The SVB story – stop me if you’ve heard this one

What would you think if you looked at an institution and found its depositors were almost exclusively from a particular industry? Then, you investigated its borrowers and found they were overwhelmingly from that same narrow industry? Then you look at where these assets are located and realise they are significantly from within a common geography?

Consider then, that this same institution maintained what can only be described as a cavalier approach to interest rate risk, while also falling outside the scope of regulation that would have required it to meet transparency requirements of its larger counterparts. Now finally, consider what might happen to that institution when interest rates rose at the fastest pace on record.

This, ultimately, was to become the tale of the Silicon Valley Bank.

The Fundamentals of Investing

In a volatile economic environment, as in all points in the economic cycle, the fundamentals of sound investment management do not change. For longer term investors with La Trobe Financial, you will have heard us preach our three ‘golden rules’ of investing: simplicity, diversification and patience. Three golden rules which have proven to work again and again for investors across all economic cycles. The demise of Silicon Valley Bank serves as a timely reminder of the importance of maintaining strong investment fundamentals such as these.

The La Trobe Financial Story – Fundamentals Driving Performance

Simplicity: Simple Structures

The structure of any investment magnifies its results. Paraphrasing Warren Buffett’s famous adage, ‘investing is not like Olympic diving – you don’t get bonus points for degrees of difficulty’. Complex structures should represent a red flag for investors and are anathema for credit and mortgage investments.

In contrast, La Trobe Financial places simplicity at the heart of its strategies. They are transparent, intuitive and easy to understand, recognising the importance of matching assets with liabilities, controlling (and actively managing) for risk, and delivering consistency in the outcome for investors.

Diversification: Strength in Assets

The performance of the assets in a portfolio drive the investment outcome for investors. Which is why it’s imperative that a manager constructs a pool of highly diversified, quality assets, which will help to protect investors during periods of market volatility or stress.

At La Trobe Financial, we established each of our portfolio investment accounts on the simple premise that a diversified portfolio of high-quality, highly granular mortgage assets performs across the cycle – and that fundamental belief is as strong now as ever.

