Readers of our columns over many years will have heard us talking about the importance of diversification. Whether an individual fund selecting its assets, or an individual investor selecting a wide array of investments to perform at all points across the economic cycle, diversification matters.

As the flagship manager in the Australian property credit sector, La Trobe Financial has grown to become a trusted partner, building the wealth of thousands of investors from Australia and around the world. Our investors make a strategically diversified allocation of their wealth to our investment products. Why? For access to low-volatility income products which aim to perform at all points across the economic cycle. We are proud that across each of our portfolio accounts, we have met this aim.

We recognise that our investors are faced with the challenge of asset selection and therefore diversification, every day. How your wealth is spread across a range of investment assets will ultimately determine the income and lifestyle outcomes through a hard-earned retirement, and it is crucially important to get them right.

The growth of investment assets in Australia

Australia has its own array of high quality, deep pools of investable assets. Consider successes within our technology and healthcare sectors in recent years. Paired with the growth of start-ups in financial technology, biotechnology, and software spaces, these burnish Australia’s reputation globally as a place of innovation, and also provide a rich array of assets for managers to place within portfolios for exposure to growth and income.

The growth in traditional asset classes of residential, commercial and industrial property cannot be overstated. The resilience of these sectors, again, provide a broad selection of assets for managers to select for portfolios which have the characteristics investors require: income, low-volatility and growth.

In an adjacent sector to property and real assets, it is hard to ignore the growth in infrastructure projects in recent years. The long-term nature of these projects, coupled with steady cash flows, presents opportunity for investors seeking income and growth over assets with pricing power, typically inflation responsive incomes and growth over a longer period of time.

Within Australia’s lending markets, the ongoing regulatory requirements imposed upon banks sees an increasing pool of high-quality, traditionally banking assets funded by a growing private credit sector. Whether this be secured property credit – the asset of choice for the La Trobe Australian Credit Fund – or within private credit to corporations, this asset class generates vast quantities of high-quality, investment grade assets. These assets are selected, and ultimately invested in by local and international investors for their low-volatility performance, delivered right across the economic cycle.

Wealth managers and investors are increasingly sophisticated

As the total pool of assets under management has grown alongside advancements in technology, the financial sector has become increasingly sophisticated. The delivery of products today versus 20 years ago, could scarcely be more different. It is expected as a minimum for all managers to maintain a modern, easy to use and well-designed online investment experience. Advancements in financial technology (FinTech) allow every day investors to engage, analyse, invest and report on a wide array of managers or strategies at the click of a button.

