Retirement is often portrayed as a time of leisure, but for many Australians, it comes with a pressing financial challenge: replacing a regular salary with reliable investment income. In today’s environment of market volatility and falling interest rates, traditional cash-based investments may no longer deliver the returns retirees need.

That’s where listed investment trusts (LITs) come in.

Understanding Listed Investment Trusts

Listed investment trusts – also known as listed investment funds – operate similarly to managed funds. They pool investor capital and allocate it across a diversified portfolio of assets. Depending on the strategy, investors benefit from regular income distributions and potential capital growth.

As with any investment, it’s important to be aware that risks do exist. Retirees are encouraged to speak with a financial adviser to ensure the investment aligns with their goals and risk tolerance. If investing directly, it’s worth taking the time to understand the key considerations.

Because LITs are listed entities, investors should be mindful of factors such as overall market volatility and the liquid nature of listed securities. There’s also the potential for units to trade at a discount or premium to their net asset value, which can affect returns. Pricing fluctuations and tax implications may also play a role depending on individual circumstances.

That said, LITs offer several distinct advantages that make them especially attractive to retirees. Unlike traditional unlisted funds, LITs are traded on the Australian Securities Exchange (ASX), providing greater transparency and ease of access.

One of the most accessible features of LITs is their low capital entry requirement. Investors can begin with as little as $500, making it easy for those with modest savings to participate in professionally managed investment strategies. This opens the door to diversification and income generation without the need for large upfront commitments.

Liquidity is another key benefit. Because LITs are listed on the ASX, units can be bought or sold within minutes during market hours~. This provides retirees with the flexibility to access their funds quickly if needed – whether for unexpected expenses or portfolio rebalancing – without being locked into long redemption periods.

Moreover, LITs do not impose fixed investment terms. Investors can choose to stay invested for as long or as short a period as suits their financial goals. This flexibility is particularly valuable for retirees who may need to adjust their investment horizon based on changing circumstances.

Introducing LF1: La Trobe Financial’s Listed Investment Trust

Recognising the growing demand for accessible private credit solutions, La Trobe Financial launched the La Trobe Private Credit Fund (ASX: LF1) earlier this year – its first ASX-listed investment trust.

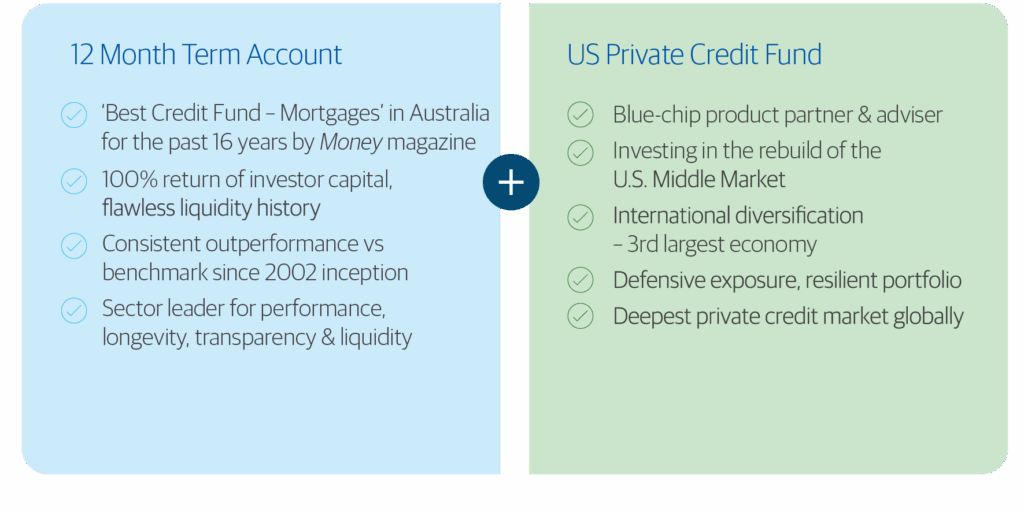

LF1 combines two of La Trobe Financial’s flagship strategies: the 12 Month Term Account, Australia’s most awarded retail credit fund, and the U.S. Private Credit Fund, managed in partnership with Morgan Stanley. Together, these strategies provide investors with exposure to over 12,000 granular loans across diverse sectors and geographies.