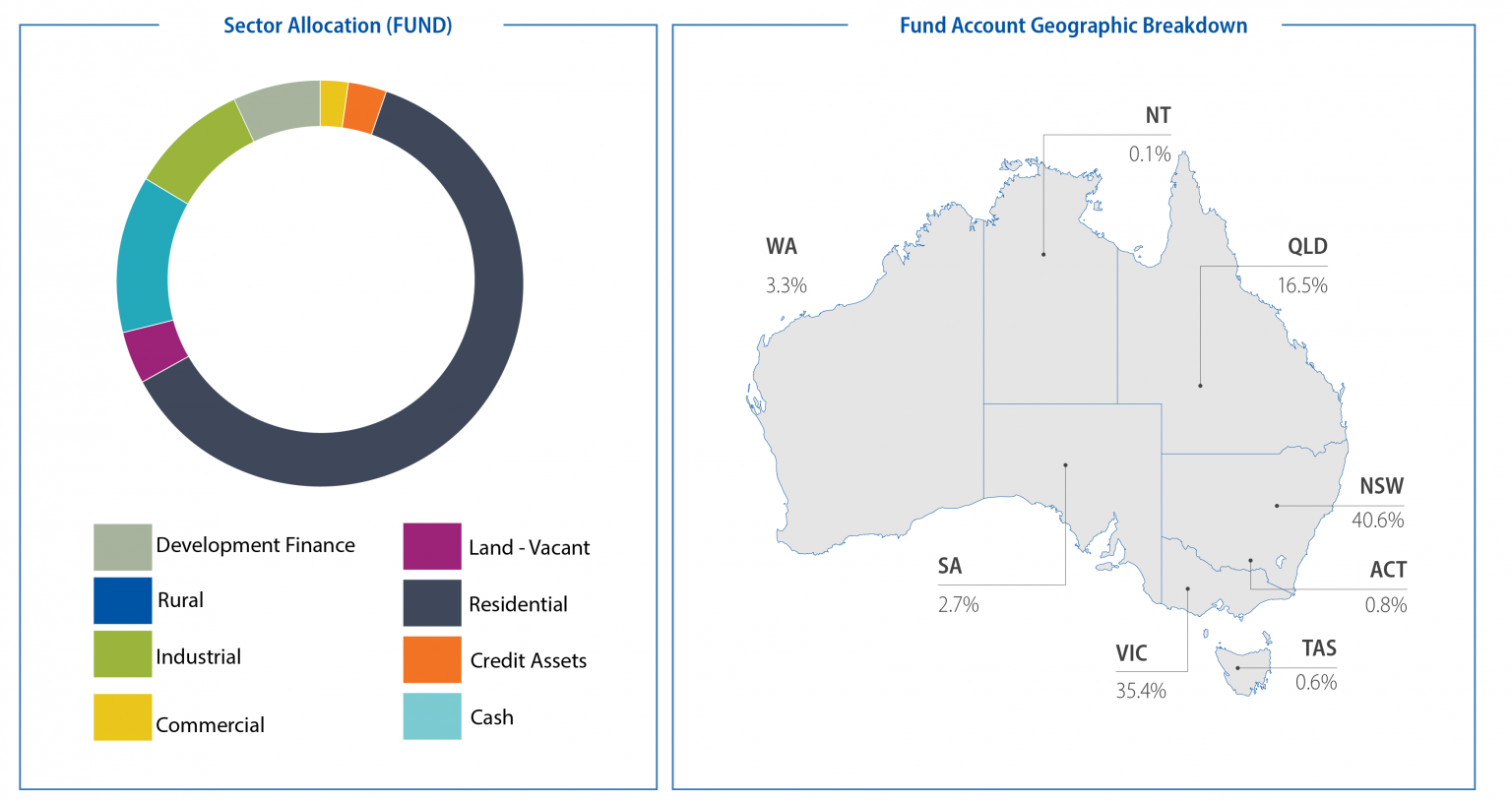

We have long spoken about the importance of diversification in the construction of our portfolios. And those portfolios have been built with discipline over time: the careful selection of granular asset exposures, diversified across sector, loan size, borrower type, and security location.

In fact, our Credit Fund of $9.3 billion (February 2023) comprises 12,640 loans with an average loan amount of $694,542 and an average loan-to-value ratio of 64.8%. Geographically our assets follow the population, ensuring they remain within the broadest and deepest markets. Our asset bias sits towards the stability of the residential asset class, with targeted exposure into commercial, light industrial, rural, vacant land and development finance.

This commitment to diversification has seen our flagship 12 Month Term Account referred to by one ratings agency as the most diversified in its sector.

