Investing is serious business. Whether you’re building wealth towards your hard-earned retirement, investing for income, or even managing generational wealth, getting the fundamentals right is of the highest importance.

Across the last number of years, property credit has really come to the fore for investors. In a low rate environment, it provided a return to investors, providing a solution to the ‘hunt for yield’ problem. In an inflationary environment, the returns from variable rate portfolios have generally increased alongside market interest rates. That has certainly been the case for La Trobe Financial’s portfolio account investors.

At La Trobe Financial, our view is that a targeted allocation to our asset class, property credit, can add real power to portfolios by addressing key investment risks. Our careful and disciplined approach to portfolio construction and management has ensured that our portfolio products have delivered cross-cyclical performance and income generation even in moments of heightened market volatility.

As investors have turned towards this asset class, new products and strategies have also entered the market. Indeed, accessing the market has never been easier with a range of portfolios, structured notes / debt and Peer to Peer strategies proliferating.

La Trobe Financial provides access to these key strategies. Our Classic Notice, 90 Day Notice, 6 Month Notice, 12 Month Term and 2 Year Accounts are all examples of portfolio products. Our 4 Year Account provides access to structured debt, and our Select Investment Account is our Peer to Peer offering.

Investors can access La Trobe Financial’s range of investment products either directly, or by using our investment platform La Trobe Direct. It’s never been easier. Indeed, La Trobe Financial’s products provide income solutions no matter the desired investment timeline. In fact, our credit fund products are bookended by our Classic Notice Account, which generally allows access to funds with two business days’ notice# , through to our 4-Year Account, which extracts an liquidity premium for investors over a longer timeframe.

Perhaps then, in an environment with newer strategies capturing attention, it’s worth revisiting the oldest of La Trobe Financial’s strategies. The Select Investment Account, our flagship Peer to Peer offering, is a long-established investment option. It predates COVID. It predates the GFC. Indeed, its origin traces back even prior to the 1991 recession. Yes, it is a survivor.

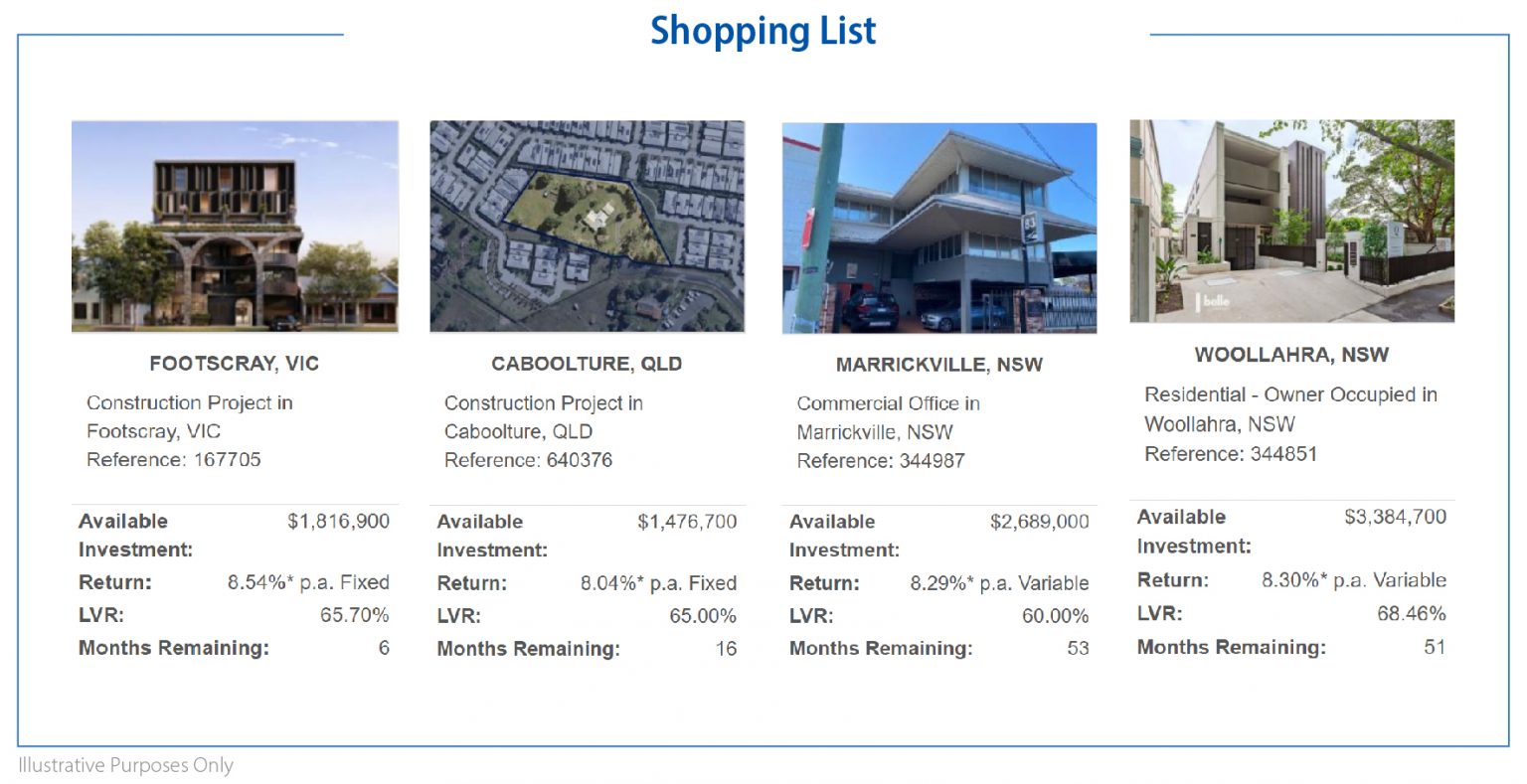

The Select Investment Account provides investors with access to Australia’s largest and most robust mortgage portfolio platform, and allows investors to select individual property credit assets into which they invest, or to build their own portfolio of property credit exposures which meet their desired return, duration, sectoral, location and risk profiles.

And it is a simple product to access.

By visiting our website (here), you can select from available opportunities and obtain information on each investment. Each week, the list of available opportunities is updated. The current available investments provide variable and fixed rates of returns between 7.99%p.a.* to 8.59%p.a.*, depending on which investments you select.

The product is designed to give power to investors:

-

- You select the investment which suits your risk appetite.

-

- You select the amount you wish to invest.

-

- You invest when you are satisfied that it makes sense for you.

Peer to Peer investing has a long history in Australia and a long history with La Trobe Financial. In an environment of new options, perhaps it is time to re-consider this industry stalwart.

Like any investment, choosing a peer-to-peer investment will carry its own risks and prospective investors should consider whether the product will help them achieve their financial goals. Consider whether you’re happy to take on an elevated level of risk through exposure to a single asset rather than a portfolio of assets, a risk which may include a loss of invested capital or variability in income.

At La Trobe Financial, we are committed to transparency and provide you with a wealth of information to ensure you can make an informed decision. For each peer-to-peer opportunity, we will provide for your consideration asset-specific information and disclosures within a Supplementary Product Disclosure Statement, with additional information on the product within our Product Disclosure Statement and Target Market Determination.

*The rate of return on your investment is current at 1 August 2023. The rate of return is not guaranteed and is determined by the performance of the investment you select as disclosed in the SPDS and may be lower than expected. Investment earnings are dependent on the borrower making the payments required under the loan. Payments are generally monthly, but this may be varied by disclosure in the SPDS.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

Past Performance is not a reliable indicator of future performance.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.