfolio.

Of course, there are always things to watch out for, with opportunities and pitfalls falling into three broad categories:

| The assets: | Diversification should be integral to the DNA of a property credit portfolio. A wide variety of holdings across a range of geographies, sectors and sizes is a great place to start. |

| The structure: | Property credit lends itself towards structures that are ordinarily easy to understand. If a product or structure sounds overly complicated, that should be a red flag for investors. |

| The manager: | Managing the property credit asset class is a real and specialised skill. Consideration should be given to experience across a range of market cycles. Performance through real life market events are a great litmus test of any manager. |

Ninety thousand investors have entrusted La Trobe with their savings and the fund is now in excess of $9.3 billion in size proving our expertise with this asset class. We approach managing investors’ money with dedication and care, we have done this for over 70 years and we are proud of being good stewards of our investors’ capital. With a range of investment products designed to suit the return and duration profile of a range of investors, we welcome any queries you may have.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.