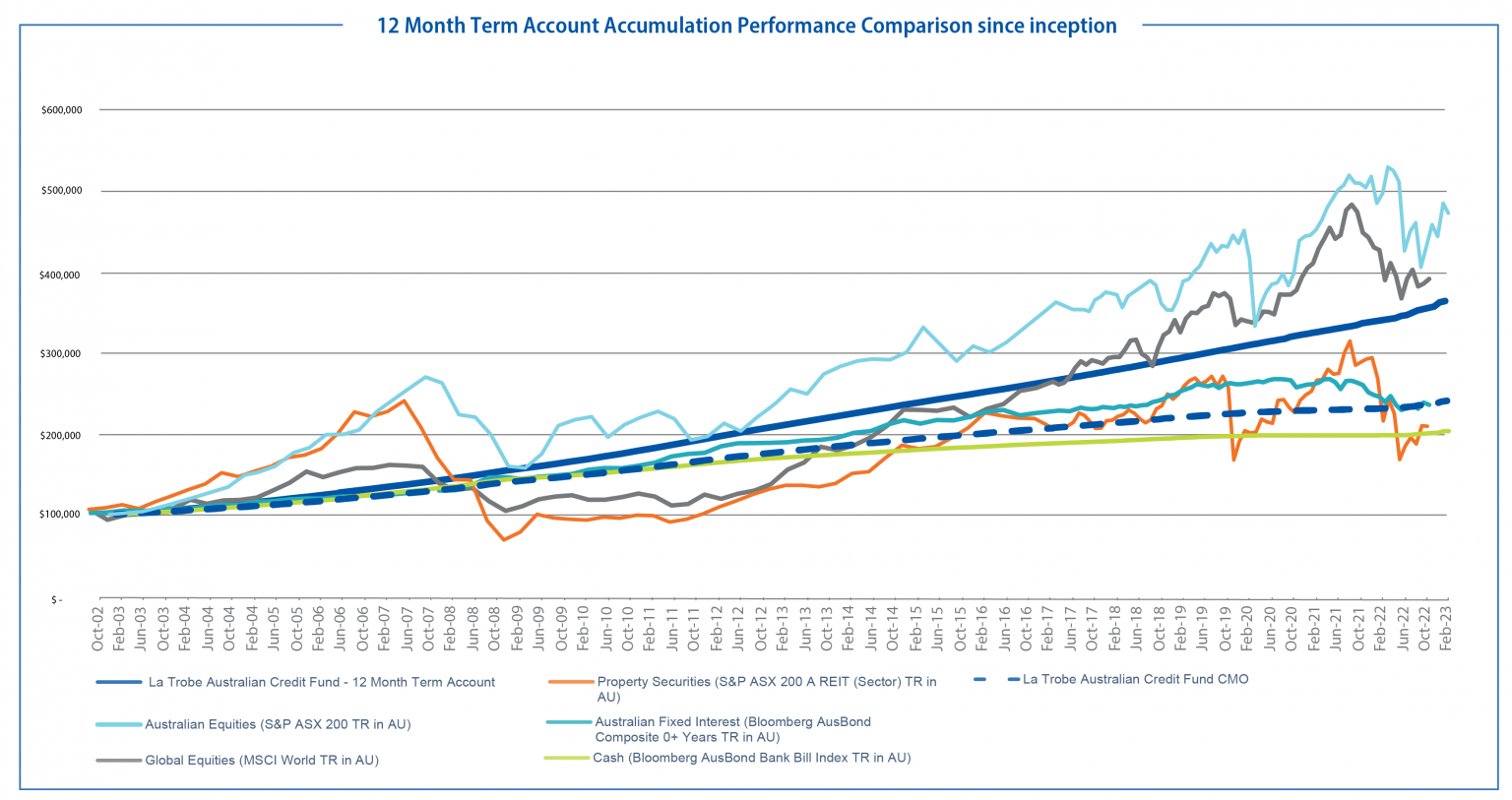

Combined, these assets deliver portfolio accounts that at all times have delivered their advertised distribution rates to investors – month after month, year after year – irrespective of the market or macroeconomic environment we have operated within.

Patience: Trusted Manager Expertise

Every so often we are reminded of the importance of the old axiom ‘getting rich slowly never goes out of fashion’. It speaks to ensuring that investment portfolios are positioned to stand the test of time. It also speaks to ensuring those portfolios are being managed by a manager who has experienced moments of market volatility and stress, and has demonstrated their ability to guide portfolios through volatility while delivering impeccable performance.

At La Trobe Financial we put the customer at the heart of everything we do. But we take that commitment a step further with a simple acknowledgement: we are managing our investor’s hard-earned money, and ultimately our investors will want it back.

At a practical level, this speaks to the fact that managing money within any sector is a real and specialised skill. Expertise – deep expertise – is only gained over years of dedication and commitment to an asset class. Managing across good times, and learning from the experience during bad or volatile times build the base of expertise to guide a business forward.

At La Trobe Financial, our 500 fully trained staff are led by a team of professionals with deep industry experience. A group of professionals who are immensely proud of our impeccable performance across three decades of the Fund, including that no investor has ever lost a cent of capital in our portfolio accounts. A group of professionals who are driven to ensuring that experience is repeated for the next three decades to come.

*The rates of return on your investment are current at 1 March 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The applicable distribution for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investments. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended. Visit our website for further information.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and Target Market Determinations on our website www.latrobefinancial.com, or ask for a copy by calling us on 1800 818 818.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To view our awards and ratings, please visit the Awards and Ratings page on our website.

To the extent that any statement in this email constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© Copyright 2023 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.