There’s been much talk about the ‘narrow path’ the RBA is attempting to traverse: cool inflation while not pushing the economy into a recession.

If we scratch beneath the surface, we get to the crux of the issues the RBA are attempting to balance. Their own stated objectives are to achieve price stability, full employment, and economic prosperity & welfare for Australians. Those objectives are difficult for the RBA to achieve when there is persistently high inflation in the system. So, the RBA has set its bearings on bringing inflation under control (i.e. back to target range) by increasing interest rates (the only tool in the RBAs arsenal). However, pulling the interest rate lever also impacts their ability to deliver their stated objectives as unemployment rises household balance sheets become stretched, while recessionary risks increase.

Ten months into a rate-rising cycle, its worth pausing to reflect on whether the RBA are walking the narrow path.

Growing Economy, However Growth Moderating

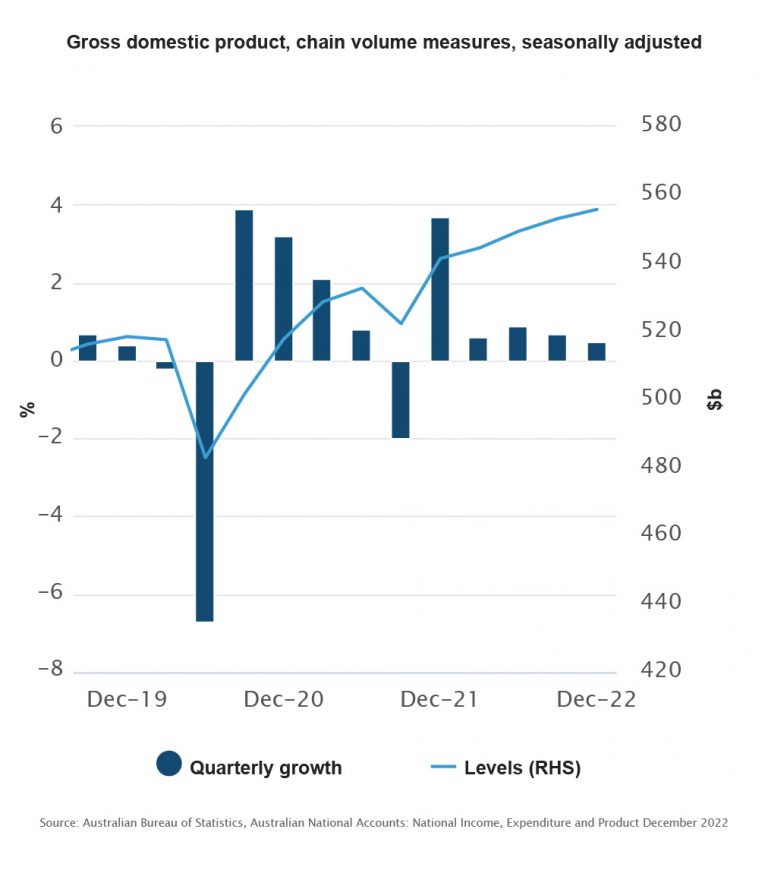

The latest GDP figures (which measures the size and growth of the domestic economy) paint a picture of a growing economy, with year-on-year growth of 2.7%. That only tells part of the story however.

While year-on-year growth of 2.7% is strong, it glosses over the fact that GDP growth has been moderating. Indeed, in Q4 2022 (October – December 2022), GDP came in at 0.5%, slightly below market expectations (median forecasts of 0.8%).

Diving further into the GDP print we see a bit of a mixed bag, with some sectors having contracted across the December quarter (e.g. domestic manufacturing, wholesale and retail trade). The economic growth was primarily driven by net trade (1.1% growth), with exports growing 1.1% while imports fell by 4.3%, contributing to a trade surplus of $40.9 billion (second-highest on record). Travel services was the biggest contributor to the growth in exports (18.9%) as international travel and tourism continued their road to recovery following the COVID-19 pandemic.

These are great signs that the global economy, while slowing down, is still (for now) driving positive economic activity for Australia.

Falling Household Demand

While inflation appears to have now passed its peak – having fallen to 7.4% in January 2023 – it remains high and well above the RBAs target range of 2-3%.