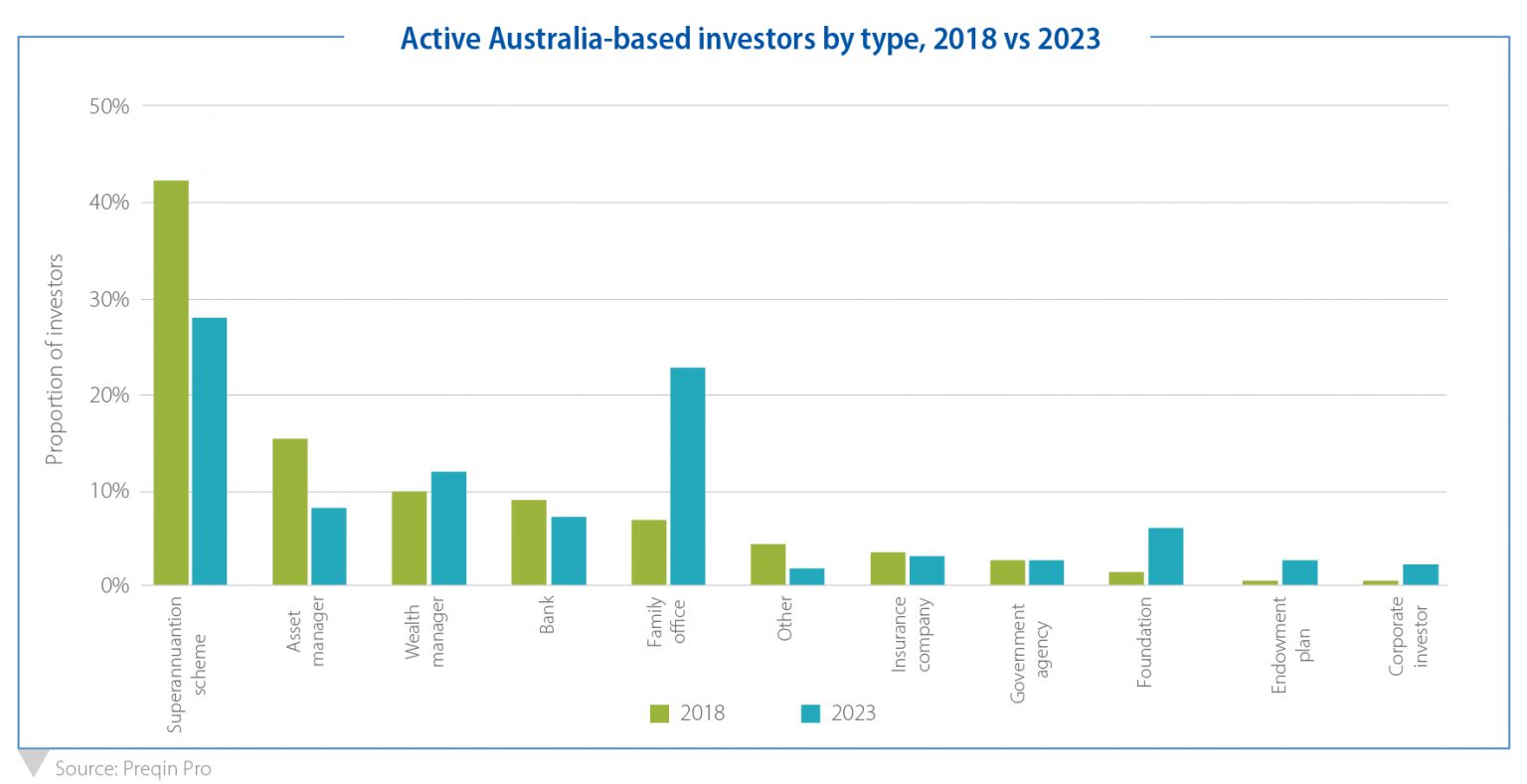

Accordingly, the growth of products and the rise in FinTech sees investors becoming more sophisticated. Consider the trend towards the establishment of Family Offices over the past five years, where affluent families pool resources to manage, preserve, and grow their wealth. Historically the domain of the ultra-wealthy, these operations incorporate wealth management, estate planning, and other related services.

As family offices grow in number, their collective influence on markets is amplifying. Taking a long-term view to investing, they often diversify to include allocations towards private equity, real estate, private credit and property credit. Within La Trobe Financial, this trend is recognised with the establishment of our Private Wealth Desk to service this investor segment.

As family offices grow in number, their collective influence on markets is amplifying. Taking a long-term view to investing, they often diversify to include allocations towards private equity, real estate, private credit and property credit. Within La Trobe Financial, this trend is recognised with the establishment of our Private Wealth Desk to service this investor segment.

Where to from here?

Even in an ever-changing environment, some things never change. At La Trobe Financial we are big believers in keeping things simple. As new products come to market, or as investors assess a product which is new to them, some simple rules apply:

Simplicity: Does the product or asset ‘make sense’? If a strategy can’t be explained easily, or doesn’t intuitively make sense, that is a red-flag. If the structure is too difficult to decipher when things are going well, imagine how hard it will be to unpick when they’re not.

Diversification: Does the product or asset enhance your investment portfolio’s range of assets, or is it just ‘more of the same’? Diversification across different asset classes assists providing a resilience towards performance at all points on the economic cycle. As managers bring new products to market, ask yourself if it addresses a risk otherwise not catered for within your portfolio.

Counterparty: If you are considering a new manager, can it demonstrate a real-life performance across all the ups and downs of markets in recent decades, or is it newer and untested? Are the underlying executives skilled in the asset class, or moving into a new sector to ‘ride a wave’?

Patience: Is the investment aligned to your longer-term goals? Getting rich slowly never goes out of fashion, and investors need to ensure any selected assets aligns with these goals. The performance towards longer term income and lifestyle goals can really make a difference over the long-run.

With interest rates normalised and the ‘hunt for yield’ over, investors can lift their eyes towards a range of investment opportunities to meet any number of investment needs. There is tremendous opportunity to build and grow wealth. Of course, with great power comes great responsibility. You’ve worked hard for your money, so consider the fundamentals, and select the right assets to make your money work hard for you.

*The rates of return on your investment are current at 1 August 2023. The rates of return are reviewed and determined monthly and may increase or decrease each month. The applicable distribution for any given month is paid at the start of the following month. The rates of return are not guaranteed and are determined by the future revenue of the Credit Fund and may be lower than expected.

An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended.

La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the responsible entity of the La Trobe Australian Credit Fund ARSN 088 178 321. It is important for you to consider the Product Disclosure Statement for the Credit Fund in deciding whether to invest, or to continue to invest, in the Credit Fund. You can read the PDS and the Target Market Determinations on our website or ask for a copy by calling us on 13 80 10.

#We will make every endeavour to release your funds 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account and 180 days for the 6 Month Notice Account, after receiving your redemption request. We however have 12 months under the Fund’s Constitution to honour that request. In determining whether to honour your redemption request within 2 business days for the Classic Notice Account, 90 days for the 90 Day Notice Account or 180 days for the 6 Month Notice Account we have to have regard to the Fund’s cash position and the best interests of all investors. There is a risk that a redemption request will not be honoured within 2 business days, 90 days or 180 days. However, there has never been a case in the history of the Fund when we have not honoured a redemption request on time due to a lack of liquidity.

Past Performance is not a reliable indicator of future performance.

La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385.

To the extent that any statement in this article constitutes financial product advice, that advice is general advice only and has been prepared without considering your objectives, financial situation or needs. You should, before deciding to acquire or to continue to hold an interest in the La Trobe Australian Credit Fund, consider the appropriateness of the advice having regard to your objectives, financial situation or needs and obtain and consider the Product Disclosure Statement for the Fund.

© 2023 La Trobe Financial Services Pty Limited. All rights reserved. No portion of this may be reproduced, copied, or in any way reused without written permission from La Trobe Financial.