This dual-engine approach delivers diversified exposure across geographies, sectors, and income sources, with a strong margin of safety embedded in each portfolio. It’s a structure designed to deliver both performance and resilience – two qualities that matter deeply to income-focused investors.

Performance and Income

As of 30 September 2025, LF1 has delivered an annualised distribution yield of 6.94%, exceeding its target of RBA Official Cash Rate + 3.25% p.a. net of fees and costs. Distributions are paid monthly, offering retirees a consistent income stream that aligns with their budgeting needs.

LF1’s September highlights include a unit price of $1.99, a net tangible asset (NTA) value of $2.00 per unit, and a market capitalisation of $293 million. A distribution of 1.14 cents per unit was declared, supported by strong underlying portfolio performance across both strategies.

Inside the Portfolios

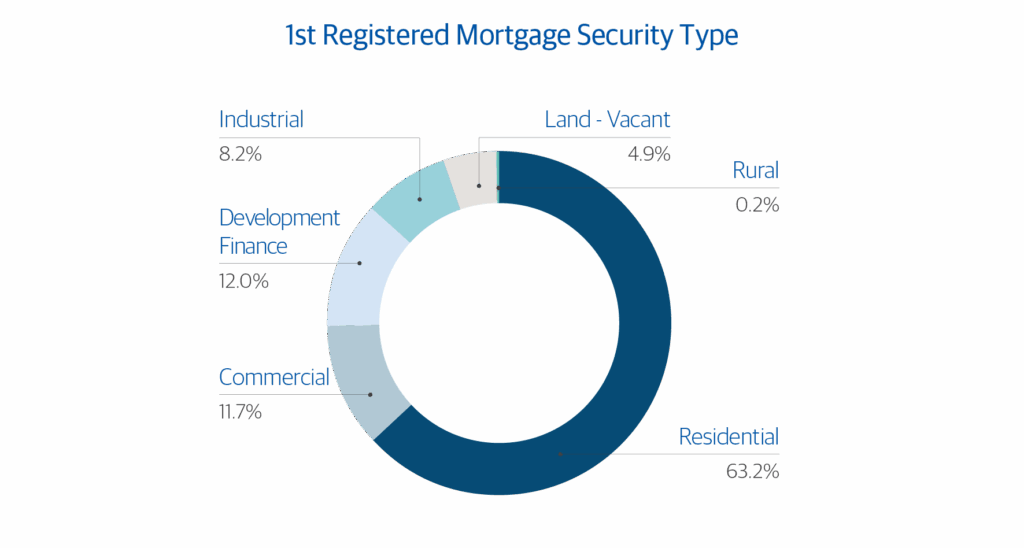

The 12 Month Term Account (12MTA) is a cornerstone of LF1’s Australian exposure. With $11.2 billion in assets under management across 12,285 loans, it is backed entirely by first registered mortgages. The portfolio maintains a weighted average loan-to-value ratio of 65.9%, with 91% of security located in metro areas. Borrower credit scores fall within the very good to excellent range, and the portfolio is conservatively constructed with exposure to residential (63.2%), development finance (12%), commercial (11.7%), and industrial (8.2%) assets.