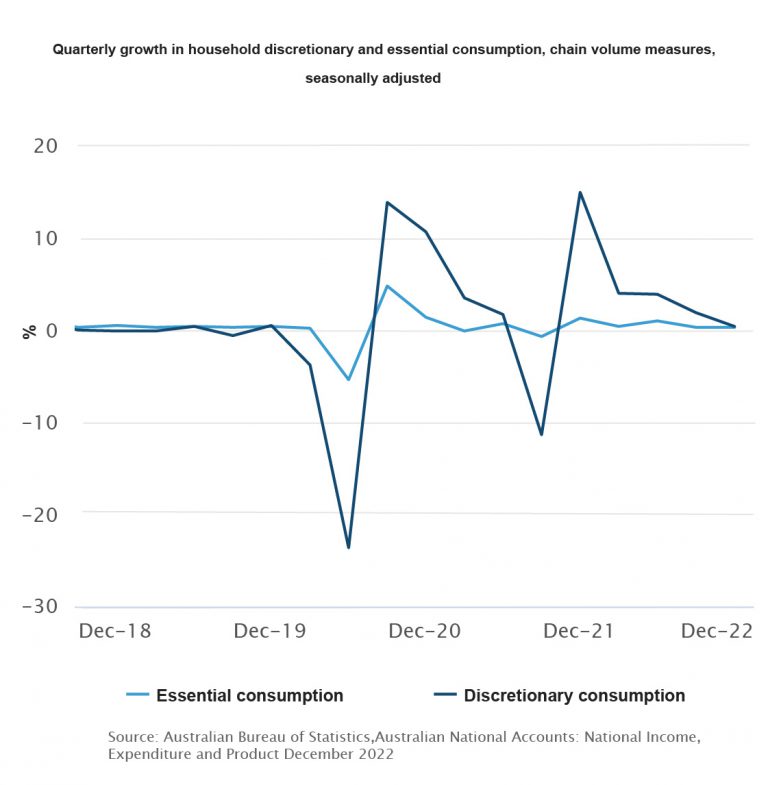

Given the persistently high-inflation prints, it is unsurprising to see consumers adjusting their spending behaviours. While household consumption increased in the December quarter by 0.3%, it is well inside the 1.0% increase seen in the September quarter and is the weakest print since the Delta-variant lockdowns in September 2021.

Drilling into the detail sees modest growth in discretionary spending, which has now slowed to be more in-line with spending on essentials. Spending at hotels, cafes & restaurants (1.6%), and transport services (5.7%) drove the growth in discretionary spending, while spending on discretionary goods (including clothing & footwear, furnishings & household equipment) fell, which was also reflected in the December retail sales figure (-3.9%).

The consumption data points to the consumer starting to ‘tighten the belt’ in response to inflationary impacts and high interest rates: a change in consumer behaviour that the RBA has been looking long and hard for.

Rising Wages, Falling Purchasing Power

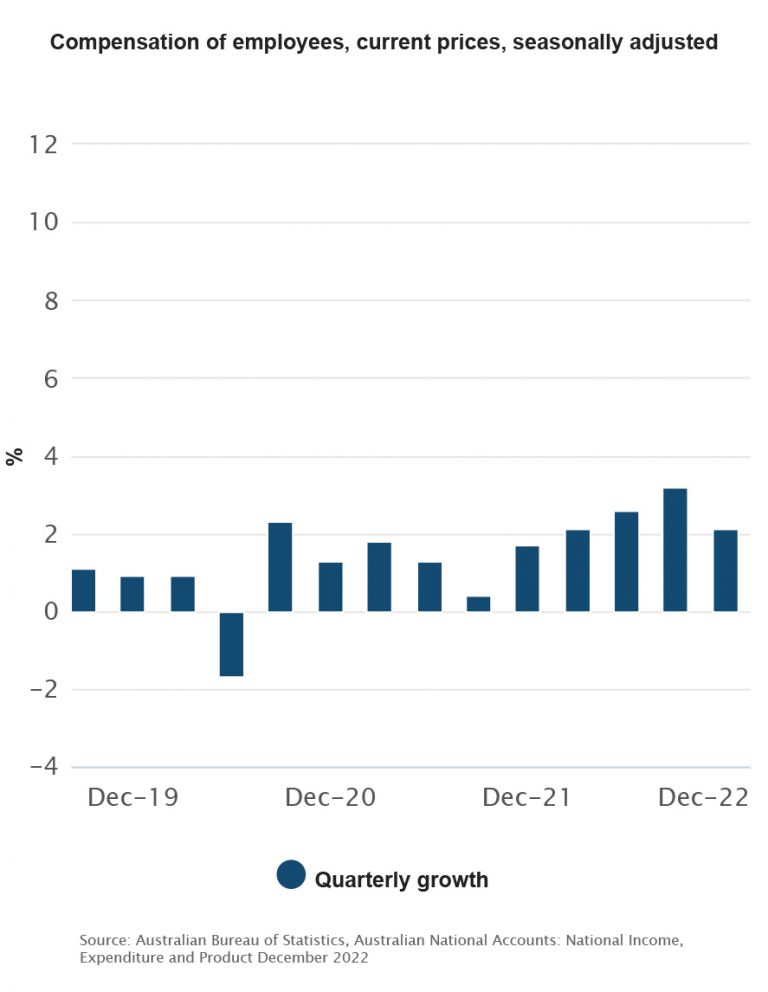

Positively, wage growth in response to tight labour market conditions was prevalent in the December quarter, with compensation of employees (COE) rising by 2.1%. Private sector wages rose by 3.6% in 2022, marking the highest annual rate of growth since 2012.

