In today’s uncertain economic climate, Australian investors are increasingly seeking dependable, low-volatility income streams. While traditional asset classes like equities and bonds will always continue to play a role, a growing number of investors are turning to private credit – and not just within Australia. The US middle market is emerging as a particularly attractive investment destination, offering scale, diversification, and resilience that can be hard to find.

What Is US Private Credit – and Why Does It Matter?

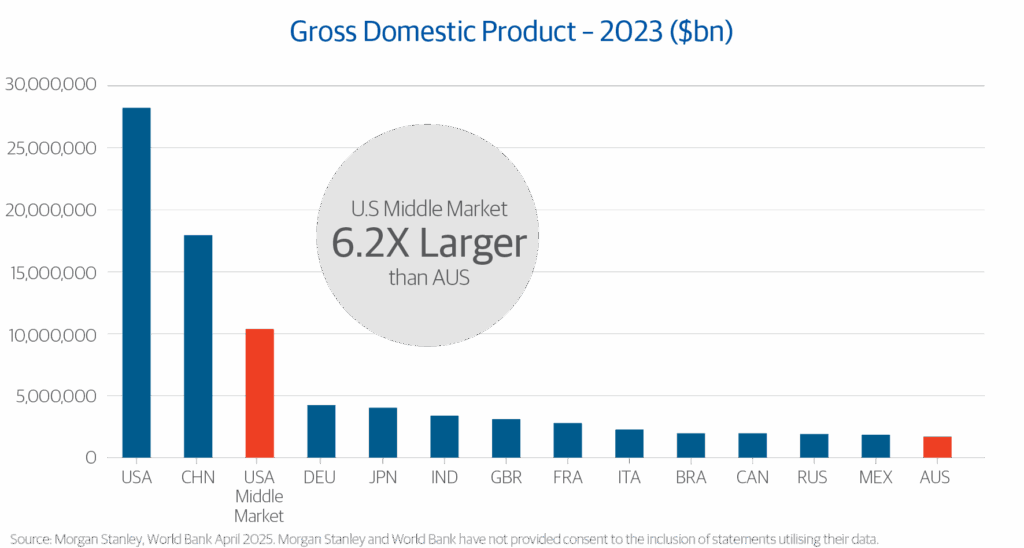

Within credit investment, some loans are able to be invested in on public markets or through banks, and other’s aren’t. Private credit simply refers to those loans which aren’t. In the US, the private market is vast and mature, especially in the middle market – companies with earnings between US$15 million and US$1 billion. These businesses are the backbone of the American economy, and they’re increasingly benefiting from bipartisan efforts to reshore jobs and rebuild domestic supply chains.

For Australian investors, this presents a unique opportunity to tap into a high-yielding, low-volatility asset class that’s uncorrelated to traditional markets and backed by strong fundamentals.

The US Middle Market is the world’s third largest economy on a standalone basis.

Why the US Middle Market Is a Sweet Spot

Unlike large corporates or startups, the US middle market companies within the La Trobe US Private Credit Fund portfolio are:

- Service-based and non-cyclical, reducing exposure to global trade disruptions;

- Low in capital intensity, meaning they’re less vulnerable to interest rate shocks; and.

- Sponsor-backed, which adds an extra layer of oversight and governance.

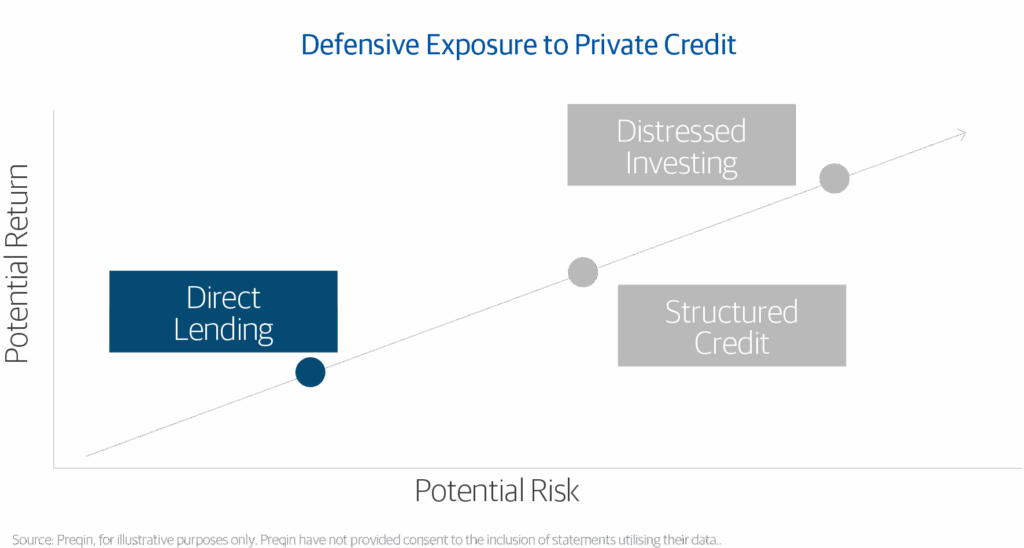

These characteristics make them ideal candidates for private credit strategies focused on first lien loans – secured lending with priority in repayment.