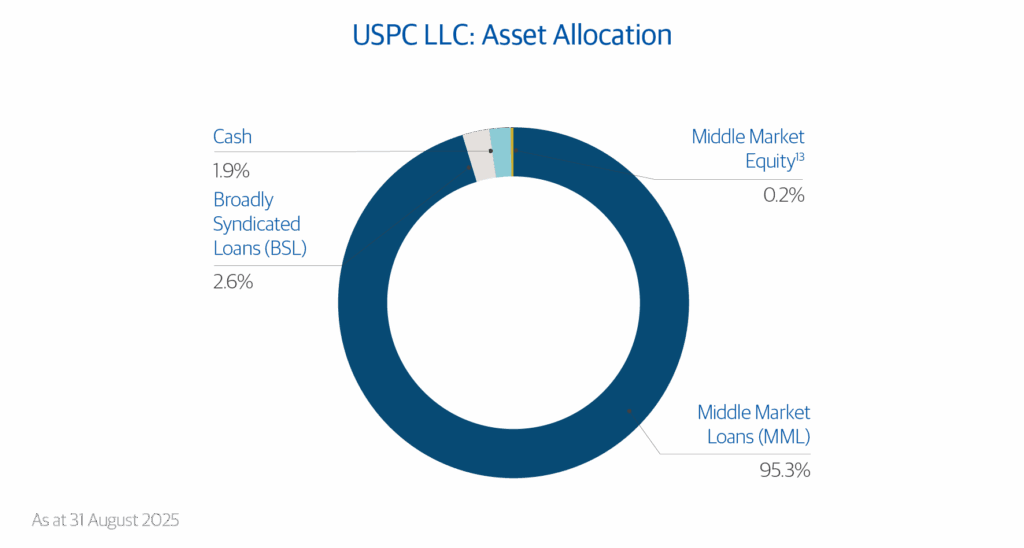

The U.S. Private Credit Fund (USPC) provides access to the U.S. middle market, home to over 200,000 companies and 40% of U.S. GDP. Managed by Morgan Stanley, the fund holds $294 million USD in assets across 112 borrowers and 30 industries. The portfolio is composed of 99.8% floating rate loans and 99.1% first lien loans, with a weighted average loan-to-value ratio of just 40.1%. Notably, 96% of the exposure is to non-cyclical industries such as software, professional services, healthcare, and IT—sectors known for their resilience and stability.

Liquidity and Access

LF1 supports investor liquidity through multiple mechanisms. Investors can trade units daily on the ASX~, participate in quarterly off-market buy-backs of up to 5% of units, and benefit from on-market buy-back programs.* Additionally, the Investor Reserve within the 12MTA helps smooth income and protect capital, further enhancing the trust’s appeal to income-focused investors.

LF1 is available on major investment platforms including BT Panorama, Macquarie Wrap, HUB24, and Netwealth. It also holds ratings from BondAdviser and Zenith, reinforcing its credibility among advisers and institutional investors.

Why LF1 Matters for Retirees

LF1 is designed to meet the needs of income-focused investors, especially retirees. It offers monthly income, diversified exposure, professional management, and a high level of transparency and governance. As interest rates trend lower, LF1 provides a compelling alternative to traditional income investments—combining the strength of private credit with the convenience of ASX access.

^ For a list of awards and ratings please visit our website.

~ Units can be bought and sold on the ASX during trading hours, subject to their being sufficient supply and demand and the units not being suspended from trading.

*The Responsible Entity (RE) will only be able to continue to buy-back 5% of the capital each calendar quarter off market where it would exceed the 10/12 Limit (10% of the smallest number of units that are on issue at any time during the previous 12 months) if the RE has obtained approval by ordinary resolution of Unitholders prior to effecting the off market buy-back. It is the intention of the RE to seek Unitholder approval when required so that it can continue to buy-back 5% of the issued capital each quarter off market. The RE may also conduct on-market buy-backs subject to the 10/12 Limit.

Any advice is general and does not consider your personal circumstances.

Past Performance is not a reliable indicator of future performance.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence No. 222213 is the responsible entity of the La Trobe Private Credit Fund ARSN 686 964 312 (ASX:LF1). It is important you consider the Product Disclosure Statement (PDS) before deciding whether to invest or continue to invest in the fund. The PDS and Target Market Determination are available on our website.