This only told part of the story however, with household disposable income ultimately falling across the period with the rise in COE offset by additional tax paid by households and rising debt interest obligations.

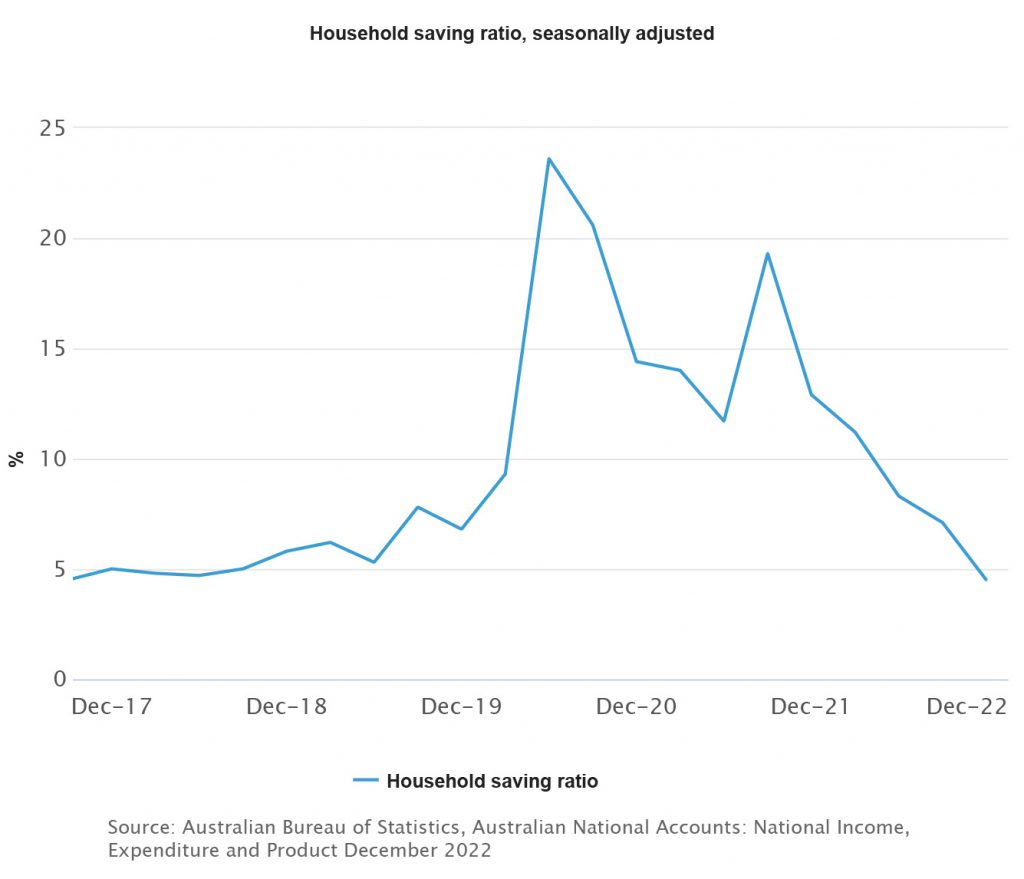

With household disposable income continuing to trend the wrong way, its unsurprising to see the savings rate continue to contract – 4.5% for the December quarter – to levels below the pre-pandemic norm. Household balance sheets remain well positioned, however, owing to the $280 billion in excess savings built up across the pandemic period.

RBA’s Dovish shift

With a number of signs now pointing towards a moderation in economic growth, the risk of the RBA walking off the narrow path and towards a recession will only increase should they continue to pull the interest rate lever, a risk the RBA appear to have recognised given their shift towards a more dovish tone in their recent statement post-OCR increase.

Whereas in February the RBA had outlined that ‘further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target’ – pointing to further increases in March and April (at least) and a higher terminal rate – in this week’s statement the RBA revised their position to state that the ‘Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target’, giving hope that a pause in interest rates is not far away. Indeed, there may just be enough canaries in the coal mine for the RBA to pause in April.

There remains a case for cautious optimism in Australia. Positive economic growth, low unemployment (near 50-year lows) and a wealthy population (with $280 billion in excess savings) may just allow the RBA to walk our economy down the narrowest of paths.

*The rates of return on your investment are current at 1 March 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The applicable distribution for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investments. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended. Visit our website for further information.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and Target Market Determinations on our website www.latrobefinancial.com, or ask for a copy by calling us on 1800 818 818.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

© Copyright 2023 La Trobe Financial Services Pty Limited ACN 006 479 527. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.

This publication does not constitute financial advice and should not be relied upon as such. It is intended only to provide a summary and a general overview on matters of interest and it is not intended to be comprehensive. You should seek your own financial or other professional advice before acting or relying on any of the content.