US Middle Market companies within our portfolio are typically service based and non-cyclical providing a hedge against global trade disruptions.

Accessing US Private Credit from Australia

Historically, international private credit has been out of reach for retail investors in Australia. But that’s changing. Through platforms like La Trobe Financial’s US Private Credit Fund, investors can now access a diversified portfolio of US middle market loans, in partnership with Morgan Stanley’s US credit team.

Here’s what sets it apart:

- Monthly income and quarterly liquidity*

- Fully hedged against FX risk~

- Available on major platforms and open to retail investors

- Transparent portfolio reporting – no passwords, no gatekeeping

How Investors Are Using It

Australian investors are incorporating US private credit into their portfolios in three key ways:

- Reliable income stream – attractive yields with minimal volatility.

- Defensive allocation – strong credit quality and low correlation to equities.

- Diversification – exposure to a different geography and part of the capital structure.

It’s a strategy that fills a gap – typically neither too conservative nor too risky, and potentially suited to long-term wealth building or retirement income. Investors could consider it for a small allocation of their total wealth when building a diversified portfolio of investments.

Direct loans to US middle market companies offer scale, diversification, and resilience that’s hard to replicate in Australia.

Transparency Is the New Differentiator

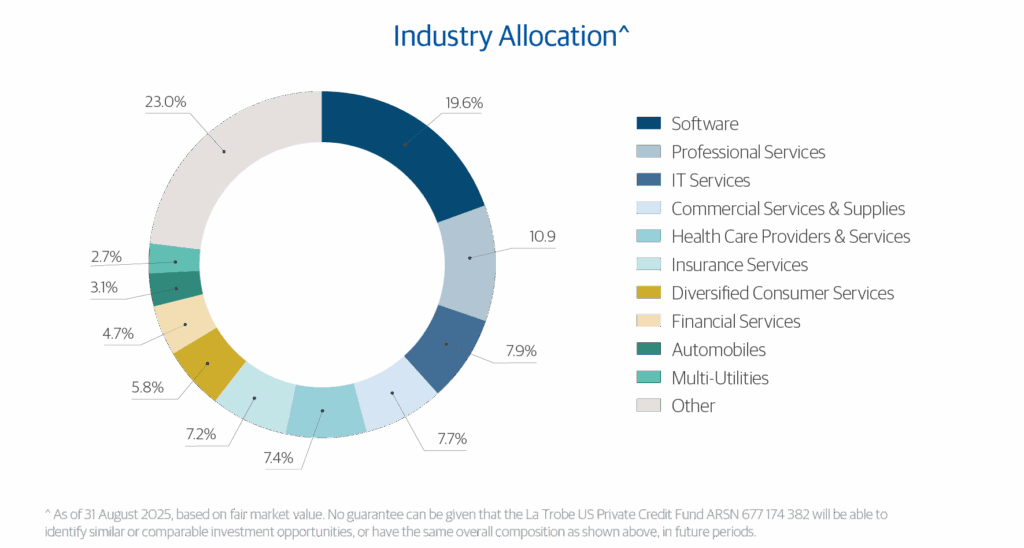

One of the standout features of La Trobe Financial’s approach is its commitment to transparency. Investors can access detailed data on asset mix, sector exposure, new loans, and even underperforming assets – without needing to log in or jump through hoops.

This level of openness is rare in the private credit space, where complexity and concentration risk often lurk beneath the surface. For investors, it’s a welcome change – and a signal of confidence from the fund manager.

Final Thoughts

Private credit is no longer just for institutions to invest and benefit from. With the right structure, the right partners, and the right level of transparency, everyday Australian investors can now participate in one of the most dynamic segments of the global economy.

If you’re looking for income, diversification, and resilience, it might be time to look beyond our borders – and into the heart of the US middle market.

* A quarterly limit of 5% of the total value of the issued Class B Units applies to redemption requests. See the PDS for more details.

~ While the Responsible Entity intends to do this on a best endeavours basis, the Fund may not provide complete protection from adverse currency movements.

Any advice is general and does not consider your personal circumstances.

Past Performance is not a reliable indicator of future performance.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe US Private Credit Fund ARSN 677 174 382. It is important that you consider the Product Disclosure Statement (PDS) when deciding whether to invest or continue to invest in the fund. The PDS and Target Market Determination are available on our website.